Best Swiss Private Banks (2023) – Swiss Private Banking

1. Explanation – A few important Words you should read

According to the official Swiss private bank list of the Swiss Financial Market Supervisory Authority (www.finma.ch, FINMA) there are 296 authorized banks and securities dealers in Switzerland (June 2018). This official list is of little help to a foreign client looking for the best private bank in Switzerland for a bank account opening. All types of banks and securities dealers in Switzerland are listed on the FINMA list of banks.

Many people are searching for the top 10 private banks. A potential foreign private client of a Swiss bank who is looking for the best private bank to invest his money in Switzerland and protect the assets needs a working tool in the form of a list with key figures of all private banks. He needs important indicators, criteria and key figures that make it possible to assess the soundness and creditworthiness of the private bank of his choice. He should be able to get a first overview and make a first judgement on a specific bank of his choice and that choice not only among the top 10 private banks but all banks offering offshore private banking services in Switzerland.

[Such a working tool does not exist on the Internet until today.]

Caputo & Partners is a specialized boutique law firm dedicated to advising high net worth individuals, HNWI. We advise foreign private clients of Swiss banks (including those who want to become one) in all matters relating to private banking.

We are the leading asset protection boutique law firm in Switzerland with a proven track record.

2. Best Private Bank List (Swiss Private Banks 2023)

Dear Investor,

Please find all existing 102 Swiss Private Banks listed. According to our definition of Private Bank, we mean all Swiss Banks offering private banking services. If you are unfamiliar with the Swiss private banking industry, I recommend our “Private Banking Guide“.

So that you can understand how we rate the banks, you should read this page carefully. I have been especially careful to explain complex things with simple words. It is important to me that everybody can easily understand why certain key-figures and factors are so important. After all, it’s all about securing your money and increasing your wealth.

Whether you are dissatisfied with your previous private bank, looking for alternatives or simply looking for more global diversification, do not hesitate to call me.

We offer comprehensive and individual advice at the highest level for protecting your assets globally.

My promise to you:

“From 102 private banks, we will help you find the best private bank for you. A bank which can satisfy your needs and expectations.”

Your

Enzo Caputo

CEO & Owner – Boutique Law Firm Caputo & Partners AG

Click on the Play Button  to start the Video

to start the Video

️ ⬇️Content of the Video⬇️

00:00 Which bank is the safest for your money?

02:04 How to reduce inflation?

02:59 The US dollar has lost 50% of its value against the Swiss franc in the past 20 years

03:40 Which Swiss bank is best for foreigners?

05:00 Select a pure asset management bank

05:15 What is a Tier 1 Capital Ratio?

06:47 What tells us the year of formation of a bank?

07:10 Avoid banks having a physical presence outside Switzerland

07:31 Avoid banks doing investment banking besides wealth management

07:50 Assets under management vs number of employees

08:32 The liquidity coverage ratio compares liquid assets to current liabilities

08:47 Risk-weighted assets meaning?

09:27 Net-profit per employee ratio meaning?

09:48 Return on equity is the net income divided by the shareholders’ equity

10:02 What is the cost-to-net income ratio?

10:45 What are structured products? How do they work?

11:49 Banks that do not create structured products are much safer

12:24 Best Swiss banks for non residents

13:26 Swiss banks without a physical presence abroad are safer

13:43 Which is the safest bank in the world?

(102 Swiss private banks in alphabetical order)

S.P. Hinduja Banque Privée SA

(will be added soon)

Click on the Play Button  to start the Video

to start the Video

🎞️ ⬇️Content of the Video⬇️

00:00 👉 The world is becoming more insecure

01:30 👉 Why Switzerland is attracting so much new money since Covid-19 crisis?

02:17 👉 Most countries are sinking deeper and deeper into insolvency

03:12 👉 How to circumvent Lebanese capital export restrictions?

04:14 👉 The last will be bitten by the dogs

04:27 👉 Capital export restriction are coming overnight – no announcement!

05:10 👉 Having a Swiss bank account is not illegal – hiding money is!

05:16 👉 How to circumvent OECD reporting obligations?

07:00 👉 How to tell if a bank is safe?

08:32 👉 Smart investors have a plan B

10:12 👉 The best asset managers of the world are located in Switzerland

11:04 👉 Why is the Swiss Franc so strong?

12:30 👉 Swiss asset managers achieve better results than banks

13:35 👉 Why you will make more money with your Swiss bank account?

