Company Formation in Switzerland – The Ultimate Guide

If you incorporate a company in Switzerland as a non-resident, you are right on-trend. Some of the largest global companies are headquartered in Switzerland. The highest concentration of Fortune 500 companies is in Kanton Zug. Company formation in Zug Switzerland can be considered as one of the most attractive locations worldwide to start a company. Prominent examples of large companies in Switzerland are Google and Adobe.

Actually, there is a start-up boom. 43,185 Swiss companies were founded last year in 2018. More than a third of the investors are foreign investors without a residence in Switzerland. Setting up a company in Switzerland takes only 2 to 6 weeks.

Innovation, political stability, no corruption, anonymity for investors, liberal legislation, excellent banking system, low taxes, quality of life and much more make a Company Formation in Switzerland attractive. Wealthy foreigners are protecting their global assets with Swiss companies.

Autor: Enzo Caputo

Banking Lawyer since: 1986

Position: Founder & CEO of the

Boutique Law Firm Caputo & Partners

Last Update: 26.07.2019

- It is easy to start a business in Switzerland?

- Global asset protection (case studies)

- How long does it take to incorporate a company in Switzerland?

- Company formation in Switzerland – comparison to international locations

- How can a foreigner start a business in Switzerland?

- Legal entity in Switzerland – GmbH or AG?

- Offshore Company Formation in Switzerland Check List: AG vs. GmbH

- Company Formation in Switzerland for Global Asset Protection

- Wild West Banking with Pump & Dump

- How to be successful with account opening?

- The Automatic Exchange of Information is a Game Changer

- Attention – Tax Trap! What 90% of business people do wrong!

- Banks are the extended arm of the state

- The Bank’s secret Checklist with Sensitive Industries (high risks of money laundering)

- The 10 best Cantons for a Swiss company formation?

1. It is easy to start a business in Switzerland?

Setting up a company in Switzerland as a foreigner is very easy and hassle-free. You will deal with a Notary Public and with the Cantonal Commercial Registry (Company Register Office). The velocity for a Swiss company Formation depends on the Swiss Canton you will chose as a domicile for the company. It can take from 2 weeks until a couple of weeks. If time is off essence you buy an existing company in one day. In one day only you can be the owner of a Swiss company. We will help you finding the right company for your needs.

Benefits at a Glance!

Facts & Figures on Switzerland!

2. Global Asset Protection (Case Studies)

The main reason international investors living in countries with a high corruption rate are using Swiss Companies (AG) is for global asset protection. Their Swiss company (AG) can safely invest in their home country and better protect their assets. Today, this is one of the most important reasons for Swiss company formation.

Let me give you a typical example of why a Swiss AG is so attractive to foreign investors.

A Swiss AG is much better protected in Russia than any Russian company can ever be. Therefore, many Russians make their investments in Russia through a Swiss AG, as a Swiss company is less vulnerable in Russia. In Russia, everyone means that Swiss people invest in Russia and leave the Swiss company unmolested. Swiss AG is considered as the best asset protection tool for successful investments in the Russian Federation.

Let me give you a real example taken of my daily business showing how important asset protection can be.

A supermarket (market value of the property: USD 88 million) was stolen from a Russian investor living in Moscow. The supermarket property was held by a simple British Virgin Island Offshore Company, which was bought for a few thousand dollars. This was a tremendous mistake.

What happened exactly?

Russian fraudsters bribed the officials responsible for registering the company on the British Virgin Islands and illegally replaced the signatories. The new agents of the company employed by the fraudsters have registered in the land register in Moscow as the new legitimate representatives. These have sold the whole supermarket complex in one night and fog action. The damage was irrecoverable. Influent individuals acted in conjunction with a competitor behind the scene in Moscow.

If the supermarket had been registered as a Swiss AG, it would have been impossible to bribe the officials of the commercial register. The owners of the supermarket made a tremendous mistake in saving money with a cheap company located in the wrong jurisdiction with a high corruption rate. A Swiss AG should own a supermarket or any other high-value asset -not a cheap BVI company.

This video shows a real case study of a client of my law firm. In this video, you can see what can happen if you take a cheap offshore company for holding a high-value property instead of a more costly Swiss AG. The money saved with the cheap British Virgin Islands offshore company vanished if compared to the high damage caused by the tremendous mistake of taking the wrong holding company.

Example of a classic car collector holding his old-timer cars with a Swiss AG.

Since the marked increase in the price of vintage cars, foreigners are increasingly buying a Swiss dormant company from an old car garage owner in order to keep the classic car collection through the AG and have it professionally cultivated in Switzerland. The international car collectors are looking for especially Swiss license plates, which have very low numbers. The lower the number on the license plate, the higher the price will be. The highly coveted number plates are issued in Switzerland on the company. Clever investors come about the purchase of an existing but dormant Swiss AG to the highly coveted deep license plates for their classic car collection.

