Dormant Swiss Bank Accounts – How to find a lost Swiss Bank Account

“There is over USD 50 Million worth of Assets currently held Dormant in Swiss Banks.“

Descendants of Swiss Bank Account holders aren’t even aware of their hidden fortunes. Due to Bank Secrecy and other reasons (including tax-neutral black money), holders of black money did not want to involve their family members in their delicate financial affairs. It is exactly for this reason that there are over USD 50 Million of hidden assets within the Swiss banks and no one is aware of her existence.

- We help you to investigate and to find the dormant swiss bank account you are searching for

- We will help you to individuate your assets with Swiss banks that you are entitled to

- When we have found the bank account of your ancestors, we will transfer it to an account in your name

- We will help you to establish the required contact with all other beneficiaries

- So far, we have successfully discovered over 100 dormant accounts

Many of our customers are dealing with the Ombudsman before they turn to us. They are not familiar with the dormant bank account rules, how to activate dormant account and how to close dormant account. If you have not been successful with the Ombudsman, come to us. We know the Swiss private banking industry and the dormant account procedures very well. We know many bankers personally.

“When looking for the right bank with your dormant account, you should know which bank has been absorbed, merged, liquidated or which has been taken over. Takeovers, mergers, acquisitions and liquidations cause old bank accounts to appear under other banks with new names.“

It’s imperative to know the history of banks in Switzerland. Just five years ago, more than 400 banks were licensed in Switzerland. Actually, more than 100 Swiss banks have been absorbed by bigger institutions and don’t exist anymore under the old name.

Our Guide explains the laws, rules and directives. If you want to be successful with the detection of your Dormant Bank Account, you need to engage a professional who knows the dormant bank account rules and the names of the banks which have absorbed smaller banks.

Table of Contents

- 1. What is it meant by Dormant Bank Account?

- 2. How to find a lost Swiss bank account

- 3. How long does it take for a Bank Account to be Dormant?

- 4. Consequences of Dormancy

- 5. Swiss Banking Ombudsman: The Manager for Dormant Accounts

- 6. Publication of Dormant Bank Accounts

- 7. What are your Rights if you are a Beneficiary of a Dormant Swiss Bank Account?

- 8. What are the Obligations of the Bank

- 9. What about Data Protection and Bank-Client Confidentiality?

- 10. The 3 Best Options for finding your Swiss Dormant Bank Account

1. What is it meant by dormant bank account?

Dormant Bank Account Definition

If there is no contact between the bank and the client for a dormant account time period of 10 years the bank account is considered to be a dormant bank account. Dormant Assets are mainly bank accounts and safe deposit boxes.

According to their new directives, most Swiss banks today, are obliged to contact the client at least once a year. The anti-money-laundering legislation is becoming more severe imposing a strict application of “Know Your Customer” rules (KYC-rules). A strict implementation of KYC-rules demands to keep a more frequent contact with the clients. The goal here is, to collect updated information on their business and economic activities, including the background to their source of wealth. In the good old days, Swiss banking activities did not include such rigorous and vigilant client supervision activities treating everyone as a criminal. The anti-money-laundering legislation has made Swiss bankers act like police officers on duty. This is why it is essential to seek the advice of an experienced lawyer when dealing with the banks today.

There are many reasons for a bank account to become dormant:

- A new place of residence

- A new temporary job placement as an expat

- Assets suspected to be hidden from authorities and family members

- Death of a natural person

- Liquidation of a company

- The outbreak of a war

- Hiding the existence of a Swiss bank account because of tax optimization

It is rather a common phenomenon for older generations to forget about the existence of not active bank accounts. These are accounts which have been neglected and forgotten to be closed. Owners of tax-neutral assets kept the opening of such bank accounts secret and that even from the closest members of their family. The list of possible causes for a dormant account is long. However, the following two facts remain the same:

- Neglected accounts eventually end up to be classified as dormant

- After a certain period of time, assets within these accounts become to be the property of the state

In Switzerland, the laws regarding dormant bank accounts have been revised in 2015. Since 1996 dormant bank accounts are collected and centralized. The legal environment in the banking world urges for transparency. Scandals have damaged the reputation and the credibility of Swiss banks. Swiss bank accounts have been connected with the Nazis and the victims of the Holocaust. As a result, account holders or any entitled persons can revive their relationship with the bank and recover their access.