14:25 👉 Since Covid-19, US investors are buying a second passport

15:00 👉 Here is the typical performance of a Swiss best in class asset manager

18:02 👉 A Swiss bank account guarantees a much better medical treatment

20:50 👉 Asset protection must take place before bad things take place

20:58 👉 Geographical diversification of assets is more important than diversification of investments

22:22 👉 How to avoid the risk of financial kidnapping?

23:20 👉 How secure are banks in Georgia?

Merges, closures and name changes of Swiss Private Banks

Merges & Closures of Swiss Private Banks

BANCA ARNER SA + GS Banque = One Swiss Bank

Bank am Bellevue AG = closed

Bankhaus Jungholz AG was bought by Alpha Rheintal Bank

Banque Paris Bertrand Sturdza was bought by Rothschild Bank AG

Banque Profil de Gestion SA was bought by One Swiss Bank

Falcon Private Bank = closed

Intesa Sanpaolo Private Bank was bought by REYL & Cie – REYL Bank

Landolt & Cie was bought by ODDO BHF

Millennium Banque Privée was bought by Union Bancaire Privée – UBP Bank

Mizuho Bank = closed

Neue Aargauer Bank was bought by Credit Suisse

United Mizrahi Bank was bought by Hyposwiss Private Bank

Bank Degroof Petercam (Switzerland) Ltd was bought by Gonet & Cie | Gonet Bank

Name Changes of Swiss Private Banks

Berenberg Bank Switzerland Ltd name changed to Bergos AG

BLOM BANK Switzerland name changed to Banque Banorient Suisse SA

Hinduja Bank name changed to S.P. Hinduja Banque Privée SA

Van Lanschot Bank name changed to F. van Lanschot Bankiers (Schweiz) AG

We work only in the interest of our clients!

Our boutique law firm Caputo & Partners is completely independent. We recommend the safest banks in the world as custodians, but we do not have any cooperation agreements with the banks for our asset management clients. We do not take money from the banks where our clients’ assets are deposited.

As most family offices do, managing the enormous fortunes of the wealthiest families, we also have our clients’ money managed exclusively by independent asset managers, not by the banks. Studies show that independent asset managers typically generate higher returns than asset management banks.

We have cooperation agreements with the asset managers we recommend. We deliberately do not have our clients’ money managed by the banks. In this way, we eliminate conflicts of interest from the outset. We share the asset management fees billed to our clients by the asset managers. This Profit-Sharing Agreement will be disclosed to the client.

3. FAQ of Foreign Private Clients

- Which Swiss private bank offers the best private banking services with the best private bank accounts?

- Is there a private bank list tailored to the needs of foreign clients?

- How can a foreign investor find the best private bank for private banking with information on the creditworthiness of a Swiss private bank?

- Where does a foreign investor find the right criteria and key figures, with which he can estimate whether the best Swiss banks for private clients can meet the high expectations?

- Which Swiss private banks ranking shows the requested services of excellent quality?

4. Why do we develop the world’s first “Swiss Private Banking Guide”?

There is no directory of banks offering private banking services with the best Swiss banks.

We asked the four major accounting firms KPMG, PWC, E & Y and Deloitte (“the Big Four Audit Firms”) if they had a list of all private banks in Switzerland and would allow us to see it. All Swiss banks are audited exclusively by the Big Four Audit Firms.

As private bank auditors, they have direct and unrestricted access to all the confidential information of the private bank they are auditing. In this respect, they have a monopoly position as international auditing companies. With the help of the auditing companies, we wanted to collect the data that is useful for finding the best Swiss bank for private clients.

It is evident that these companies keep internal lists of the key figures of the Swiss private banks, which they look after as auditors. These data are kept like state secrets. All answers were negative, except for one audit firm. Only one major accounting firm has admitted to owning an internal list of private banks with private banking ranking. She refused, however, to disclose these lists with the key figures. Our request was dismissed without explanation.

Unfortunately, this valuable information is kept secret. The accounting firms are not interested in making the private banking list, including key figures, accessible to the public. Obviously, they do not want the private investor to be able to get a first idea of the creditworthiness and quality of private banks. They want to serve the wealthy clientele (HNWI) alone.