Example of a car license plate number: ZH 755.

Such a low number (ZH 755) on the car license plate shows that it was car number 755 who entered into circulation in the Canton of Zurich before WWII. If you buy a new car your car license plate number will be something like ZH 1’222’456.

Let me give you other most frequent reasons for a Swiss Company Formation.

The outstanding quality of life leads to the longest life expectancy in the world. The unspoiled nature, unlimited cultural and leisure opportunities do not lure only tourists. Rather, highly qualified foreign workers and investors come today with innovative business ideas. Of an average income of CHF 7,566 per month, 70% remains for consumption. The inhabitants of Switzerland enjoy the highest purchasing power in the world – despite high prices.

Switzerland is regarded as the most innovative business location in the world. This statement does not come from me but is taken from the last Global Report 2018 by Global Entrepreneurship Monitor. Experts all over the world are considering planning a move to Switzerland.

“Switzerland pays the highest salaries in the world”

Switzerland meets the highest quality standards. Around 70 technology and start-up centers, mentors and investors will support you and your business idea with advice and action. The Swiss cantons look forward to supporting your business financially.

Crypto-Valley in Zug

Company formation in Switzerland, Canton Zug, with its “Crypto Valley”, has become very famous for foreigners. Zug has advanced to become the Mecca for block-chain technology. The best traders in the world have turned their backs on the big banks. Well-researched trading teams now trade in Zug professionally with cryptocurrencies worth billions in the services of successful start-ups. Since Marc Rich, the most famous tax fugitive in the world, set up his commodity empire with “Glencore” in Zug, everything that has rank and fame in commodity trading has moved to Zug. The majority of foreigners opt for a Swiss Company Formation in Zug, including BREXIT-fugitives from the UK.

The English language predominates in Zug’s noble restaurants. International private schools are springing up constantly. As a result of BREXIT, many companies are moving away from London to Zurich, Zug or Geneva.

3. How long does it take to incorporate a company in Switzerland?

a Swiss company formation takes several weeks.

Depending on the Canton you prefer as a domicile, it can take from 2 to 6 weeks.

If you are in a hurry, you can shorten the time for company formation in Switzerland.

The express procedure with the commercial register allows a faster Swiss company registration.

4. Swiss Company Formation – comparison with other international locations

| Country | Research & Development | Taxes & Bureaucracy | Continuing Education | Infrastructure |

|---|---|---|---|---|

| Switzerland | 1 | 3 | 1 | 5 |

| Netherlands | 2 | 2 | 2 | 1 |

| Indonesia | 3 | 4 | 3 | 28 |

| Luxembourg | 4 | 5 | 20 | 19 |

| France | 5 | 8 | 11 | 9 |

| United Arab Emirates | 6 | 1 | 10 | 3 |

Source: Global Entrepreneurship Monitor, Global Report 2018

5. How can a foreigner start a business in Switzerland?

Can a foreigner start a business in Switzerland? Yes, it is very common setting up a business in Switzerland as a foreigner without a Swiss domicile. However, certain Swiss company formation requirements must be met in order to set up your own company in Switzerland. At least one of the company’s representatives with a single signature must be a resident in Switzerland. A company’s representative can sign for the company alone with a single signature, or there are 2 representatives needed in case of collective signatory rights (jointly by two).

What many do not know.

Many people think that at least one Swiss must be a Director. That is no longer true. Today, it is sufficient if at least one foreigner residing in Switzerland acts as a Director. The purpose of the Swiss company formation residency rule is that the authorities can hold an individual being responsible if something goes wrong. If all Directors lived abroad, everyone could run away in case of damage. At least one member of the board of directors must be a resident in Switzerland. It is sufficient for a foreigner permanently resident in Switzerland to assume the function of a Director.

People from the European Union have the right to personal freedom of movement and the right of free residence in Switzerland. Citizens from third countries, on the other hand, need a work permit from the Labour Market Inspectorate and a residence permit from the Immigration Office. Obtaining both permits for a citizen from a third country is close to impossible.

Only large companies can claim quotas and submit complicated applications for special permits to the Immigration Office of the canton concerned. These specialist permits are subject to high requirements. The chances of success are very limited. Citizens from third countries (non-EU countries) may set up a Swiss AG if they do not live in Switzerland and look after the company from abroad. This is not a problem from the Swiss perspective.

Under Swiss law, there is only one obligation imposed on the shareholder and company owner:

He must liberate the shares, i.e. his sole obligation is to pay up the share capital. There are no other obligations.

6. Legal Entities in Switzerland: GmbH or AG?

There are two important ways to choose. There is company formation procedure in Switzerland for the AG and the GmbH.