2. How to find a lost Swiss bank account

In Switzerland, it is close to impossible to find a lost Swiss bank account without having specific bank account information such as the name of the bank, the account number or bank statements. There is no official register with the names of Swiss bank account holders or ultimate beneficial owners.

The Swiss bank secrecy law is still in force. It does not protect tax evaders anymore but the privacy of clients is still severely protected. Switzerland offers the highest level of client confidentiality in the world. This is just one of the reasons why Switzerland is the number one destination for bank secrecy, privacy and asset protection.

Switzerland has the strongest data protection laws in the world.

If the Swiss bank account is in the name of an offshore company the beneficial owner appears only on the famous Form A. Form A is an internal form of the bank.

Descendants of Swiss bank account holders who believe they may be entitled to assets in a bank or safe deposit box can contact the bank directly. However, good advice from a local banking lawyer or expert who is an insider of the Swiss private banking industry cannot be weighed in gold.

The reality is that if much time has passed with a Swiss bank account after death many things have changed. Some names of banks have changed. Some banks have a different name because of mergers, liquidation, acquisitions, change of name and logo etc.

Therefore, it’s important to be guided by a local expert who knows what happened in the past. Any small hint can be decisive. An old business card of a Swiss private banker, a note on an old agenda of the account holder, hotel booking evidence, names of Swiss lawyers, retired bankers or fiduciaries can help to identify the current name of the bank.

Before contacting Caputo & Partners, please make sure that you have all possible information assembled. An accurate preparation with suitable documents is imperative for a successful search.

Swiss laws, ruling dormant bank accounts?

There are 3 key legal bases, ruling dormant bank accounts in Switzerland:

- The Swiss Federal Banking Act hereafter referred to as BA

https://www.admin.ch/opc/de/classified-compilation/19340083/index.html - The Swiss Federal Banking Ordinance hereafter referred to as BO

https://www.admin.ch/opc/de/classified-compilation/20131795/index.html - Guidelines of the Swiss Bankers Association hereafter referred to as SBA

All of these laws are important. Their provisions together are used to govern a dormant bank account.

3. How long does it take for a Bank Account to be Dormant?

3.1. Definition

Dormant Bank Account Definition

according to the article 45 of the Swiss Federal Banking Ordinance (BO)

(German: Verordnung über Banken und Sparkassen, Art. 45)

“If a decade passes without any contact with the client, despite the bank`s efforts to re-connect with him, then the account is considered to be dormant. The decade begins with the last documented contact with the client according to the banking records.”

In conclusion, only in the end of a decade without any recorded contacts with the client the lack of communication or contact is established. And only at the end of the decade, the account becomes dormant.

3.2. What is considered as “Contact” by law?

The Guidelines provided by the Swiss Bankers Association is detailed. As “contact” is classified as any sign of communication on behalf or to the client by the bank. A sign means any message, any news, statement or instruction from the client. Consequently, a lack of contact or communication with the client would be established, for example, if the post is returned.

Electronic correspondence remains without reply or attempted phone calls fail. No account movement was initiated by the customer. Also, in the case of electronic banking, three years is passed without any log-in in the e-banking account. Regarding safe-deposit boxes, no visit occurred for a decade. And as far as saving passbooks are concerned, a decade has passed without any interest entered.

Moreover, the communication could be initiated by the following individuals:

The account holder himself, in the case of a legal person, his legal representatives, in the case of the death of a natural person his heirs, a legal guardian, an agent authorized to manage the accountholder`s finances or any other person that holds an authorization or an entitlement to the account in question.