It surprised us that such private banking lists are still kept secret in today’s world of data transparency. That the Geneva private banks still do not publish their annual reports today, we can still understand to a certain extent. Geneva-based private bankers do not conduct banking business with the help of a corporation (a stock corporation limited by shares), but with a partnership. The bank’s owners are fully liable for the bank’s debts with their private wealth. They see themselves as private service providers who accept new customers only on personal recommendation. Therefore, the arch-conservative private banks are preventing the public to look in the cards. The client can only rely on the regulator, FINMA, which also oversees the Geneva private banks.

All business relationships are based on purely personal relationships with personal recommendations. All business is private as it was 200 years ago. For a businessman who is not familiar with the history of the old secretive banking business culture and the typical low-profile mentality among the Swiss population, it will be difficult to understand such a secretive business approach.

We had to find after extensive research that no helpful criteria, numbers and ratios are readily accessible. This means that an international investor will not be in a position to analyse whether his best Swiss bank for private clients is financially stable. There is no immediately accessible information available to the prospective customer, which will enable initial investigations and first valuations of top private banks. The client makes recommendations from private contacts that he trusts to invest money in Switzerland. Most private banks only accept new customers if they are privately introduced and recommended. For 200 years, the client on boarding procedure remained unchanged.

Our private bank list should be a substantial contribution to more transparency within the Swiss private banking industry. That is why we have launched this working tool, our list of 132 private banks, including the 16 most important figures and ratios per private bank, and made it freely available to the international business community on the internet making global private banking more transparent.

The frequently asked questions from our customers and the lack of helpful information have encouraged us to create the first Swiss private bank list showing the best private banks in the world. We are convinced that we have created a working tool that helps foreign investors find the best wealth management banks for offshore banking.

5. 115 Banks providing Private Banking Services

All 115 institutions providing private banking services have a brief description of the key metrics. The key figures were selected from the customer’s point of view. The private bank list is provided with key figures, criteria and information that help the client to make his judgment on his best Swiss bank.

The information was extracted from the annual reports. However, not all annual reports are publicly available. We will continuously collect more information, update and supplement our list.

Which “ratios” are important to the client to estimate the quality of services and the number of financial reserves?

Each Swiss private bank has 16 key figures

Each listed Swiss private bank contains 16 criteria and key figures explained in simple terms. The most important key figure for the customer is the Tier 1 Capital Ratio, better known as Tier 1 Ratio. That is why we have explained in detail the calculation method of this key figure.

Our goal is to make the private bank list as understandable as possible. The international investor should have a comfortable overview of all Swiss private banks and their key figures so that he can make an initial assessment.

Alert!

The private bank list is not a substitute for personal advice.

Caputo & Partners is a law firm specializing in advising international banking clients. Although the list of 115 private banks provides the first overview of Swiss private banks, it can never replace our tailored advice.

6. The 3 most fatal Errors in Private Banking

We protect you from the 3 most fatal errors in private banking that can destroy your assets in no time.

- The choice of the wrong private bank

- Working with a greedy private banker

- The purchase of risky private banking products

If you make one of these 3 fatal mistakes, you risk losing your savings overnight.

For large assets over CHF 30 million, we recommend diversification for multiple banks. The service quality, the asset management fees and the performance of the portfolio can be compared and optimized.

7. Club Deals & Off-Market Real Estate Opportunities with Swiss Private Banks

We will introduce you to the best private bank and a top banker for Swiss bank account opening. The best private banks for high net worth individuals, including the largest private banks such as UBS and Credit Suisse are useless if the client will be served by a junior banker. That’s why we make sure you are served by a top banker. Our top bankers, with whom we have been working together for 30 years, demonstrably increase their clients’ assets. We are happy to explain to you the track record of the performance of our top bankers.

We give you access to exclusive club deals and off-market deals. These are very confidential business opportunities handled quickly and discreetly. The relationship of trust among the parties ensures above-average returns. Club Deals are exclusive deals that a top banker offers only to his best private clients and to us. The parties to such deals have already proven successful transactions. In many cases, prominent personalities are involved who attach great importance to the utmost confidentiality. Cumbersome credit checks with a proof of funds are not necessary since the money already lies with the private bank on the Swiss bank account. Being allowed to participate in such lucrative “club deals” is a privilege. Anyone who behaves unfairly has quickly lost his privilege.

When you show the outcome of your Club Deal, for example, a newly acquired trophy property, to your friends, they will turn green with envy and be amazed. Astonished, they will ask you: “How did you manage to get access to such exclusive property?”