Foreign investors opt for

- the stock company limited by shares (AG)

- the limited liability company (GmbH)

a) Swiss Company Formation with a GmbH for non-residents (residence outside Switzerland)

- The nationality of the founders is irrelevant

- At least 1 Director with individual signature (2 directors with a collective signature by two) must be a Swiss resident

- The names of the members of the Board of Directors are published in the Commercial Register

- The names of the owners (associates) are published

b) Swiss Company Formation with an AG (a company limited by shares) for non-residents (residing outside Switzerland)

- The nationality of the founders is irrelevant

- At least 1 Director with individual signature (2 directors with a collective signature by two) must reside in Switzerland

- The names of the members of the Board of Directors are published in the Commercial Register

- The names of the shareholders are not published

- Bearer shares are still permitted

- However, the Board of Directors must keep an internal register of shareholders

AG Key Advantage: The identity is not accessible to the public. Anonymity is granted.

7. Offshore Company Formation in Switzerland

| AG | GmbH | |

|---|---|---|

| Minimum Capital | CHF 100’000, minimum, CHF 50’000 fully paid | CHF 20’000, must be paid, CHF 20’000 fully paid |

| Creditworthiness | better with bigger capital | bad, because of CHF 20,000 only |

| Nominal Value | par value shares min. 1 Cent | Ordinary shares min. CHF 100 |

| Duties of shareholders | only 1 duty: Contribution Payment | additional funding duties as in articles of incorporation |

| Anonymity | No publication | name, address published in the company register |

| Transfer of title | simple | complicated & consent needed |

| Exit/exclusion | simple | can be complicated |

The foreign investor often decides to register the company in Switzerland as an AG. The names of the owners (investors) of a GmbH are published in the commercial register. The owners of an AG are not published.

Whoever wants to fly under the radar protecting the assets will register the company as an AG.

I can assure you, there are many of them. The AG allows (still) an anonymous company formation in Switzerland. The pressure on Switzerland from the EU is increasing. Many investors are opting for Switzerland because of global asset protection with the benefits of anonymous ownership.

“Anyone who wants to fly under the radar for increased privacy and asset protection will choose the AG.”

8. Company Formation in Switzerland for Global Asset Protection

Foreign investors often seek anonymity and asset protection in safe Switzerland. They want to keep a low profile. He does not want people in his – often dangerous – home country to know that he owns high-value assets. He wants to protect his global assets with his Swiss AG, at home and globally.

Following the abolition of banking secrecy for tax matters, “International Asset Protection” is the main reason why foreign investors are opting for the Swiss AG. Financial Kidnapping is a widespread phenomenon in many countries prone to corruption. This is why discretion is so important, especially for investors from and in certain countries (South America, former Soviet republics, Arabia, etc.).

Shares of an AG are more easily transferable than ordinary ownership titles of a GmbH. In the case of bearer shares, a simple hand-over of the share certificate is sufficient. In the case of registered shares, a written assignment agreement is required in which the seller cedes his rights to the buyer and defines a price in the assignment agreement. In addition, the AG enjoys greater acceptance in the business world, including banks.

The AG and GmbH protect global assets because they are separated from the private assets. If the AG or the GmbH produces losses, only the share capital of CHF 20,000 is liable for the GmbH or the share capital of CHF 100,000 (or higher) for the AG, but not the private assets of the owner.

Swiss Holding Company Formation: Holding Privileges with Tax Benefits

Both types of company offer scope for tax optimization. The negative consequences of progression, in particular, tax progression peaks, can be capped by skillful profit distributions and wage payments. Consequently, holding privileges with tax benefits are provided for AGs in the form of holding companies. How long these holding privileges will continue to be tolerated by the EU in Switzerland is uncertain.

Both the AG and the GmbH may be required by law to appoint an auditor above a certain size. The independent auditor controls the financial activities of the AG. It audits the company’s balance sheet and income statement. However, if all shareholders agree, small AGs or GmbHs may, under certain conditions, dispense with an audit office.

The shareholders of an AG are anonymous

That is why the AG is called “Société Anonyme” in French. Companies operating on the international capital markets prefer the anonymous company. The European Union has threatened Switzerland to abolish bearer shares because they make the owners of the company anonymous. Today, bearer shares are available only in Switzerland.

Global asset protection starts with the opening of a private bank account and is subsequently expanded. Often, foreign investors start with a private account and a Swiss company formation in Zug, for the acquisition of commercial real estate.

Swiss Company Formation Cost

Those who are unable to raise the CHF 100,000 in start-up capital often opt for a shell company purchase. The investor buys an existing company limited by shares, an AG, which has usually already used up the share capital. No bank opens an account for an undercapitalized company.

Swiss Company Formation Services in Switzerland (AG or GmbH) can be found on the Internet for less than CHF 1,000. You have not bought an account opening with it. To open an account successfully, you need competent advice on setting up a company in Switzerland, tailored to your specific case. Swiss company formation and account opening should be coordinated since the beginning.