A “contact” is initiated by actions on behalf of a beneficiary. Any change in the accounts that are made by the system (e.g. interest rates added in the saving accounts) or by the bank to cover certain expenses related to those accounts preservation, does not count as “contact”.

4. Consequences of Dormancy

4.1. What is the Distinction of Dormant Assets based on their Value?

“If the contact with the client is lost, the bank will concentrate its efforts to revive their connection, with no success. If the absence of any communication with the client could last for a decade, then this absence of communication is acknowledged and recorded, only afterwards the assets become dormant.”

The law makes a distinction between:

a) The assets with a value equal to or more than 500 CHF

b) The assets with a value less than 500 CHF

4.2. Why the 500 CHF Account Value important?

The total value of the minimum dormant assets belonging to a client must be CHF 500.–. The dormancy is connected to one client and not a contractual link. In case of deposit boxes, if the value of their content is equal or exceeding CHF 500.–, then they obviously belong to the first category. If this value is less than 500 CHF, then they obviously belong to the second category. However, if the value of the content cannot immediately be calculated, then they are considered as “Safe-deposit box with unknown value” and they belong to the first category.

In the first case, dormant assets with a value equal to or exceeding CHF 500 with a safe-deposit box, the Swiss banks are obliged by law to report it.

5. Swiss Banking Ombudsman: The Manager for Swiss Dormant Bank Accounts

The banks have to transmit all data regarding a dormant bank account to a centralized authority. This centralized database is managed and is only accessible by the Central Claims Office of the Swiss Banking Ombudsman. The data remain on this centralized database for 50 years.

If the account holder or any other beneficiary claims their entitlement rights, then the relationship between the client and the banking institution is restored.

3 Biggest Mistakes with Inheritance Swiss Bank Account After Death

You will learn the list of documents for accessing the Swiss bank account inheritance. For transferring the assets as fast as possible in favour of your own account you should avoid these 3 mistakes. Mistakes cost money.

6. Publication of Dormant Bank Accounts

If 50 years after dormancy have passed and no claims have been made or an application sent has been proven unsuccessful, then the banks are required to publish these dormant accounts on an online electronic platform. The publication is in an attempt to find the account holders or any other entitled individuals (article 37m BA, article 49 BO).

After the publication, a time period is given for potential beneficiaries to apply and claims to be made. This time period begins with the publication of the account related information online. In case of new information coming to light concerning the account and its beneficiaries, the bank will add the new data or amend the old ones. The timeline for the claims restarts at the date of the new publication (article 51 BO). This time period is 1 year.

If 50 years after the dormant period, or, 60 years after the last communication with the client has passed and no claims were made successfully, then the assets will be liquidated and automatically transmitted to the Federal Finance Administration. No additional publications occur.

🎞️ ⬇️Content of the Video⬇️

00:00 👉 How to access the bank account of your deceased parent

01:20 👉 Swiss banks will not take the lead with distributing the assets to the heirs

01:32 👉 Do banks close accounts after death?

01:58 👉 Swiss banks want to keep the funds of the heirs as their new clients

02:21 👉 Mistake No 1: Telling the bank that you need the money urgently

02:41 👉 Tell the bank that you don’t need the money

03:00 👉 Mistake No 2: Not asking to see all account information kept on file with the bank

03:45 👉 Mistake No 3: Not checking the history of transactions

05:12 👉 All heirs must be in agreement otherwise the account remains frozen

05:24 👉 How do you access someone’s bank account after death?

05:39 👉 What is Certificate of Inheritance?

06:01 👉 How does inheritance work in Switzerland?

08:25 👉 How to make sure to not inherit black money?

09:02 👉 There are different ways to legalize inherited money from tax evasion

09:24 👉 The penalties for tax evasion are very high

7. What are your Rights if you are a Beneficiary of a Dormant Swiss Bank Account?

From the last communication with the client until the final transmission to the Federal Government, the rights of the account holder or any other entitled person remains intact for 60 years. Thus, the client is able to reestablish communication with the banking institution at any time during this 60 year-period and reestablish access to their assets.