Choosing the best Swiss private bank is a very important decision on your financial life. According to a study by the Banking Institute of the University of Zurich, a bank account relationship with a private bank lasts an average of 17 years. The duration of an account relationship with a Swiss bank far exceeds the duration of a marriage. This comparison shows that an important decision with a long-term effect in your financial life should be well considered.

Financially successful people seek advice. Our advisory fee is nothing compared with the cost of a wrong financial decision.

8. How a Protector can protect your Wealth

Protect your assets by engaging us as the protector of your assets in Switzerland!

Every Anglo-Saxon offshore trust has a “Protector”. An offshore trust is an instrument of international estate planning for High Net Worth Individuals (HNWI). The trust has similar characteristics to a family foundation. The Protector is usually a lawyer who oversees the activities of banks and asset managers. Appoint us as the “Protector” for your offshore accounts.

We will negotiate better conditions for you. The bank charges are not set in stone. As we have placed several clients with the private bank, we are in the fortunate position of negotiating advantageous terms. We know the pricing standards of the Swiss private banking industry.

Thanks to our introduction, you can be sure that you will only be looked after by the best professionals for private wealth management – according to the “best of class” principle.

9. Facts, Figures & Criteria to find your Best Swiss Private Bank

9.1. Address

Address of the Bank

9.2. Phone

Telephone number at the reception

9.3. Website

Internet Domain

9.4. Year of foundation

Year of formation of the Bank

9.5. Subsidiaries

Controlled legal entities by the Bank

9.6. No. of employees

Number of staff

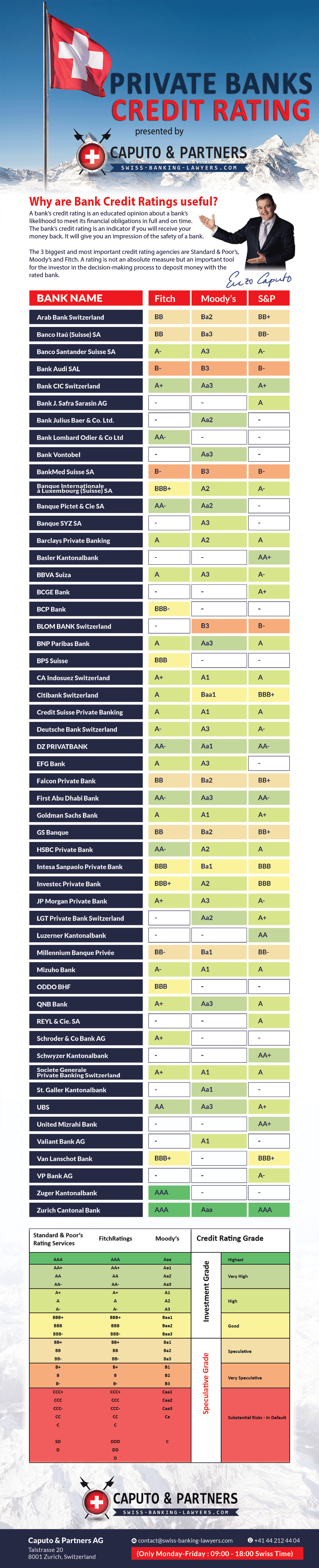

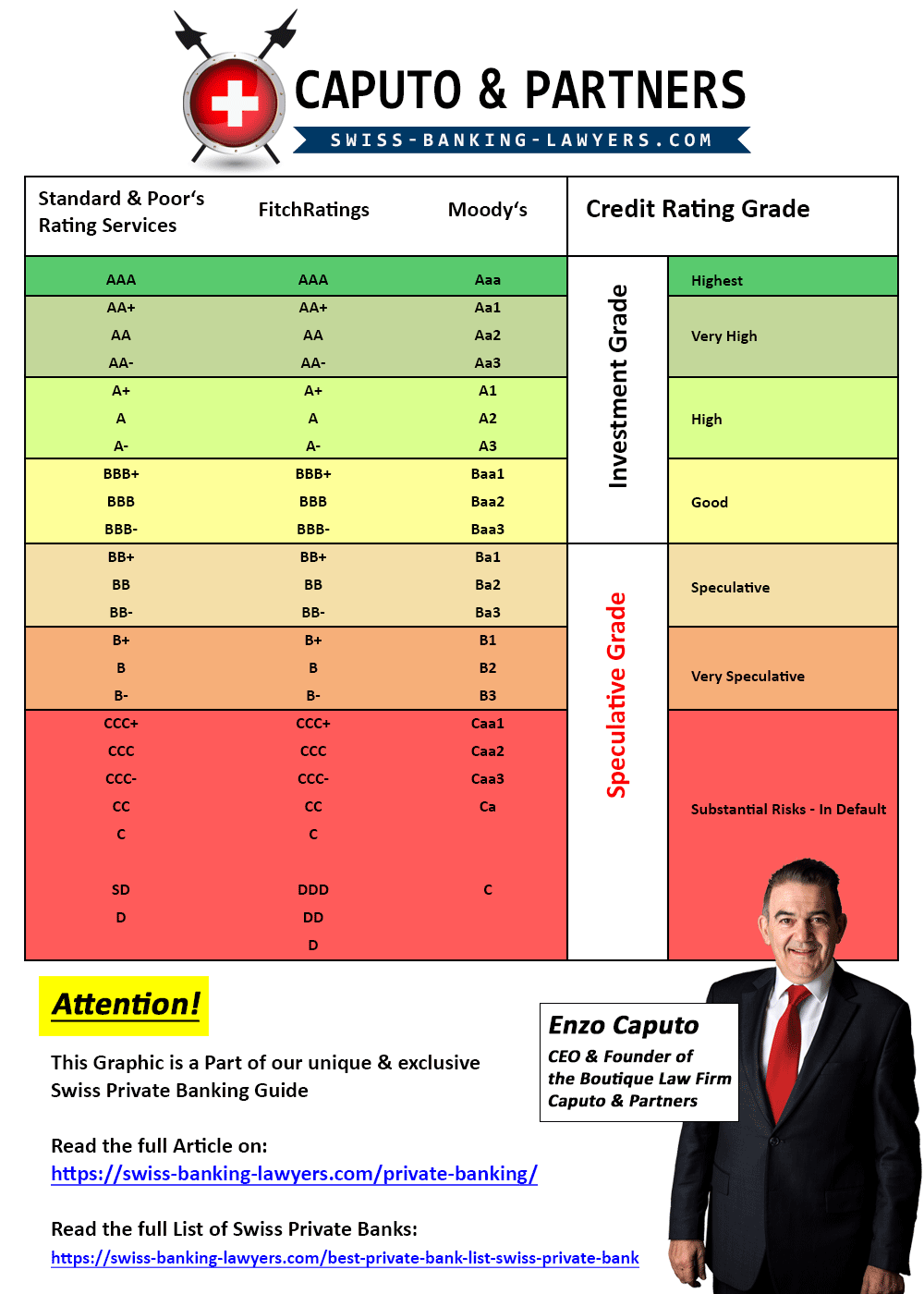

9.7. Rating

The rating agencies assess the credit rating, i.e. the creditworthiness of a bank.

The 3 Big Rating Agencies are Moody’s, Standard & Poor’s and Fitch Ratings.

These 3 agencies have a de facto monopoly, controlling 95% of the market.