Swiss Company Formation cost with account opening?

The cost factor will be the opening an account and not the Swiss offshore company formation. The cost for account opening cannot be more different. The costs vary from CHF 2,500 for a simple account opening to several hundred thousand francs for a complex account opening with a Politically Exposed Person (PEP account). Extensive background checks can be expensive. The costs of the opening of swiss banks accounts depend on the type of business activity, the origin of the assets, the susceptibility of the countries involved in corruption and other factors.

“If you can’t raise enough money for proper business set-up in Switzerland, you should consider another jurisdiction.”

Investing money in an offshore company registration starting with a shell company is money thrown out of the window. You should relocate your business to another country. There are many ways to get to Rome.

It’s much better to consider an express offshore company formation in Tbilisi, Georgia, than an AG shell company without money in Switzerland.

Express Offshore Company Registration with Offshore Banking Facilities in Tbilisi, Georgia

Tbilisi at sunset

We offer express company start-ups with bank account opening in Tbilisi, Georgia. In half a day, we organize for you a company with a bank account for only EUR 4’000. You will be picked up at the airport by our English-speaking representative. Immediately you will be chauffeured to the notary for the purpose of setting up your company and then you will go straight to the bank, where you will take care of your account opening formalities with the bank director. Georgia has risen massively in the ranking as a company location. Many owners of companies that are active on the Internet find the ideal conditions in Georgia. The strict guidelines imposed by the European Union have no value in Georgia.

The Crux with the Shell Companies

The price for a shell purchase increases with the age and the amount of the share capital of the AG. As a rule, share shells are available for between CHF 10,000 and CHF 50,000. The trade with shell companies flourishes not only for AG but also for GmbH, the limited liability companies.

Anyone who buys an old Swiss corporation for marketing reasons or for prestige will be happy to pay the surcharge. I had customers from the Arab world paying CHF 75,000 for an AG opened in 1933.

“You should not make the following mistakes when setting up a company in Switzerland.”

Insider tip with the c/o address – What many do not know

Anyone who buys a Swiss AG with a so-called c/o address has become the owner of a Swiss AG, but he will have trouble finding a bank to open an account. If your company does not have its own registered office and is therefore registered with a c/o address at the trustee, you have already lost from the beginning.

When a bank opens an account, it immediately looks at the excerpt from the commercial register. The bank immediately notices a company headquarters with a c/o address at the trustee with the first glance in the commercial register extract. The bank will bombard you with questions. Banks that open an account with an AG with c/o address are very hard to find. The Swiss AG is completely useless without an account. When buying an AG, make sure that you have an independent registered office, which is also entered in the commercial register as such. Do not visit the bank until a proper independent domicile has been published in the commercial register.

What do you want to do with an AG with no bank account?

The bank is very sceptical about opening an account for an AG if foreign customers want to open an account for a shell company. However, there are quite plausible reasons for buying a shell company. These reasons must be clearly explained to the bank.

⚠️ (Attention!) High risk with the letter-box company

Anyone can set up an offshore company in Switzerland in any tax haven. The problems arise only when the account is opened at the bank. Good advice is needed here. Do not throw your money out the window for mailbox companies that do not open a bank account. From the very beginning, you deal with the requirements for opening an account right from the start.

Here good advice is in demand. Don’t throw your money out the window for mailbox companies that don’t get a bank account opened.

Be careful when opening an account!

Many foreigners still see Switzerland as an Offshore Banking Paradise for offshore company formation in Switzerland with bank secrecy. The OECD killed the Swiss Banking Paradise forever. Unfortunately, many people with criminal intentions are still coming to Switzerland. They dream of a bank account that belongs to an AG. The owner of the AG is not visible. The AG is equipped with anonymous bearer shares. They dream that this anonymous Swiss company formation, in combination with banking secrecy, should serve as a vehicle to hide or collect illegal funds and then transfer them to a Wild-West Jurisdiction.

9. Wild West Offshore Banking – Pump & Dump

The days of Wild-West Offshore Banking in Switzerland are over. In the past, the hotels around Paradeplatz were frequented by a swarm of Canadians who bought 50 offshore companies with 50 bank accounts that had already been opened. The accounts were easily filled with worthless share certificates. Stock prices were driven up by price manipulation and the complicity of bribed journalists. Artificial markets with high trading volumes per trading day were created. With such classical “Pump & Dump” strategies unsuspecting investors were defrauded.

“What previously used to be considered socially acceptable and tolerated is now illegal, even in Switzerland.”

The fraudsters were hidden behind anonymous companies and banking secrecy. The stock exchange supervisory authorities in Canada and the USA have triggered waves of arrests with international requests for legal assistance. Not only fraudsters were arrested. In fact, even unsuspecting Swiss bankers were severely punished as accomplices. The reputation of the Swiss financial centre has suffered massively.

