Where Do Rich People Keep Their Money?

Most rich people invest in their businesses and in real estate. However, a substantial part of the wealth has been invested outside of the country of residence, mainly with Swiss banks. They don’t trust their government anymore. 30% of all privately held global money of rich people is kept in Swiss banks for asset protection. This trend is increasing.

As an asset protection lawyer with more than 30 years professional experience I introduce rich people to the safest banks in the world and the best performing wealth managers. Rich people have become afraid of losing money with their domestic banks. Smart investors ask for safe-haven countries and professional investments in tangible assets.

Discover the latest increasing investment trends.

Here are 7 Alarm Signals with high risks of losing money:

- unlimited money-printing

- very low capitalized banks

- new wealth taxation

- the US dollar losing value and reputation

- global currency reset

- capital export restrictions and confiscation by unstable governments

- lawsuits

Autor: Enzo Caputo

Banking Lawyer since: 1986

Position: Founder & CEO of the

Boutique Law Firm Caputo & Partners

Updated on: 23.08.2021

Unpredictable governments are preparing the legal confiscation of wealth!

Since the Covid-19 pandemic, the number of international people calling me is skyrocketing. They are looking for the safest place to keep money invested in tangible assets.

Where do millionaires keep their money?

- safe-haven jurisdictions like Switzerland

- highest level of privacy

- best-capitalized and safest banks in the world for liquidity

- best in class wealth manager with a 10-year track record

- tangible assets such as dividend-paying stocks, physical gold, battery metals, gold coins, private vault, crypto storage, modern art, from 1850 until today, trophy properties, historical documents, commodities and much more

They also invest millions in second passports and golden visas for having more options and flexibility with tax optimization and asset protection.

Rich people keep their money with tangible assets out of their legal system at home. Their fear is devaluation, inflation and confiscation.

Click on the Play Button  to start the Video

to start the Video

🎞️ ⬇️Content of the Video⬇️

00:00 👉 Where do rich people keep their money?

02:17 👉 What do rich people invest in?

03:49 👉 What banks do rich people use?

04:33 👉 How do millionaires insure their money?

05:15 👉 How do the wealthy protect their money?

06:30 👉 Where do millionaires keep their money?

08:08 👉 Where to invest large sums of money safely?

11:19 👉 Why are Swiss banks famous?

11:38 👉 Why is a Swiss bank account so special?

12:52 👉 Millionaire bank account interest rates

16:01 👉 How do rich people guarantee the safety of their money?

- What do rich people invest in?

- What banks do rich people use?

- How do millionaires insure their money?

- How do the wealthy protect their money?

- Where do millionaires keep their money?

- Where to invest large sums of money safely?

- Where do billionaires keep their money?

- Where do billionaires hide their money?

- Why are Swiss banks famous?

- Millionaire bank account interest rates

- How do rich people guarantee the safety of their money?

📌 [1.] What do rich people invest in?

Since Covid-19, rich people keep their money in tangible assets. They invest in their business and in real estate. However, they are afraid of cluster risks. Geographically well-diversified investments are crucial. Do not put all of your eggs in one basket.

They invest in tangible assets such as:

- high-quality stocks

- dividend-paying stocks

- physical gold in bars and coins

- battery metals

- cryptocurrencies

- real estate in the most wanted locations

- commodities

- historical documents, for example, Napoleon’s declaration of war to Spain

- modern art starting from 1850 until today

- antiques

- car collections

- Roman gold coins and much more

Rich people like multi-currency accounts which are located out of their country of residence. There is no doubt, the US dollar lost value and reputation. They invest in a safe-haven currency like the Swiss franc. The Swiss franc is reliable and stable. The Swiss franc is the sixth most traded currency in the world and 40% backed by gold. They like depositing their liquidity with the best-capitalized and safest banks in the world.

Danger of frequent mistakes!

- My experience shows that rich people discover their investment mistakes ONLY AFTER having suffered substantial losses. The wrong choice of the bank and wealth manager can lead to a total loss. Learn from the mistakes of others.

- I show you important Safety-Criteria to easily discover IN ADVANCE a good wealth manager and unmask wealth destroyers. Do your homework BEFORE you invest!

📌 [2.] What banks do rich people use?

They use the Swiss banks for large sums of money. 30% of all offshore assets are kept with Swiss banks. They are the safest banks in the world. All European countries have budget problems, except Switzerland, Liechtenstein and Norway. Swiss bank accounts offer the highest degree of privacy in the world.

The safest banks in the world are Swiss banks BUT not all Swiss banks are safe enough!

Check the following Safety-criteria

A safe bank should comply with the following safety-criteria (you should consider before investing):

📌 [3.] How do millionaires insure their money?