7.1. Savings accounts

These accounts are maintained while interest rates are added according to the interest rates.

7.2. Custody Accounts

Custody accounts are also maintained while these cases are being handled and invested by the bank in the client`s best interest.

7.3. Safe-deposit Boxes

Safe deposit boxes are kept, while they are opened only to protect the client`s rights e.g. to ensure the preservation of the value of their content or because it is needed for the research of the beneficiaries.

8. What are the Obligations of the Bank?

In all these cases the bank is obliged to take all measures necessary to protect the client`s rights:

- It will concentrate its efforts to restore the contact with its clients. Former residence information, email addresses, phone numbers; any available means will be used. It might conduct a research by hiring a professional agent in order to track them down.

- It will archive all the dormant assets related information following the legal provisions.

- It will take security measures against third parties and ensure that only authorized claimants will gain access to the accounts.

- If the bank bankrupts the dormant assets and their respective data will be transmitted to another bank. The rights of the beneficiaries will remain intact (article 37I BA).

- It may use the assets to cover the cost of their preservation; rent, potential investments, publication on the online platform, attempts to re-connect with the customer will all be recorded.

When the cost of the assets management and preservation exceed their value, the bank has the right to terminate the contract and close the account.

“After the assets are handed over to the Federal Government, the liquidation process is considered closed. Then, any rights of the clients upon the accounts become nullified (article 57 BO)!”

9. What about Data Protection and Bank-Client Confidentiality?

The protection of client data remains a top priority during the accumulation of the dormant bank account information. The bank will take all the essential security measures and ensure that only authorized claimants will gain access to the accounts.

The bank-client confidentiality protects all the client data during their accumulation in the bank recording system and the centralized database of the Banking Ombudsman. However, the bank-client confidentiality is bending in the publication of the customer information (name, nationality etc.) on the online platform after 60 years without communication.

“This exception might lift the confidentiality rule but it is set with the best interests of the client as an objective.”

10. The 3 Best Options for finding your Swiss Dormant Bank Account

If a person believes that he is entitled to any assets held in a private account at a Swiss bank, here are the 3 best options for him to engage in:

10.1. Approaching the Bank directly

Needless to say, this option is possible only if the bank in question is known and is willing to co-operate. We never recommend this option as owners of dormant accounts do not have the experience to deal with such situations and can easily be turned away from the bank. We always recommend to delegate the discovery of such dormant assets to professionals.

Caputo & Partners have successfully discovered many such dormant accounts, within the Swiss banking system and returned the assets to their rightful owners.

“Remember: Success is based on professional advice”

10.2. Application to the centralized Database with the Swiss Banking Ombudsman

A person might think that is the account holder or another beneficiary to a bank account. It has information about the account e.g. the account number but the bank`s identity remains unknown. In that case, the person can reach the Central Claims Office where the Ombudsman has collected all dormant assets data provided by the banks.

A Questionnaire must be filed with all the information that proves the applicant to be someone authorized to have access to these accounts along with the related documents.

Then, if the Central Claims Office finds the proof provided by the applicant sufficient, it contacts the bank for further confirmation. At the end, the relations between bank and customer are revived. The assets cease to be considered dormant. And their data are removed from the centralized database. If on the other hand, the Central Claims Office finds the proof to be insufficient, then the applicant’s request is rejected. The assets remain dormant.

10.2.1. Restrictions

The centralized database of the Central Claims Office is well organized and updated. However, the data of the assets the applicants seek might not be stored there if:

- It is not a dormant account but a closed account. Then the contractual relationship with the client is over

- The assets worth is less than 500 CHF

- It has not been classified as dormant account yet

- The applicant is one of the beneficiaries that has lost contact while other beneficiaries maintained communication e.g. the account holder lost connection with the bank but his legal heirs did not

- The assets have already been transmitted to the Federal Finance Administration and became the property of the government

10.2.2. Timeline

The search in the centralized database and the consequent application can be made anytime during the 60-year dormant account period; from the last recorded communication with the client till the assets are transmitted to the government.