Today, a Swiss AG has to be operationally active. It must have its own offices and employees. It must show substance. There is no opening an account without substance. Account opening applications for shell offshore companies have no chance. They are categorically rejected. The more substance you can show, the more successful you will be at opening an account.

A company formation in Switzerland for international trading activities can be a success story. There are specialised Trade Finance banks in Zurich and Geneva. They are happy to issue bank guarantees and letters of credit. Swiss Bank Guarantees and Standby Letters of Credit are accepted everywhere.

Swiss banks have grown thanks to international trade in goods. Here, too, turnover must be in the tens of millions for the bank to open a Trade Finance account. The effort required for compliance is very significant today. The banks only join in when it pays off. There are only a handful of selected banks with sufficiently strong balance sheets that can handle such transactions at all. We know these banks very well. We would be happy to introduce you.

“Every time you open an account, you have to consider what advantage I can offer the bank so that the bank would like to work with me.”

Before the bank opens an account, it wants to be sure that there is enough money for a plausible business model. A Swiss bank will no longer open an account without submitting a rental and employment contract.

10. How to be successful with account opening?

Let me give you an example:

If you promise to invest your private assets with the bank, the chances of opening a company account will increase tremendously. If the company account is opened, it will not be closed if the promised private assets are not transferred.

The best part?

Having an account with a Swiss bank today opens the door to the international business. Every internationally active businessman knows that anyone who has successfully passed an account opening procedure at a Swiss bank enjoys a good reputation. He trusts in the bank’s strict obligations to clarify the origin of the assets and the reputation of the account holder.

It is highly probable that a business partner will also have his money in Switzerland. Having bank accounts with the same bank can simplify complex transactions.

It is worth not going to the bank until the account opening documents are ready. A plausible business model is particularly helpful.

If you don’t want to risk the bank rejecting your application to open an account, you’d better let us open the account for you. We know exactly what the bank wants to hear and what is absolutely taboo.

“It’s very easy to make mistakes with the company formation procedure in Switzerland, including account opening.”

If your AG has to make many payments abroad, you must go to a transaction bank. Transaction banks are banks that specialize in international transactions. They have the necessary compliance tools. You charge a certain fee per payment according to the tariff. Since there are only a few transaction banks, transaction banks usually do not negotiate the number of fees.

Do not look for the bank unprepared. Since you do not negotiate with the bank on an equal footing, the negotiations can degenerate. Some of my clients were outraged because the bank asked too detailed questions about the source of the money. They wanted to break off the negotiations. If the customer refuses to provide additional information, the bank can unexpectedly file a suspicious transaction report on money laundering. It often happens that clients feel personally offended and therefore stop communicating with the bank immediately.

“Don’t get involved in contradictions. Only if we meet with you, visit the bank, do we negotiate with the bank on an equal footing.”

Suspicious Activity Report (SAR) on Money Laundering

Many of my clients were outraged because the bank asked too detailed questions about the origin of the funds. They wanted to break off the negotiations. If the client refuses to provide additional information, the bank can unexpectedly submit a Suspicious Activity Report on money laundering (SAR). It often happens that clients feel personally insulted and therefore immediately break off communication with the bank.

Don’t do this mistake.

It is sufficient if the customer refuses to provide additional information. In the best case scenario, you risk being blacklisted or – even worse – ending as a reported and suspected of money laundering. Then you will be rejected forever and ever.

We already pointed out to you that the EU has only recently tightened up the anti-money laundering provisions ad absurdum. The EU has blackmailed Switzerland into implementing these provisions in Switzerland. With anticipatory obedience, Switzerland – as in the Primus class school – has already implemented the new absurd regulations in internal legislation, so that they will come into force in 2020.

We advise you to submit planned account opening applications immediately or before the end of 2019 at the latest. From 2020, more stringent practice is to be expected. It will certainly not be simpler.

Warning: Low-cost suppliers can cause enormous damage

AG and offshore company without a bank account are useless.

Business people from all over the world call me regularly several times a month. The applications to open an account were rejected by the bank. A shell company from a low-cost provider is useless.

What you don’t get from a low-cost provider.

The most low-cost provider doesn’t offer advice on opening an account. Errors in the company formation torpedo the account opening. If you buy a Swiss AG with a c/o address, there are guaranteed problems opening the account. If the description of the purpose of the company mentions high-risk activities for money laundering, you will be rejected by the bank. The devil is in the details. With the account opening, you should deal right at the beginning of the formation procedure. Swiss company formation and account opening goes hand in hand.

What a low-cost provider will not provide:

- Big picture advice on setting up a company in Switzerland

- Advice on the best Swiss company location (international taxation, logistics etc.)