Here is the nice thing. If a Swiss bank goes bust, your investments are not falling under the bankruptcy mass. Your investments are protected 100% by Swiss law but not liquidity. The Swiss federal government insures a limited amount of 100,000 CHF only. The FDIC in the US insures the first 250,000 USD. The insurance works exclusively for accounts in the name of the client. It’s consumer protection only. If you keep your account in the name of an offshore company, there is no protection.

The Zurich Cantonal Bank offers an unlimited guarantee for the full amount of liquidity. The Zurich Cantonal Bank offers a 100% guarantee. Your liquidity is fully insured by the government of Canton Zurich. That’s exceptional. In the countries of the European Union, the insurance is limited to 100,000 EUR.

The big family offices in Switzerland are engaging independent asset managers for managing the big wealth of their family. They never engage the banks for asset management services. Banks are used for depositing the money but not more. I do the same for my clients as the family offices do. I always engage external asset managers to provide asset management services and the safest Swiss banks for depositing the funds. You should do the same.

According to my “Wealth Management Switzerland Study” analysing 115 existing investment portfolios, only 20% of the Swiss banks engaged for asset management activities outperformed the average performance of 115 portfolios, while 80% of the Swiss banks delivered below-average results. According to my study, independent asset managers have outperformed the banks. Engaging an independent asset manager is imperative for ensuring financial success.

📌 [4.] How do the wealthy protect their money?

The wealthy move their money out of their country of residence.

The biggest risks of losing money are lawsuits (and not Swiss banks going bankrupt) and hiring the wrong financial adviser.

Experience form my law firm shows that

If you keep your money in your home jurisdiction your money is immediately available on a silver plate. It’s very easy to confiscate your money based on a lawsuit if your assets are located in your country.

“The wrong choice of a bank or asset manager can lead to a total loss.“

Rich people have much more lawsuits than poor people. For wealthy people, the biggest risks of losing money are lawsuits.

According to a US study, normal people have to deal with 7 lawsuits in a lifetime on average. Millionaires are suffering dozens of lawsuits per lifetime. Let me give you an example of a well-known millionaire.

Donald Trump and his businesses suffered 3,500 lawsuits in the last 30 years (according to USA Today). The best way for insuring your money against lawsuits is to open a Swiss bank account online and move your wealth to Switzerland.

Swiss bank accounts offer the highest level of protection against lawsuits from the US. I made a specific video on that very important topic with the title:

“How safe is a Swiss bank account from US court cases and foreign judgments”.

Click on the video below!

Click on the Play Button  to start the Video

to start the Video

🎞️ ⬇️Content of the Video⬇️

00:00 👉 Introduction

00:26 👉 Disconnect your assets from the influence of your government and its courtrooms

00:45 👉 Can US court cases or court orders crack a Swiss bank account?

01:12 👉 An offshore bank account in Switzerland is the first step of an offshore plan B

02:28 👉 Reasons for asset protection: frivolous lawsuits, creditors, divorce

02:54 👉 Best asset protection tools are the Cook Islands Trust and Panama Foundation

03:37 👉 The transfer to the trust has to be done before something bad happens

04:02 👉 The Cook Islands trust will become an invulnerable fortress only 2 years after the transfer

04:41 👉 The Cook Islands trust is court-tested. It has a proven track record that it protects assets

05:36 👉 Asset protection trusts must be created before something bad happens

06:10 👉 Swiss banks without a physical presence in the US should be privileged

06:36 👉 There is no beneficial owner register in Switzerland

06:59 👉 Switzerland offers the highest degree of privacy

08:00 👉 Banking jurisdictions with low regulation are so-called Wild-west baking jurisdictions

10:54 👉 An attachment is a Swiss court order freezing the assets

12:05 👉 Creditors have no chance of finding out the Swiss bank account number

12:37 👉 If the account is owned by an offshore company there is no chance for an attachment

13:54 👉 Creditors have many hurdles to surmount

15:11 👉 Cracking a Swiss bank account is nearly impossible

📌 [5.] Where do millionaires keep their money?

The first choice for offshore banking business remains Switzerland. There is no doubt. Switzerland is the number one offshore jurisdiction. It’s the place to be.

“Switzerland is the place where 30% of all offshore wealth is managed“

Singapore and Hong Kong were serious competitors – not anymore. The last 2 years, things have changed.

Since Covid-19, Chinese investors have moved their money from Hong Kong and Singapore to Switzerland. Singapore is too close to China. Investors are afraid of the Chinese leader Xi Jinping and his unpredictable government. The requests from the US for Swiss bank account opening doubled since January 2021 until today.

The Swiss wealth management industry offers the best wealth managers in the world. However, not all wealth managers are good. Here is the thing.

“Choosing the right wealth manager is the key to financial success“

Let’s assume 2 wealth managers are managing a balanced portfolio of max. 40% stocks with exactly the same risk profile. Wealth manager no 1 delivers 8% net performance for the client and wealth manager no 2 delivers only 2% net performance. You should hire wealth manager no 1. A best-in-class wealth manager identified by me has the ability to deliver better results based on the same risk profile!