After the application with the Questionnaire and the proving documents are made, the estimated time of the processing is 3 to 4 weeks.

10.2.3. Costs and Fees

100 CHF per Questionnaire.

10.2.4. Application

The Questionnaire is advised to be as detailed and accurate as possible. It is available on the Ombudsman website and must be filled, printed and signed by the applicant. Copies of the documentation that proves the applicant`s identification and its entitlement rights to the account must also be submitted.

10.2.5. Documents for the Questionnaire

- Passport or an Identity Card

- Power of Attorney

- Birth Certificate, Death Certificate, Certificate of Inheritance, Certificate of Marriage etc.

10.2.6 Official Website

www.bankingombudsman.ch

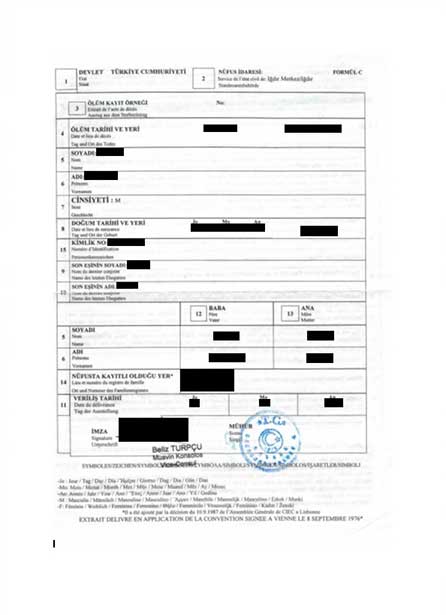

Certificate of Death Example

Certificate of Inheritance Example

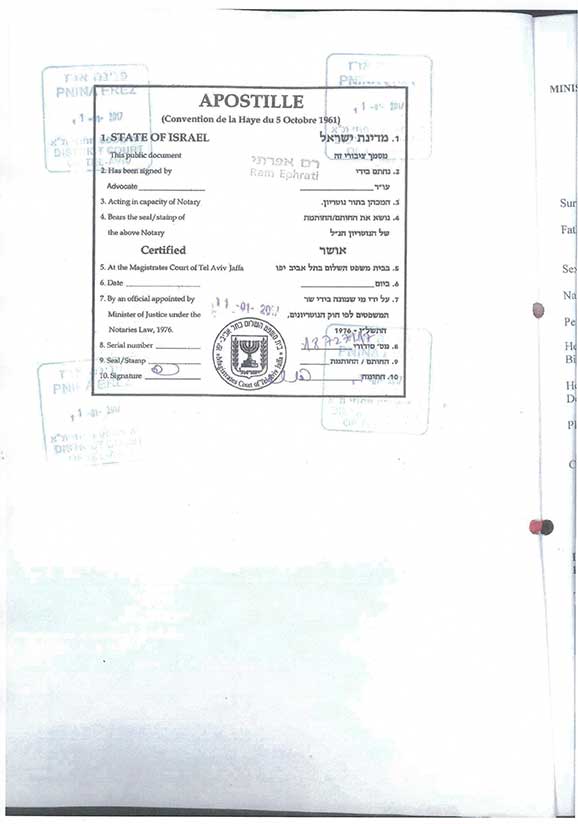

Super Legalization with Apostille Example

10.3. Search in the Public List

A person might show interest and search in the list with the published dormant accounts. After 60 years (a decade from the last contact plus fifty years of dormancy), the data of these accounts are published online.

The information that can be published on the online platform is about the account holder: the first and last name as well as the date of birth of a natural person, the name of a legal person, the nationality, the last recorded residence and in some cases also the account-number (article 49 BO).

According to a person’s judgement and the information published, he might believe to have a valid claim to the dormant bank account. In this case, he should proceed with the application available on the website.

A form must be filled with all the information that proves the applicant to be someone authorized to have access to these accounts along with the related proof.

