Amex Centurion Card Benefits – without Invitation (2019)

The American Express Centurion Card is the most prestigious and exclusive black card on the planet. It’s a charge-card for the elite. It’s not a simple credit card for everybody. It’s available by invitation only. You have to wait for a personal invitation letter from American Express. If you are lucky, you might receive the invitation letter after 1 year ownership of an American Express Platinum card.

Not with my insider banking connections.

I promise to get the Amex Centurion Card Benefits for you within 1 week.

- ✓ Direct application

- ✓ No invitation letter

- ✓ No 1 year credit history

- ✓ No 1 year spending history

- ✓ No earnings of 1 Million per year

Discover how I will organize the Amex Centurion Card Benefits for you, in 1 week, straightforward and hassle-free.

Hello, I am Enzo Caputo, a Swiss banking lawyer, the owner of the boutique law firm Caputo & Partners and the founder of swiss-banking-lawyers.com, the place where international businesspeople find tips and solutions to protect their global assets with Swiss banks, pay less tax and make more money.

How do you qualify for a black American Express card?

There are no official requirements published.

They are subject to speculation but in reality, there are 4 requirements:

- Ownership of an American Express Platinum Card for at least one year with an impeccable credit history

- spend at least 100 to 500’000 Dollar a year

- earn 1 M Dollar annually

- be a high net worth individual

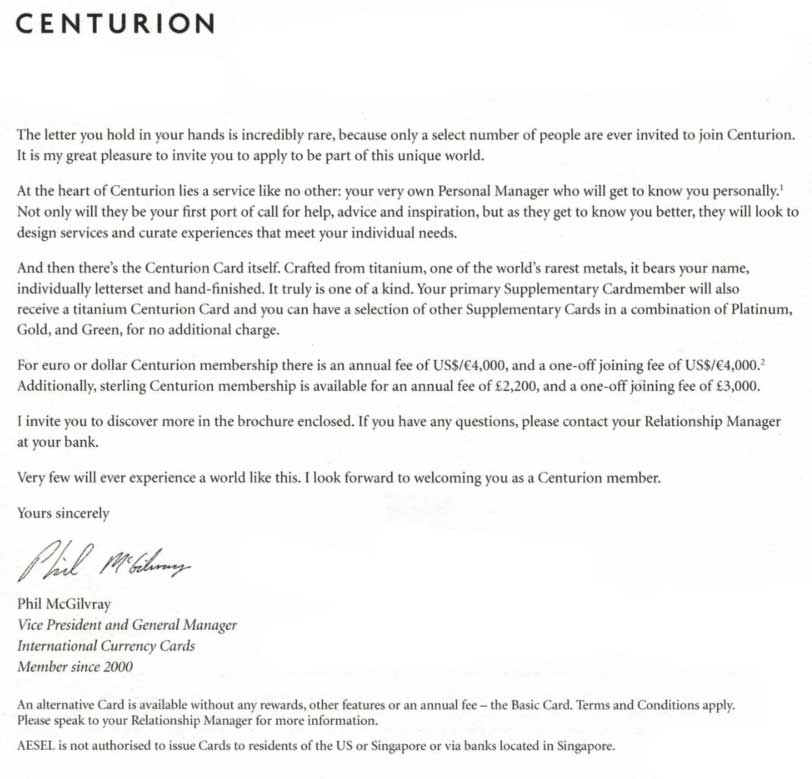

If you meet the 4 criteria, you might receive an invitation letter from Amex which I am holding here in my hands.

Let’s analyse the invitation letter:

“The letter you hold in your hands is incredibly rare because only a select number of people are ever invited to join Centurion. It is my great pleasure to invite you to apply to be part of this unique world. At the heart of Centurion lies a service like no other: your very own Personal Manager who will get to know you personally. Not only will they be your first port of call for help, advice and inspiration, but as they get to know you better, they will look to design services and curate experiences that meet your individual needs. Very few will ever experience a world like this”

Smart marketing based on exclusivity

There is a clever marketing strategy behind these words. The restricted access to the black card created a legend based on exclusivity, prestige and privileges associated with the international lifestyle of celebrities.