We know the best of them. Swiss banks offer online access. The account opening process can be done online. We will help you. Identification takes place by a video call. We can open a Swiss bank account for you within 10 days. Millionaires can spend money all over the world with a credit card. The credit card can be connected to a Swiss bank account in the name of an offshore company for more privacy.

Remote account opening services are very important in times of Covid-19 because of travel restrictions. However, we recommend our clients to fly to Zurich for personal meetings after account opening is done. Personal contact with honest service providers is imperative.

📌 [6.] Where to invest large sums of money safely?

Swiss bank accounts are tailor-made for large sums of money. For opening a Swiss bank account most Swiss banks ask for a Swiss bank minimum balance of one million Swiss francs. Swiss banks accept investment accounts exclusively. If a client is not willing to invest he will not be accepted as a client. Foreign clients of Swiss banks are millionaires, of course.

However, Swiss banks do not call their clients millionaires or billionaires. Here is the technical terminology. Swiss banks call them high net-worth individuals.

- A high net-worth individual has one to 30 million Swiss francs invested for asset management purposes.

- An ultra-high-net-worth individual has 31 million and more assets under management.

Swiss bank minimum balance with Caputo & Partners?

Due to our special connections to best in class asset managers, we can start with 500,000 Swiss francs only.

The assets under management of the vast majority of clients of Swiss banks are ranging between one and 10 million Swiss Francs.

📌 [7.] Where do billionaires keep their money?

Most of their wealth is invested in the stocks of their businesses and, of course, in real estate properties. However, most billionaires have a Swiss bank account for asset protection.

Billionaires are named key clients according to the terminology used in the Swiss private banking industry. Key clients are ultra-high-net-worth individuals with 50 million and more.

📌 [8.] Where do billionaires hide their money?

Billionaires are celebrities. Confidentiality and privacy are important. They do not want to keep all of their assets in their own name. They want to keep their assets hidden and protected. Most Billionaires have offshore structures for their wealth.

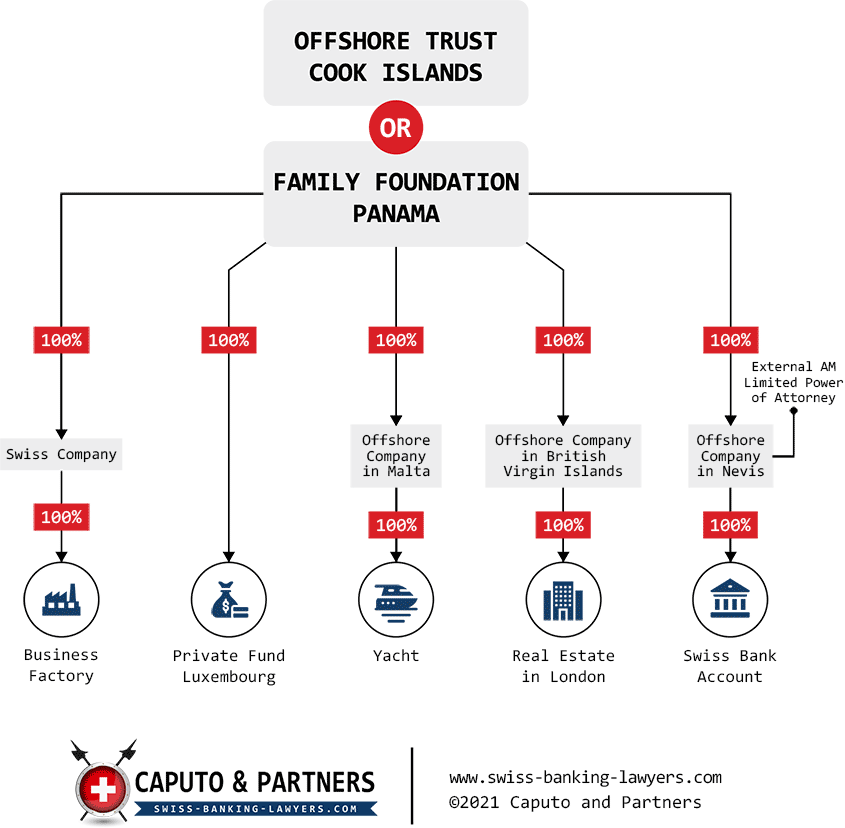

They mostly use irrevocable and discretionary asset protection trusts or family foundations with underlying offshore companies.

The assets are held in the name of offshore companies. Swiss banks are very familiar with confidentiality and privacy as they grow up with the mentality of Swiss banking secrecy.

The classic structure is an asset protection trust in the Cook Islands, or in St. Kitts and Nevis or a Family Foundation in Panama or Liechtenstein. Once the wealth is transferred into the trust for a period of two years, nobody can attack such assets.

