Independent Financial Advisor in Switzerland

Facts you must know BEFORE investing money

My daily business as a Swiss banking lawyer shows that most investors have recognized their bad investments only AFTER having suffered millions of losses. The wrong choice of banks and Swiss investment firms is the main reason for substantial losses. Learn from the mistakes of others.

If you hire a good independent financial advisor in Switzerland – the same as the big family offices are doing – your returns will be 4 times better than if you have your money managed by a bank.

I show you how to easily recognize the good Swiss wealth advisors and unmask wealth destroyers BEFORE you start investing your money.

This insider information will give you the answers you always wanted to know but your private banker kept secret.

As a former CEO of the Swiss Association of Asset Managers (https://www.vsv-asg.ch), I know the Swiss financial consulting industry very well. I know the dirty tricks of the product pushers disguised as private bankers. Later, you will discover a real-life example of a product pusher (=dishonest consultant).

Due to my special connections, I got access to reliable data on 115 real existing investment portfolios with a long-term track record of 10 years. They were managed directly by a Swiss bank or an independent financial advisor in Switzerland.

Your

Autor: Enzo Caputo

Banking Lawyer since: 1986

Position: Founder & CEO of the

Boutique Law Firm Caputo & Partners

Updated on: 18.02.2022

Results of Swiss investment firms that will shock you!

According to my estimate based on 115 case studies and 30 years of professional experience, only 29% – from 2,500 independent asset managers in Switzerland and all 115 Swiss private banks that offer private banking services – can outperform the benchmark.

Among the 29% outperformers, only 20% of them are Swiss private banks while 80% are independent Swiss investment firms. During the last 13 years, my Best-in-Class wealth managers made between 8% and 12% a year on average for my clients. I never lost a client in the last 13 years.

Performance of 2.500 independent Asset Managers & 115 Swiss Private Banks

29% Outperformer of Independent Asset Managers & Swiss Private Banks

- How to find the Best-in-Class Swiss Wealth Advisors?

- Achieve better results with an independent financial advisor in Switzerland

- Swiss financial consulting firms means no conflict of interest

- What are the 5 most important reasons why Swiss investment firms (including Swiss banks) can produce substantial losses destroying your wealth?

- Financial Advisor Switzerland vs Bank in Switzerland: Who makes better returns?

- What is a reasonable fee to pay a financial advisor?

- Is it worth the money to hire a financial advisor?

- What is fair pricing?

- How much do financial advisors make in Switzerland?

- Are the largest asset managers in Switzerland the best?

[1.] How to find a Best-in-Class Swiss wealth management company?

do NOT rely on:

- Chance or luck

- The advice of your private banker

- Coincidence

- The well-intentioned advice of a family member or an old friend

- Your instinct

When your wealth is concerned, you should only rely on the long-term track records of proven professionals.

After all, foreign investors are coming to Switzerland to protect their assets long-term with a Zurich protection adviser such as Caputo & Partners AG. As the average duration of a Swiss bank account is 17 years – longer than a marriage – choosing a safe bank and a proven asset manager are important decisions. Caputo &Partners will supervise your depository bank and independent asset manager.

Here, you get the chance to educate yourself and make smart decisions.

Caputo & Partners AG is a boutique law firm. We introduce our clients to the best capitalized Swiss banks. Our partner banks are not involved in derivatives, risky lending, trade finance, letter of credit and other risky activities. For depositing your assets, we only suggest the safest Swiss banks without leveraged balance sheets. Your money will be deposited with the safest banks on earth.