- Information on finding the best bank (we know all banks)

- Tips for Swiss bank account opening (100% practical experience, no theory!)

- Tips on how to negotiate with the bank on an equal footing (savings potential of up to CHF 100,000 and more per year)

Low-cost providers have no idea of compliance and combating money laundering. They don’t know what the compliance officer wants to see and hear when opening a bank account.

We help you to present your account opening story correctly. We know exactly which industries are waved through and which are not.

“Today, a misplaced sentence is enough to be rejected by the paranoid banks.”

Some banks have been transformed into a police station. They hired former criminal prosecutors as compliance officers. The truth is that the new strategy should convince FINMA (financial watch-dog) that combating money laundering has become a paramount target. For obvious reasons, I am not in a position to name and shame specific banks here. Banks known of being involved in never-ending investigations are under the constant pressure by FINMA. Because of the previous mistakes with corruption money they like to convince FINMA that combating money-laundering has become a priority.

The correct choice of the location of the AG and the choice of a suitable bank depend on many factors that must be clarified beforehand. Low-cost providers hardly know anything about combating money laundering, criminal tax evasion, automatic exchange of information, AEOI, CRS, OECD, etc.

Only in the context of a case-specific consultation, the account opening procedure will end successfully.

We recommend our Private Bank Guide as the first step in choosing the right bank. You will become a first insight into the special fields of banks. But our Private Bank Guide can never replace a consultation.

Let me give you an example:

If you want to build your business in international commodity trading, then you should avoid banks that offer asset management. Asset management banks do not want to execute payments. But there are banks that specialize in international transactions in almost all currencies. Transaction banks will be happy doing business with you. 3 months after successful account opening, we will accompany you to the transaction bank and negotiate special conditions for you. If the Transaction Bank has been successful for you for 3 months, it will also be willing to negotiate with you about the charges.

What many investors still have not understood!

Beware of providers of classic offshore companies.

Prior to the Automatic Exchange of Information (AEOI) in the old days of bank secrecy, offshore companies with the associated nominee services were sought-after services. Through intervening trustees who acted as a shareholder, you could previously hide the owner (Beneficial Owner) of black money. Such corporate constructs no longer work today. The contrary is the case. They can even do damage by attracting the attention of the taxman. The taxman assumes that you want to evade taxes and can initiate a procedure – with a reverse burden of proof – against you.

We live today in the age of transparency. The European Union wants to set an inclusive register of all beneficial owners for the year 2020. Privacy and privacy interests nobody here.

Many business people are buying (still today) Offshore Companies from offshore providers without professional experience, opening up bank accounts in exotic countries with dangerous legal systems, where they can easily squander all their money. The truth is that you will encounter big problems with the tax authorities. In addition, they will have problems transferring the money back. They all act in the mistaken belief that they could hide as owners (beneficial owners) with their untaxed money.

The black money periods are definitely over. As new laws were introduced earlier, solutions were immediately created to elegantly circumnavigate these laws. This is not the case today. Many investors still have not understood that.

11. The Automatic Exchange of Information is a Game Changer

It is close to impossible today for a classic offshore company without substance to open an account with a good bank in a safe country.

The traditional offshore company has not only become completely useless today but rather a dangerous tax trap that can put you behind bars.

Since the Automatic Exchange of Information, fiduciary shareholders and fiduciary directors have become obsolete. In today’s age of transparency, offshore providers continue to offer these useless services. They don’t have the slightest idea about the tax consequences, CRS, AEOI and OECD. They argue that there is always a country that does not participate. In the past, it was always the case that some country did not join in and that there was always a way out. Not today.

Those who buy such services not only throw their money out of the window, but risk unexpectedly falling into a tax trap as tax evaders and being criminalized.

12. Attention – Tax Trap! What 90% of business people do wrong!

Error No. 1: Shell Company without Substance

Without substance, every offshore company necessarily ends up with a tax audit or criminal investigation if the beneficial owner is living in an OECD high-tax country.

Almost all states that offer a functioning financial center participate in the Automatic Exchange of Information (AEOI) and supply bank data to the tax agency in the country of residence. Since 2016, there has been no anonymity with banking secrecy. Read here our detailed article on how the AEOI works.

No matter whether your company is based in Switzerland, Malta, Cyprus, London, Isle of Man, British Virgin Islands or anywhere else, your bank information will end up at the tax agency where you, as a private individual, are tax resident.

Having substance means having your own office space with an official lease, at least one employed director (no nominee director, no trustee or lawyer), an operational and value-adding activity in Switzerland (or Malta, Cyprus, etc.). You must be able (especially with the very strict tax offices in high-tax countries such as Germany, Italy, Denmark or France) to provide a real plausible economic reason for your business in Malta or Switzerland (or any other tax haven).

Forget arguments such as constitutional rights and freedom of movement.