“The assets are not only hidden behind the name of an offshore company but also protected”

The assets are bullet-proof. The trusts and the family foundations have underlying offshore companies or LLCs with a Swiss bank account. The money is always invested in Switzerland in the name of an offshore company or LLC.

Offshore Structure with an Offshore Trust (similar as a holding company)

The banks for millionaires and billionaires are always located in Switzerland because of asset protection. If an investor has an asset-protection-trust in the Cook Islands, it does not mean that the money is also in the Cook Islands. Geographical diversification is important but the best jurisdiction for big money is Switzerland. It will be the job of your Swiss wealth manager to diversify your wealth geographically out of Switzerland. There is no doubt about that.

There may be other minor accounts somewhere around the globe but the big part of the cake is stashed in Switzerland. The trust can have underlying companies. The trust is used similarly to a holding company. Trusts can hold real estate properties, a yacht, intellectual property, a private investment fund and other assets.

📌 [9.] Why are Swiss banks famous?

Since the Covid-19 crisis, there has been a spike in new opening Swiss bank accounts as today the mobility of wealthy families is increasing. Let’s come back to the question.

Why is a Swiss bank account so special?

I will give you 14 reasons for it.

For our non-resident clients asking for safety, we have been recommending only the

Ultra-safe Swiss private banks with a tier-one capital ratio of a minimum 20% that are not involved in derivatives, risky lending, no investment banking, no trade finance, no letters of credit, no bank guarantees.

📌 [10.] Millionaire bank account interest rates

Smart investors use banks for depositing their money. That’s it. The banks should not be engaged in asset management services. The asset management services are outsourced with an independent wealth manager. Let me explain why this is so important.

Given the low interest rates, investing in bonds is not attractive anymore.

“High-quality shares have replaced bonds”

All these conservative bond-portfolio investors disappeared from the surface because of very low interest rates.

The appointment of a professional wealth manager who gets results has become more important than ever.

I made a Swiss wealth management study. I analysed the data of 115 investment portfolios. What I discovered shocked me. Here are the results of my study.

The results produced by independent asset managers are five times better than the results of banks. That’s the reason why all big family offices are managing large amounts of money safely and professionally only with external asset managers. They diversify their assets with multiple banks and multiple wealth managers. Diversification is imperative for big amounts of money.

They constantly monitor and compare the results. They kick out non-performing asset managers. Family offices are intentionally not engaging banks for asset management purposes. They are aware of the risks involved. There are dangerous conflict of interest situations that must be avoided.

“We call greedy bankers product pushers – not bankers”

The Swiss banking bonus system is a dangerous misconception. Unfortunately, the product pushers are rewarded with attractive bonuses by the bank if they induce their clients to speculative activities with nonsense transactions and risky leverage strategies with lombard loans. With lombard loans, the investor speculates with money he doesn’t have.

Lombard loans: loans granted against a pledge of liquid assets on the bank accounts.

The sole goal of a product pusher is generating commissions for his bank and himself. The client’s performance is not important for a product pusher. I saw clients who lost a fortune because of product pushers who sold lombard loans leveraging the portfolio.

That’s the reason I always advise my clients to engage a best in class external asset manager with a long-term track record. My best in class asset managers made between 8 and 12% per year on average since 2008. They generated roughly 11% per year on average and this for the last 13 years is based on a balanced investment portfolio.

📌 [11.] How do rich people guarantee the safety of their money?

Many rich people fear a Global Currency Reset. They look for investments able to survive a global currency reset with today’s banking system. This is the reason why tangible assets have become more important than ever.

A Global Currency Reset refers to a change of the financial system based on the US dollar. Instead, the central banks will use, for example, gold in combination blockchain as a new global monetary standard.

Smart investors are looking, for example, storage facilities for physical gold out of the banking system in the bunkers of the second world war in the Swiss Alps, secure crypto storage with specialized Swiss banks, storage facilities for modern art, real estate investments, golden visa and second passports and much more.

Since Covid-19, Rich people mainly from the US are investing in second passports and golden visas. Having more passports means having more options for tax optimization.

Let me give you two examples.

- As soon as Tina Turner received the Swiss passport she relinquished her US citizenship. Having a second passport allows you to relinquish US citizenship and cut all your tax liabilities with the IRS in one shot. No more FBAR filings.

- Many countries introduced severe travel restrictions because of Covid-19. All Russian citizens could not leave Russia because of Covid-19. Wealthy Russians who acquired a St. Kitts and Nevis passport left Russia legally because of their second passport. Having a portfolio of passports offers more flexibility and mobility.

You have automatically more options with tax optimization and asset protection. You can jump in an airplane and take immediate residence in a new country. You have automatically more options with international tax optimization and smart asset protection.