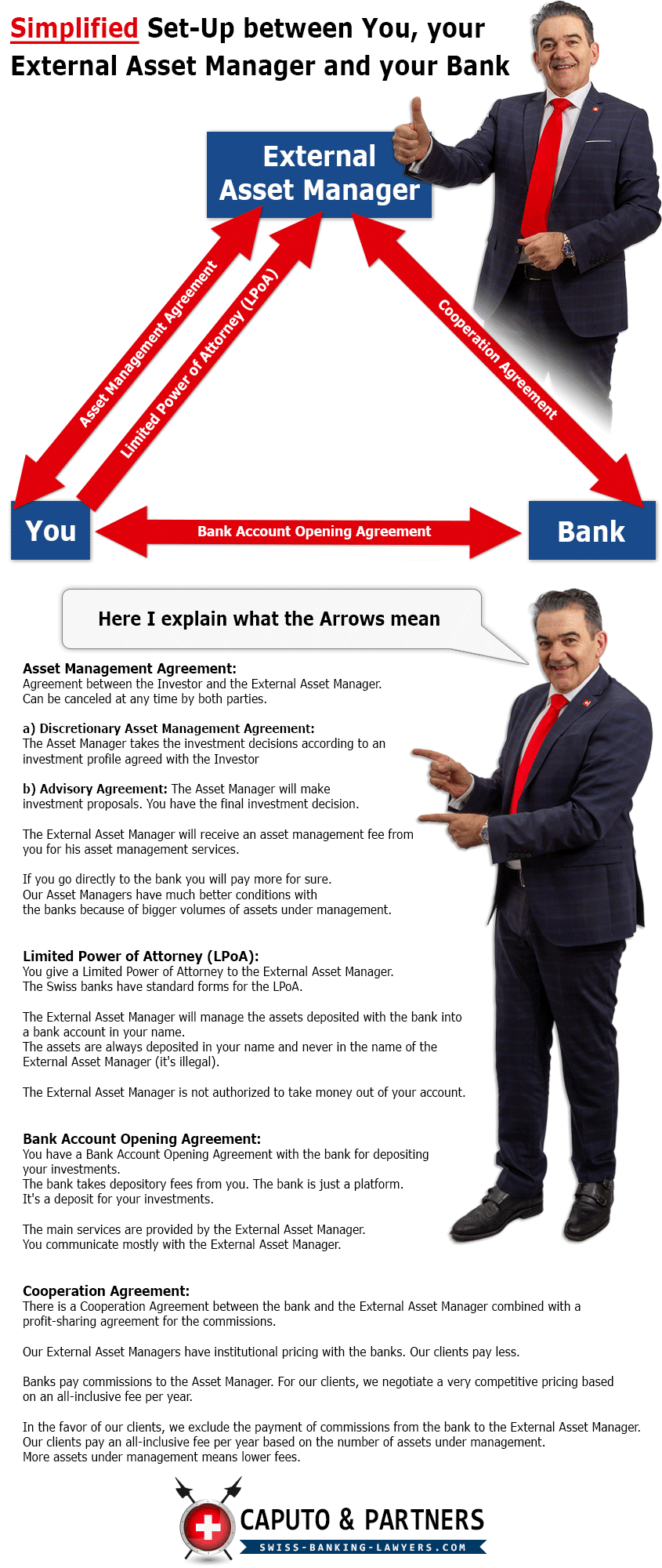

For the asset management services, we engage a Best-in-Class external asset manager in Switzerland and not a bank. The bank should just be a platform (a very safe platform) as a booking center and not manage your money.

[2.] Achieve better results with an independent financial advisor in Switzerland

Can a financial advisor be independent?

He must be. Avoid a bank-owned asset management firm under the same umbrella as the bank. In case of a conflict, this will backfire. The money manager should be subject to a financial advisor regulation in Switzerland or a professional organization, for example, the Swiss Association of Asset Managers, www.vsv-asg.ch in Zurich, or an organization for financial planning in Geneva.

Swiss banks tend to invest your money in their homemade financial products. That’s one of the main reasons why independent asset managers (not offering homemade products) deliver four times better results than banks! They invest in the best product for the client and not for the bank.

[3.] Swiss financial consulting firms means no conflict of interest

Swiss bankers are often in a conflict of interest situation when managing the assets. Having a Swiss financial consulting firm AND a depository bank as a platform means lower costs and better results for your investment portfolio.

The last stock market crash (March 2020) revealed crystal clear who masters the job when the markets go crazy and who is only a fair-weather captain when markets constantly go up. Only those who can manage critical market situations and can hedge the assets of their clients deserve our qualification “Best-in-Class Swiss Wealth Advisors”.

[4.] What are the 5 most important reasons why Swiss investment firms (including Swiss banks) can produce substantial losses destroying your wealth?

71% of the portfolios analyzed, have underperformed below the benchmark.