At the very beginning of 1999, the Centurion Cards have been distributed free of charge to the Rolling Stones, Madonna and other rock stars and Hollywood celebrities. Even today, the eligibility criteria are subject to speculation.

The AMEX Centurion Card became a success story. Meanwhile, other strong competitors are offering such exclusive black cards tailor-made to wealthy people. Black Card Mastercard and Visa Black Card are some of them.

Is the Centurion Card worth it? What are the AMEX Centurion Card Benefits?

On the black page named Centurion Account Overview there are listed 4000 USD or EUR as a one-time joining fee and 4000 USD or EUR AMEX Centurion Card fee. The Main Card Holder is entitled to 2 Titanium Centurion Cards and until 19 Centurion plastic cards in Green, Gold and Platinum. All for the same AMEX Centurion Card annual fee. The Main Card Holder alone is financially responsible for the expenses of closely related family members or friends.

What makes the Amex Centurion Card Benefits unique compared to other cards?

The Global Lifestyle without Limits

You receive updates on the most prestigious VIP events. You can buy expensive paintings with your charge card. In case the tickets for special events are sold out, that’s not an issue for a Centurion Card owner. The concierge service will always find a solution to satisfy the extravagant requests. Centurion cardholders have access to over 1000 airport lounges, including Emirates Skywards, meet and greet services, fast-track clearances through arrivals and departures with safe passages through the airport for family members and business partners.

The concierge service ensures a global lifestyle without limits – as written on the black brochure. According to my opinion, the Centurion Card can be the entry ticket to exclusive events with the opportunity to meet extraordinary people for international business.

[ The following text section contains business insider information. ]

What have Amex Centurion Card, Money Laundering & Swiss Banks together?

Combating money laundering became more difficult and risky. Compliance officers taking care of anti-money laundering are very expensive. Therefore, American Express under the guidance of the new CEO is more than happy, to delegate the Know Your Customer rules and the anti-money laundering background checks to the banks.

All the mystical requirements are history for you. The new CEO, Mr Squeri, is very happy to expand his business with the prestigious Swiss private banks spending less money on combating money laundering. The new CEO has decreased the AMEX Centurion Card requirements.

If you order the Amex Black card with me it will be yours within 1 week. The immediate access is guaranteed. There is no need for a credit history with the Platinum card, no spending limits and no need to wait, pray and hope for an invitation letter issued by American Express. We will send you a very simple Questionnaire.

Based on your information on the Questionnaire and your passport copy we will collect a pre-approval from a solid Swiss bank. We made agreements with the best Swiss private banks. We agreed on excellent terms and conditions for you. If you go directly to the bank, you will have higher banking fees. If we will introduce you to the Swiss bank, you will pay 20% to 40% less. All you have to do is opening a Swiss bank account in your name with a minimum investment of 1 Million EUR with a prestigious Swiss private bank.

Pre-approval from the Swiss private bank

We will prepare all the paperwork. We introduce you to an exclusive Swiss private bank. The bank or an external asset manager will take care of your application forms with American Express. We will make sure that professionals who constantly grow your assets manage your assets. A classic Swiss asset manager can generate between 6% and 8% performance per year with your portfolio.

You will receive the pre-approval for the bank account opening and the Centurion Card before the invitation for the personal meeting in Zurich. A top banker will continuously take care and grow your assets. Having a Swiss bank account is a long-term relationship. The duration of a Swiss bank account is 17 years, on average. The average marriage duration is much less than 17 years. A Swiss bank account is for life or even for the next generation to come.

American Express appreciates the high standards and the stability of Swiss banks. Therefore, the AMEX Centurion Card Benefits are offered to the clients of Swiss banks. They love cooperating with Swiss banks having a Tier One Capital Ratio exceeding 20%.

Please keep in mind. Having your Amex Centurion Card combined with a Swiss bank account in multiple currencies is not only the most prestigious status symbol money can buy but also the best global asset protection for your hard earned money.

Insider information just like this cannot be found in universities, not in libraries and not on the internet. If you like such information, make sure to not miss the new videos and subscribe to my YouTube Channel now. Click the Subscribe button.

Be rich and stay rich. Have a wonderful day.