The application can be submitted electronically on the website or in written form by post to the Banking Ombudsman. The Banking Ombudsman`s office is also available for the applicant questions regarding the process.

Then, the application is sent to the respective bank for confirmation. If the bank finds the proof to be sufficient then the claim is considered valid. The relations between bank and costumer are revived, the assets cease to be considered dormant and their data are removed from the publication list.

If on the other hand, the bank finds the proof to be insufficient, then the applicant’s request is rejected. The assets remain dormant and published on the website until their liquidation and its transmission to the government.

“In case of rejection, the applicant can take legal action against the bank or apply to the Banking Ombudsman to resolve the issue as a trusted mediator.”

Timeline: the time in which applications and claims can be made is:

- One year, if the last contact with the client occurred after 1954.

- Five years, if the last contact with the customer occurred in or before 1954.

If the application is rejected, the applicant can resent it modified (e.g. with documents that were missing from the first application).

There is no provision regarding the processing time of the application.

“Nevertheless, as long as a claim is considered and remains open, no liquidation or transmission to the government can take place!”

Cost and fees: The bank may use the value of the dormant assets to cover the publication expenses in compliance with the proportionality principle.

No fees charged for the application.

Important notice!

“If the claim of the applicant clearly lacks foundation then the bank may proceed legally against the applicant and demand reimbursement for the research and processing expenses (article 53 (3) BO).”

Application: the form is advised to be as detailed and accurate as possible. It is also advised that if the application is submitted on the online platform, that the applicant has prepared all the needed documentation. The sessions expire after 30 minutes.

It can be found on the publication website and must be filled, printed and signed by the applicant. Copies of the documentation that proves the applicant`s identification and its entitlement rights to the accounts must also be submitted.

Official Website: www.dormantaccounts.ch

10.4. How could Dormancy be avoided?

The customer can take a variety of measures in order to ensure that his account in a bank will not end up as dormant with the danger to lose his property to the government.

Such measures include but are not limited to:

- Inform the bank of any kind of changes regarding his personal and contact information; first name, surname, company`s name, address, country of residence, being abroad for a long period of time etc

- Give the bank instructions. Provide the banking institution with a new address for written or digital correspondence. Or request that the mail remains at the bank for a period of time

- Notify the bank of the appointment of a lawyer to communicate on his behalf

- Inform close and trustworthy individuals about it. In these contacts are included close friends and family, a lawyer and a notary

- Ask guidance from the banking institution itself

“If you want to know if your grandfather had a Swiss bank account with a Swiss bank, you can find out right now. 2600 clients from all over the world are listed. Since 60 years there has been no contact between client and bank.”

Find out and check the following link.

https://www.dormantaccounts.ch/narilo/

If your Dormant Bank Account is not on the list or if your account is less than 60 years old, you can contact the Ombudsman or you can come to us directly. We know the private banking industry very well. We know many bankers personally and we know the history of the banks to identify the right bank with your Dormant Bank Account.

If you are searching for a Dormant Bank Account or for any other bank account in Switzerland, we help you with the identification of your Swiss bank account and to deal with the bank. We helped creditors, victims of fraud, spouses, heirs, beneficiaries of a family foundation or a trust to find the right banks with the accounts they are looking for.

We are here to help you. We walk you through the procedures and we deliver results.

“Success is based on Professional Advice.”

We will find your account in cooperation with you. If there are any assets belonging to you, we are confident to find where there are and release them to your new account.

How to find out if someone has a Secret Bank Account in Switzerland?

This video will help potential heirs, spouses, descendent of spouses, victims of fraudsters and private investigators finding a secret bank account in Switzerland.

The probabilities of finding money are higher than commonly expected. 30% of all offshore money is managed by Swiss banks. Switzerland is the first destination for treasure hunting.

Mainly older clients of Swiss banks carried the secret of having money in a secret Swiss bank account to the grave maintaining the silence with their own family members. That’s the main reason why 50 million CHF are still booked on so-called dormant accounts.