I learned that honest Best-in-Class Swiss financial consulting providers can not be found around the corner. Caputo & Partners will introduce you to a handful of impeccable professionals who are not doing the following 5 common mistakes.

5 most common rip-off strategies of Swiss investment firms that can destroy your wealth

[5.] Financial Advisor Switzerland vs Bank in Switzerland:

Who makes better returns?

Here is the truth (based on my 115 case studies):

“Among the outperformers (=29% made better results than the benchmark), only 20% were banks and 80% were Swiss financial consulting firms, respectively, independent asset managers.”

Unbelievable, isn’t it?

Let’s put it in other words.

“Good asset managers are 4 times more likely to be found among Swiss wealth advisors than among Swiss banks.”

It’s an open secret that Swiss private bankers are under massive pressure to sell investment funds and structured products issued by the bank they work for.

“The controversial bonus policy of the big Swiss banks is transforming honest private bankers into greedy product pushers.”

Typical real-life case-study example from my daily business:

“The victim of a product pusher”

Very important legal Information:

Due to legal consequences, I will not disclose any data of banks and clients in this true case. However, I will disclose an astonishing fact. The bank involved is one of the largest banks in Switzerland. The following information has been slightly changed to protect the client. The rest of the facts correspond to reality.

Last January 2022, a foreign client from Kuwait with a 25 million portfolio being the victim of a product pusher came to my office. He submitted his portfolio statement. The assets were managed by one of the big Swiss banks. He asked me why he has made only a 1,2% return in the last year of 2021 while others made 15% in the same year? (2021 was an exceptional year for stocks)

After a quick look of only one minute into the portfolio statement, I discovered that the 25 million were invested exclusively in investment funds. This is a no-go for big money. The funds have been issued by the same big Swiss bank. Investment funds are super-expensive. They have hidden fees.

The product pusher (greedy private banker) justified his strategy with the argument of reducing risks with a wide diversification. I told him that with a 25 million portfolio there is no need for diversification of investments with funds. There is by far enough money to diversify with direct investments in stocks and bonds instead of investing in super-expensive funds, hedge funds and funds of funds as suggested by the product pusher. I told him that he can easily compose his own fund with direct investments.

Unfortunately, this legal rip-off strategy is very common among the big Swiss banks. It’s common knowledge in the private banking industry that direct investments in stocks are outperforming indirect investments with expensive funds. Fund investments can be justified for small portfolios worth less than 1 million EUR.

The truth is that the big cake, the majority of the performance of the client’s 25 million portfolio, has been shared between the Swiss bank (owner of the products) and the product pusher (disguised as a bonus payment) instead of him as a client.

Subsequently, it was very easy for me to convince him to immediately cancel the asset management agreement with the bank and sign a new one with a Best-in-Class independent asset manager I suggested.

Today, he is using the same Swiss bank as a depository bank, not more. The big Swiss bank will never manage my client’s assets again.

[6.] What is a reasonable fee to pay a financial advisor?

Let’s assume that you invest 2 million CHF with your Swiss bank.

Swiss banks are charging up to a 2,75% all-in fee per year from the assets under management.

The hidden fees in their financial products are very difficult to calculate. Despite the fact of hiring an external asset manager or not, asset management fees must be paid anyway, to the bank or to the external asset manager. At the end of the day, you pay less with an external asset manager.

I suggest asset management companies providing Swiss financial services in Zurich without their own financial products. That means that the conflict of interest situations are eliminated.

If you engage an independent financial advisor in Switzerland you will pay less because of the institutional pricing between the depository bank and the independent asset manager. I advise my clients to negotiate all-inclusive fees.

Don’t blindly follow the advice of the big bank’s advisors.

I have seen significant losses in the millions of dollars and hidden fees that have destroyed many assets of wealthy entrepreneurs.

Be smart and learn from other millionaires’ mistakes.

Speak to Mr. Enzo Caputo today and let us analyze your situation.

[7.] Is it worth the money to hire a financial advisor?

Yes, because you will pay less and make more profit. Swiss investment firms have better conditions with the banks because they bring substantial assets of their clients to the banks. They have an institutional pricing agreement in place for their clients.