Tax authorities require solid evidence to justify why the choice has been made in Malta, Ireland, Switzerland, Cyprus or any other offshore jurisdiction. The tax benefits may play only a marginal role if any. We are creative. We will find a plausible justification for you and help you to document your argument.

Error No. 2: Move profits to a tax efficient jurisdiction (Malta or another tax haven/offshore centre)

Shifting profits to tax-efficient tax havens (Profit Shifting)

If you invoice your own company, lend money or charge royalties, you may not do so in any amount. Rather, they must adhere to guidelines that are based on the “arm’s length” principle (third-party comparison test). The amount of the payments is only permitted as if the market-conform payments were made to uninvolved third parties. Anyone who does not follow these rules is at risk to be criminalized as a tax evader.

Here, too, the following applies: Ignorance does not protect against punishment.

Error No. 3: You follow dangerous “half-truths” or a “good tip” from a friend

The coffers are empty. The law machinery of the state continuously produces new laws, directives, ordinances and rules. Even the financial administration does not agree on how these new norms should be interpreted. In any case, they have a clear mandate from the state: to secure the tax substrate against outflow abroad.

The density of new standards in the EU has reached a dangerous level. Even someone with serious and bona fide intentions risks unexpectedly falling into a tax trap. You will be criminalized and charged with tax evasion or fraud.

The consequences can trigger a financial disaster.

“The tax authorities are under pressure to succeed. They must produce results. Therefore, it’s not surprising when authorities shoot from the hip and block accounts. Today, tax agencies shoot first and ask questions later.”

Blocked accounts immediately ruin the business. By the time a court decision is made, the business is already ruined. Every businessperson must have accounts abroad. Blocking an account in Switzerland is much more difficult than blocking an account in the country of residence. A bank account abroad has already saved many companies from bankruptcy.

Legal uncertainty in the practical application of the diversity of standards is the ideal breeding ground for tax traps. It’s easy to step in, but you can’t escape. Even winning the court case against the tax authorities cannot avert financial ruin.

The owner can no longer hide. We live in an age of transparency and compliance. Anonymity and privacy hardly exist anymore. An anonymous Swiss company formation in Switzerland with banking secrecy for tax purposes no longer exists.

Nevertheless, there are ways in which you as a German (or as a European residing in a high-tax country) can legally make massive tax savings. For example, you can move your business to Malta and reduce total taxation to 5%. You have to do it right. This means you have to build substance in the new country.

My advice to you:

Cheap providers are dangerous because they don’t know what they are doing. Setting up a company in Switzerland, Malta, Bulgaria or any other tax haven as a German (or European) is a complex issue that can only be solved based on case-specific professional advice. All questions regarding compliance, taxes and banks must be appropriately discovered, acknowledged and answered. The big-picture approach is fundamental.

“Don’t rely on half-truths.”

Trust an honest and critical expert who also has the courage to stop you from buying companies. Many Swiss company formation services are selling a cheap company. They don’t care if you fall into a tax trap.

90% of business people who visit me for the first time with their foreign company have a company but no bank account. Before they came to me, they were with a low-cost company that had advised them badly or not at all. There, they bought a company for little money. They asked me to open an account for a cheap company without substance.

Account opening application rejected – what now?

Customers often don’t know why they were rejected by the bank. The bank usually does not provide a reason. If, for example, the bank asks: “In which country are your customers living? Then it is sufficient for one of your customers to be in a country that has a high ranking in the CPI Index (Corruption Perceptions Index).

This would be a country where corruption is widespread. Before visiting the bank, the consultant must ensure that the owner of the company does not mention any corrupt countries. We will find you the bank that is familiar with certain countries.

13. Banks are the extended arm of the state

Compliance departments turned to police stations.

Experience shows that foreign businessmen are too honest with the bank.

The bank is not always your friend and helper! They mention unsolicited facts to which they attach no importance. The state controls the banks increasingly. It is the task of the expert to prepare the owner for the meeting with the bank. A wrong word can torpedo the opening of the account and ultimately cause it to fail. You are not allowed to lie in the bank. But that does not mean that you should tell everything without being asked.

Company formation and account opening must be a coordinated mission. Without proper preparation for opening an account, you risk being turned down or you end up on a blacklist. If you lie to the bank, you run the risk of being reported to the Money Laundering Reporting Office (MROS).

Opening an account for internationally active business people can be very delicate, time-consuming and demanding. Account opening procedures can get out of hand and even degenerate into criminal proceedings. Language difficulties make for misunderstandings. The banks have strict reporting requirements. When banks are reporting a suspicious transaction, they are on the safe side. The bank employee fulfilled his duty and secured his job. The statements are logged. Only a consultant ensures an effective presentation in the bank. The state has turned the bank into a law enforcement assistant. The banker is in a conflict of interest. If the banker wants to help, he cannot help by law.