9.8. Chairman

The Chairman of the Board of Directors

Here is a distinction:

Executive Director, the member of the Board of Directors, is active in day-to-day operations.

Non-executive Director, the member of the Board is not active in the operating business.

9.9. Shareholder’s equity

Share Capital with Reserves

Shareholder’s equity is calculated by subtracting all liabilities from the sum of all assets. Shareholder’s equity is the result of the share capital plus retained profits. Interesting to know is how has the bank used the money shown as shareholder equity. Where did the bank invest? Has the bank established a representative office in Asia? If a bank, instead of paying dividends, retains these realized gains as reserves, these funds become part of shareholder’s equity.

9.10 Assets under Management (AuM)

Clients‘ assets managed by the Bank

Assets under Management represents the market value of the assets that the Bank manages, either passively or actively, for bank clients. The assets under management cover all assets managed in the bank, including assets, where the customer decides on his own investments – with or without consulting or asset management agreement.

AuM extends to all types of assets in custody of the bank:

- Asset Management Agreement, known as the Discretionary Asset Management Agreement

The bank manages the assets for the customer. The bank makes all investment decisions. - Advisory Agreement, the Investor decides which investment products are taken

- Pure Custody Agreement, known as “Execution Only” Agreement (Bank acts as Custodian)

9.11. Assets under Management : Employees = X

The managed assets of the private bank are divided by the number of employees. This provides an indicator for assessing the quality of care. The more assets an employee has to look after, the less attention he can give to his customer. To make more accurate statements about the quality of the service, one would need to know how many assets are serviced by a consulting mandate (customer makes investment decision) and how many assets are actively managed with an asset management mandate (bank meets investment decision).