To increase their salary and bonus, many dishonest bankers (=product pushers) are selling so-called Lombard-loans at very attractive interest rates of less than 1% per annum leveraging your portfolio. The bank takes the liquid assets in the portfolio as a pledge which can be liquidated very easily, normally within 24 hours.

Alert:

“Do not leverage your investment portfolio with Lombard-loans!“

In case of market fluctuations, the bank will force you with a so-called Margin Call to instantly liquidate your investments, at the wrong moment.

I saw many clients losing a fortune as the victims of Margin-Calls connected to risky Lombard-loans exposed to market fluctuations.

An honest financial advisor will not leverage your portfolio.

[8.] What is fair pricing?

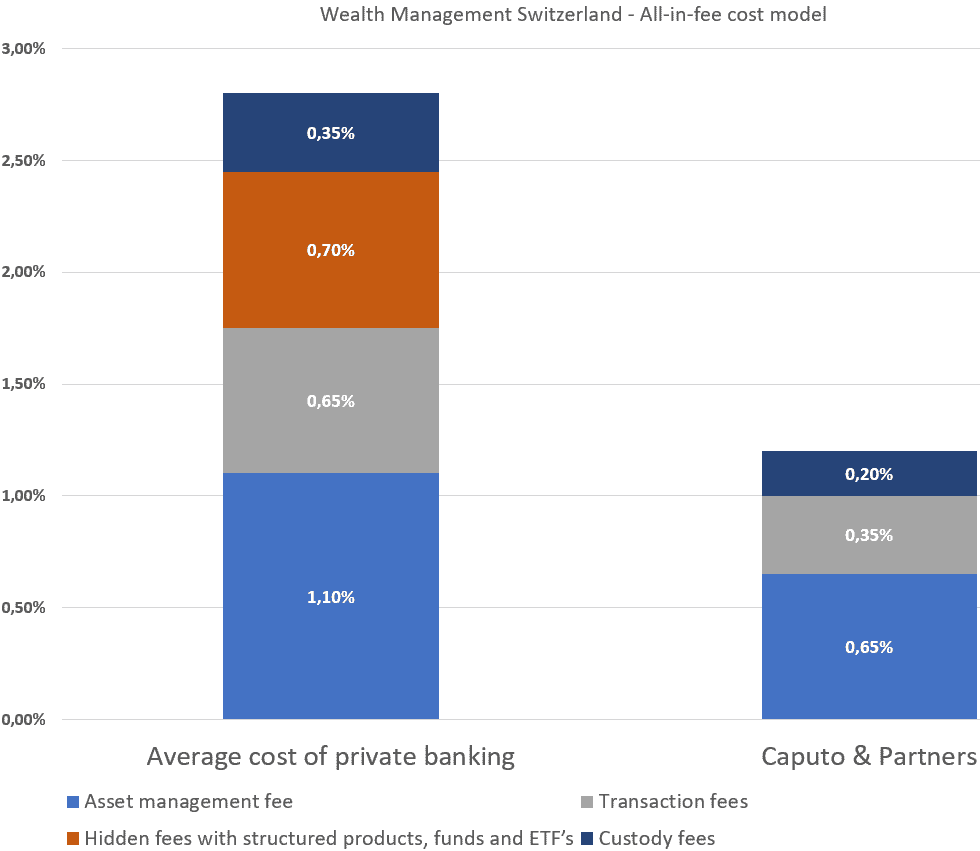

Fair and all-inclusive pricing for having 2 million CHF assets under management should not exceed a 1,2% all-in fee for Swiss financial services in Zurich. That’s 24,000 CHF per year.

The pricing model of a Swiss private bank vs Caputo & Partners all-inclusive fee pricing model

| Fees | Private Bank | Caputo & Partners |

| Custody fees | 0.35% | 0.20% |

| Transaction fees | 0.65% | 0.35% |

| Hidden fees with structured products, funds and ETF’s | 0.70%* | 0% |

| Asset management fee | 1.10% | 0.65% |

| Total fees | 2.80% | 1.20% |

*We assume that 50% of the assets are invested in funds, ETFs and structured products and 50% with direct investments (stocks, bonds).

A Swiss private bank can typically charge you up to 2.75% per year (2,000,000 CHF). That means that you will pay 55,000 CHF (all-inclusive fee) to the Swiss bank.