My best advice:

Call in experts. Let me advise you which banks are suitable for your business. If we accompany you to the right bank that is already familiar with your industry, the chances of opening an account are significantly higher. As a rule, we know the banker personally. We will obtain a non-binding preliminary decision from the bank for you before the first meeting.

Our consulting fee is disproportionate to the incomparable extent of the damage that can result from dangerous communication with banks.

Company Formation in Switzerland cost

Starting your own business in Switzerland, you can already with CHF 1’000 or less at a low-cost provider. If you start your company online in Switzerland, it will cost you a few hundred francs. AG will be founded quickly. What good is a Swiss AG without an account? So the right question is, how much is an account opening?

We pursue a holistic consulting approach. Business model, compliance and taxes are analyzed in their entirety. Starting a business with opening an account usually costs CHF 10’000 for simple cases. Certain industries are more expensive because the effort becomes more substantial.

If the company is controlled by an economically or politically exposed person (PEP Accounts), opening an account can quickly cost hundreds of thousands of francs. Extensive background clarifications are required for an account opening. A new industry with former members of intelligence services has evolved from this.

Here you will find business areas that the bank will automatically associate with a high risk of money laundering.

14. The Bank’s secret Checklist with Sensitive Industries (high risks of money laundering)

The following checklist shows business areas that will make account opening difficult.

The checklist shows business areas that the bank classifies as high-risk (high money laundering risk).

If your business has contact points with the following industries, the account opening procedure will be an adventure.

The consulting fee for the introduction to the right bank is very well invested money.

It bears no relation to the alleged damage that can result from an out-of-control account opening procedure.

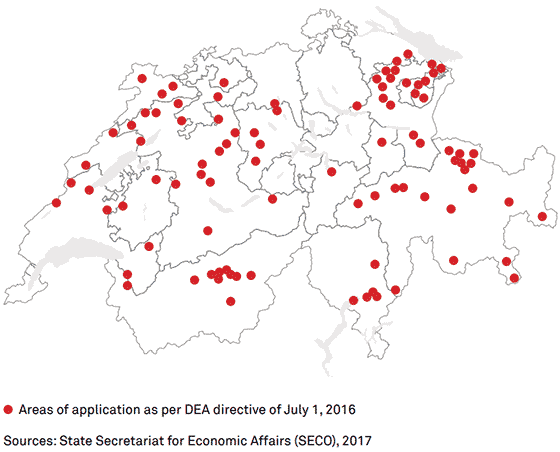

15. The 10 best Cantons for a Swiss Company Formation

For every foreign entrepreneur, taxation is an important issue.

Taxation in Switzerland takes place separately at the level of the federal government,

the cantons and the municipalities. The Cantons Zug, Lucerne, Obwalden, Nidwalden, Schwyz

and Appenzell offer the lowest taxes.

Total taxation is between 12% and 25% depending on the location and progression of taxation.

The Swiss average of all cantons is shown in red.

All traditional offshore countries are shown in black.

️Move your mouse over the bars to find out more.

Corporate Tax - Swiss Cantons in Global Comparison

The cantonal Business Support campaigns play a major role in the choice of location. Switzerland has over 70 technology and start-up parks that help entrepreneurs start their business promotion activities. Cantons can completely waive their taxes in the first years. It’s all a matter of negotiation.

We are happy to negotiate for you with the Canton or the federal government about …

- Tax benefits or even tax relief (Tax Holiday, Tax Rulings)

- Convenience with building permits, land purchase, restructuring, promotion

- Loans with interest reductions or even “à fond perdu”, providing collateral for loans

We have many years of experience in negotiating with authorities. If you have an innovative business idea, you can be sure that the Canton or the federal government will support you. Let us clarify for you which forms of support and benefits are suitable for your business.

The best is yet to come.

Tax benefits are a declared part of the tax policy of the government.

Canton Zurich is a prime example of this. The Canton of Zurich is outperforming financially. He likes to invest in innovative companies. It is no coincidence that Switzerland has been decorated worldwide as the most innovative business location.

If you want to invest for your company, buy real estate, either for the company or for private use, we offer targeted support here. We are looking for off-market objects that others can only dream of. For years, we have been optimally networked with bankers, family offices and other real estate investors so that we can secure the best off-market access for you.

Conclusion

Combine Swiss Company Formation & Account Opening – right from the start.

Let us advise you because there is too much at stake. Our big-picture approach will save you time and money, at the end of the day.

Let an expert accompany you to the bank. Only then, you will negotiate with the bank on an equal footing. Never go to the bank alone. Since the Automatic Exchange of Information imposed by the OECD, the rules of the game have changed drastically.

Every businessman takes a lawyer when he is summoned to an interrogation. You should do the same for opening your bank account. Do not go alone to the meeting with your banker.