9.12. Net Profit

Every investor wants to invest his money in a bank that generates as constant profits as possible. If the bank makes profits and loses, be careful. This could be an indication of risky investment banking activities. Those looking for the best Swiss bank for private clients should take a closer look at banks that are also active in investment banking. Investment banking means a high risk.

Other risk indicators are lending and proprietary trading (proprietary trading). Only very few banks trade foreign exchange, which they take on their own books. Anyone who comes to Switzerland because he wants to secure and diversify his assets with the help of Swiss private banks avoids banks that are active in lending, investment banking and proprietary trading. These are all risk factors.

9.13. Net Profit : Employees = X

The net profit is shared by the number of employees. This metric shows the financial performance of the employees. An average indicator may exceed CHF 100,000, but should not exceed CHF 500,000. If the number is very high, investment banking businesses could be involved.

On average, Swiss private banks currently generate 0.8% of their assets under management. For example, if the private bank manages CHF 1’000 million in client assets, it makes an average of CHF 8 million in revenues from private banking services. Before the financial crisis in 2008, the revenues of the banks were much higher. Before the financial crisis, banks received 1.3% of assets under management (AuM). Bank charges have come under pressure. They will continue to decline.

Lower bank fees due to the elimination of Swiss bank secrecy in tax matters

Thanks to the strong banking secrecy, it had many customers with black money on an anonymous bank account. The bank was able to effortlessly enforce higher fees with the customer. Today, in the age of tax transparency, customers are increasingly negotiating the number of bank charges. We always negotiate the conditions for our customers. The higher the AuM of a customer, the better conditions can be negotiated with the private bank.

9.14. Tier 1 Capital Ratio

The Tier 1 Capital Ratio is the most important indicator for clients. It provides information on the indebtedness of a bank as a risk indicator compared to the own funds. That is why a detailed description follows.

The share capital and the retained profits are aggregated and shared with the liabilities.

(Share capital + retained profits) : Liabilities = Tier 1 Capital Ratio

The equity is in the ranking at the very end of insolvency-related repayability to the creditors. It stands at the end of the bankruptcy process and remains as a liability substrate for the creditors. Therefore, the shareholder’s equity in total capital is of great importance to the creditors of the bank. The most important creditors of the bank are the customers.

Investing money in Switzerland enjoys bankruptcy privilege with the right of separation

Bank customers in Switzerland do not lose their money when it is invested. Investing in a securities portfolio in Switzerland protects investors in the event of bankruptcy thanks to a bankruptcy privilege. The money invested in securities portfolio consisting of shares, bonds and other investments in Switzerland does not fall into the Bank’s bankruptcy estate. Only the liquid assets of CHF or EUR fall into the bankruptcy estate and form the liability substrate for the creditors.

In Switzerland, in the bankruptcy of the bank, the customer may remove and rescue his investments (shares, bonds, certificates, structured products, etc.) from the bank. He has a segregation and a right of protection against bankruptcy. The investments are privileged in bankruptcy. He only loses his positions in cash. The first 100’000 CHF in cash is guaranteed by the state. Anything over CHF 100,000 becomes part of the bankruptcy estate. The higher the bankruptcy dividend, the more the customer can save.

“Attention! Benefit from the bankruptcy privilege in Switzerland!”

If you invest your money with a Swiss bank, you will not lose your money in case of a bankruptcy of the bank.

You are exposed at risk if you hold EUR, CHF or other positions in currencies.

As banks worldwide operate with relatively little equity capital and their liabilities exceed equity levels by 6 to 15 times (“gearing” with non-banks usually only goes up to three times), banks’ risks are particularly high for investors. Too low equity ratios quickly lead to unstable banking systems in case of losses. These are so-called systemic risks. Banking supervision has learned from the lessons received in the 2008 financial crisis and from devastating leverage effects. It has set strict rules for the protection of equity.

In the 2007/2008 financial crisis, bank regulators realized that banks needed more equity.

Since January 2014, the Capital Requirements Regulation (CRR) has been applied primarily in relation to “hard core capital”, the purest form of equity:

- „Common Equity Tier 1“ (Art. 25 CRR): hard core capital

- “Additional Tier 1 Capital (Art. 51 CRR): additional core capital

- „Tier 2 Capital“ (Art. 62 CRR): supplementary capital

The Tier 1 capital consists of the subscribed share capital, the premium (mark-up) from a super-premium issue (the market value is above the nominal value) and the earnings retention (retained earnings). Supplementary capital (Tier 2 Capital) is losing more and more importance.