If you work with Caputo & Partners the all-inclusive fee is 1.2% of 2,000,000 CHF.

1,2% means 24,000 CHF per year instead of 55,000 CHF.

Since Swiss banking secrecy is not protecting tax evasion anymore, the pricing for foreign investors became more attractive.

Let’s have a closer look at a portfolio of 5,000,000 CHF. If you let us negotiate, the all-inclusive fee should not exceed 1% per year.

Unfortunately, the pricing is not transparent. Most non-resident clients just accept the standard pricing without negotiating. A huge mistake.

Let us negotiate for you. Everything is negotiable.

[9.] How much do financial advisors make in Switzerland?

Employed asset managers (without private clients) have a yearly salary of ca. 120,000 CHF – 150,000 CHF.

If they bring their own clients from the bank they previously worked for to the new employer, they will make much more money depending on the number of assets under management they can transfer to the employer.

At what salary do I need a financial advisor?

For people having small salaries (50,000 EUR – 100,000 EUR per year) I suggest booking a financial advisor on an hourly basis, just for a couple of hours, and, from time to time reviewing the portfolio.

How much does it cost to talk to a financial advisor?

You can book one for ca. 300 CHF/h. It is definitely worth it. Receiving impartial advice is key to preventing costly mistakes.

If you deposit 1 million CHF with a Swiss bank, and you hire an honest Swiss financial advisor, you should not pay more than 12,000 CHF (=1,2%), an all-in fee per year, including bank and independent financial advisor.

How much does an independent financial advisor make?

The income depends on the number of assets under management. The majority of firms, among the 2,500 asset management firms in Switzerland, are small boutique firms with 100 million assets under management, on average.

The more assets they manage the more money they will earn. If they have their own clients the salary is much bigger depending on the number of assets under management they can introduce to the employer.

Is an independent financial advisor worth it?

An independent financial advisor will bring transparency to the intransparent Swiss private banking industry. The risk of receiving low-quality advice from product pushers can be drastically reduced with an honest financial advisor.

Educate yourself before you hire an asset manager. Check the track record based on genuine bank statements. Do not rely on excel sheets only. Counterfeit charts are often used to convince non-resident investors. A good advisor will help you to become familiar with the industry. Your invested money will come back twice.

[10.] Are the largest asset managers in Switzerland the best?

Bank-owned firms are the largest asset managers in Switzerland.

The 3 largest asset managers have 800 billion CHF of assets under management as per the end of the year, 2020.

-

- UBS Asset Management

- Credit Suisse Asset Management

- Swisscanto Invest by Zürcher Kantonalbank

- Pictet Asset Management

- Partners Group

- Vontobel

- AXA

- LGT Capital Partners

- DWS

- Lombard Odier Asset Management

(Source: Swiss Asset Management Study 2021 of the Lucerne University of Applied Sciences and Arts

https://www.hslu.ch/)The majority of investors are convinced that the largest asset management companies deliver the best service, the best performance and the best pricing.

It’s a misconception.

It’s a big mistake to blindly engage the largest asset management firms just because they are the largest.

The same misconception exists with the safest Swiss banks.

As the largest Swiss banks are not the safest Swiss banks, the largest asset management companies are not the best.

As we have seen, the private banking and asset management industry is not transparent. If you are interested in outperforming asset management providers that have outperformed the benchmark, for the last decade, you should call Caputo & Partners.

I don’t have a crystal ball. I can’t promise a two-digit performance with my Best-in-Class financial advisors with a “how to become rich” recipe for the future.

I can promise you one thing for sure. I never lost a client in the past. All my clients are happy to have their assets professionally managed and booked with one of the safest banks on earth in a secure and reliable country.

Final Comment from the Author Enzo Caputo:

We will help you to find the safest Swiss banks to deposit your money in a Swiss bank account in your name (money stays always with the bank). The asset management services will be outsourced to a Best-in-Class Financial Adviser in Switzerland introduced by our law firm. Our asset management firms made above-average returns between 8% and 12%, the past 13 years. They are transparent, fair and honest.

Because of the same reasons, also the well-managed family offices prefer to engage independent financial advisors.