Hard core capital ratio = Common Equity Tier 1 / Total amount of liabilities x 100%

Additional Tier 1 capital ratio = core capital / total amount of liabilities x 100%

Total capital ratio = total capital / total amount of liabilities x 100%

Minimum Ratios in Europe – will start in 2019

As of January 2019, banks in Europe must comply with the following minimum ratios under Art. 92 CRR:

- Hard core capital ratio: at least 4.5%

- Additional Tier 1 capital ratio: at least 6%

- Total capital ratio: at least 8%

If the total claim amount of a bank amounts to 100 million, the hard core capital must amount to at least 4.5 million. If the Tier 1 Capital Ratio falls below the 4% threshold several times, the bank license is withdrawn in the EU.

The Swiss private banks fulfil these requirements by far. With a Tier 1 Capital Ratio of 15%, you can certainly sleep soundly. If you make sure that you invest your money wherever possible in stocks, bonds, etc., not much can happen to you in Switzerland. Since Private Banking is considered a non-risky business for the banks, your money in Switzerland is safe with Swiss private banks with Tier 1 Capital Ratio of 15% – 30%.

Should a bank go bankrupt anyway, the Swiss government will intervene or the bank will be taken over by a sound institution. Since Switzerland is never in debt, there is always enough money to save a bank.

When a bank massively destroys money and the financial situation becomes precarious, the rumours will immediately seethe among the bankers in Zurich. Rumours spread like wildfire in well-informed circles. The bankers refer to the spreading of such rumours in banking as a “Bush phone”. If you subscribe to our newsletters, I’ll let you know about such rumours right away, so you have plenty of time to repost your money to a secure bank.

The core capital ratio (the Tier 1 Capital Ratio) is the most important balance sheet ratio of a bank. It is an indicator of banking supervision, of the reputation of the bank, of investors and always part of rating agency ratings.

FINMA, the watchdog of the Swiss banks, will withdraw the bank license from a bank that does not meet the minimum requirements.

The CRR apply in the EU. FINMA has set a hard core capital ratio of 10% for UBS and Credit Suisse, as both biggest private banks are classified systemically important (“too big to fail”). These specifications are known in relevant circles as “Swiss Finish”.

The Swiss public will demand a hard core capital ratio of 19% by the end of 2018. In the UK, only a core capital ratio of 9% has been required since the financial crisis. If the minimum quota in the EU is not reached by banks, there are state subsidies from the government bailout package, with which the state plays a part in the banks. I refer to the article “Private Banking”.

Tier 1 capital ratio explained in simple terms

The effectively available funds are divided with liabilities (debts).

Bail-In Legislation came into force since 2017 in the 28 EU nations

The article on Private Banking explains the Bail-In Legislation introduced in Europe, which has been in force since 2017. In the event of a crisis, bank balances of more than EUR 100,000 will be forcibly nationalized, as was already the case in Cyprus in 2013.

The next crisis will come for sure

If your money is still in a dilapidated country, it’s time to save your money. Bring your money to Switzerland before money transfers to Switzerland are banned by EU countries. It is never too early, but often too late. Capital transfer restrictions are sanctions that are often used in financial crises to stop capital flight.

“Save your money and not your bank”

9.15. Cost : Income Ratio = (CIR)

This cost-income ratio is an indicator of the bank’s efficiency. Cost divided by revenue yields a measure that shows how economically the bank is operating. The lower the value, the more efficient the bank is. This measure shows how many EUR cents are needed to earn one EUR. This consideration only makes sense in similar markets.

If you compare banks that operate in a different interest rate environment the key figure quickly loses its meaningfulness. That’s why you should never compare Swiss banks with banks in Turkey. In Turkey, interest rates are high. There does not need much capital there to generate high-interest income.

9.16. CEO

The Chief Operating Officer (CEO) is the managing director of the bank.

He leads the daily business.

If something goes wrong in the bank, then the CEO has to stand straight.

One hour after your first call we accompany you in the bank solving your issue.

We act faster than any other big law firm in Zurich.

Get answers now +41 43 508 24 59 or write us an E-Mail.

Who is Enzo Caputo?

► ► ► Click here and learn more about

the Tax Attorney & Financial Lawyer No.1