How Millionaires pay less Tax using Secret Tax Avoidance Strategies – Confessions of an International Tax Lawyer

“Ex-UBS Lawyer lets you in the Secret Strategies of Millionaires for Instant Tax Savings.”

Discover at first-hand how it really works.

Use the same Tips & Tricks that are used by the Rich and Famous. Let me reveal the proven Secrets how financially successful Businessmen and Women legally save Millions on their taxes.

Below, we have summarized what No One will tell you!

Tax Avoidance Solutions that work!

Experience the unedited and controversial Insider Information which will result in the Millions worth of Tax Savings each Year.

Table of Contents

- Tax Avoidance vs Tax Evasion

- Tax Avoidance Definition

- Tax Evasion can destroy your Health

- Aggressive Tax Strategies

- President Trump supports the Offshore Industry

- Tax Avoidance Measures, Models und Strategies for Private Individuals

- The Legalisation of Black Money with International Tax Number

- Lump-sum Taxation in Switzerland

- How much money do you need to qualify for the Lump-sum Taxation

- Taxation is calculated on the Cost of Living

- Taxation in Switzerland

- Special Purpose Vehicle – The Instrument for Confidential Business

- Club Deals – The secret Transactions of Key-clients of Swiss Private Banks

- Tax Avoidance based on Loopholes

- Tax Avoidance Examples

- Canton Zug: The Paradise for Holding Companies

- Tax Avoidance Methods of Lewis Hamilton

- How Giants like Google, Amazon, Apple & Starbucks avoid Income Tax!

1. Tax Avoidance vs Tax Evasion

What is tax avoidance?

Tax avoidance is often confused with tax evasion. It is enormously important to know the difference between legal tax avoidance and illegal tax evasion.

Tax avoidance meaning? Why is that so important?

- Tax avoidance with legal corporate structures means saving taxes legally

- Tax evasion is illegal because you are hiding assets which are taxable

2. Tax Avoidance Definition

What conditions and circumstances must be created to pay less or no taxes? Giving the right answer to this question means successful tax avoidance.

Tax avoidance deals with methods and strategies to legally save taxes. These must be checked in advance by tax consultants and approved.

Tax Avoidance Examples

- Tax Deductions

- Tax Credits

- Buy Second Citizenship & Passport

- International Relocation

- Flat Rate Tax Switzerland

- Taxes in Switzerland

- Swiss AG

- Flat Tax in Italy with Golden Visa & Non-Dom Status

- Give up Citizenship

- Diverting Income to other Companies located in tax-efficient jurisdictions

- Offshore Tax Avoidance

- Claiming Double Taxation Treaties

- Special Purpose Vehicle (SPV)

- Tax Avoidance with Tax Loopholes

“Abusing the methods and strategies listed above to mask existing tax liabilities is equivalent to criminal tax evasion. That means: imprisonment, after-tax payments and exorbitant penalties for criminal tax evasion.”

Example 1:

You live in Italy. You have an undeclared bank account in Switzerland. You are selling all of your assets in Italy to not leave behind any assets to be confiscated by the Italian tax authority. You are transferring your fiscal residence to Switzerland to circumvent the tax liabilities to the Italian State. Relevant facts for taxation have already been created. The effective collection of tax has been made difficult or impossible. That means illegal tax evasion and not legal tax avoidance.

On the other hand, if you create the legal prerequisites with the above methods and strategies that tax-based circumstances cannot even arise, this is synonymous with successful legal tax avoidance.

Example 2:

You are a citizen of the USA and live in Switzerland. Nonetheless, you continue to be subject to be taxed in the USA because the Internal Revenue Service (IRS) attaches tax liability to nationality. One of the most efficient tax avoidance methods, in this case, is that you renounce definitely to your American citizenship (relinquishment procedure).

The same tax avoidance strategy was successfully used by Tina Turner, the US superstar, shortly after she received the new Swiss passport. To renounce to a nationality, you must have another citizenship because nobody wants to become stateless. Tax avoidance cases must be considered on a case by case basis. Legal tax avoidance methods are made to avoid taxation for the future.

3. Tax Evasion can destroy your Health

The draconian punishments in connection with criminal tax evasion have ruined the existence of tax evaders. Tax evasion is no longer considered to be a cavalier offence, as it used to be. In many cases, the existing assets are no longer enough to pay for the high after taxes and exorbitant fines.

Some clients preferred to escape the bankruptcy judge and relocate with their families in third world countries. Some of my clients were in good faith and ready to start with a Voluntary Disclosure Program to legalize the offshore bank account. The exact calculation of the tax consequences revealed that there was not enough money to cover the tax liabilities and the penalties. Many families of those affected were not prepared to deal with the horrendous financial pressure.

The black money problem changed not only the lifestyle of the families involved but their entire life. Divorce, serious health problems, relocation to another continent, bad family disputes have been the consequences of criminal tax evasion.

4. Aggressive Tax Strategies

Tax evaders have no chance to open a bank account with a Swiss bank today. Even aggressive but legal tax avoidance practices should never be discussed with your private banker alone without the presence of an international tax adviser. Misunderstandings of the features of tax avoidance could easily arise. The discipline of international tax avoidance is a very complicated matter. A normal average Swiss banker is afraid of liability risks.

Swiss bankers are instructed to stay away from tax issues. Some top senior bankers are quite familiar with international tax avoidance schemes, but most of them are scared to create liabilities for the bank. Junior bankers are afraid to be involved with the aid for tax evasion. They might even come up with the idea of reporting you for money laundering as part of a short-circuit reaction. A blocked bank account would be the result of such a hasty reaction. Be careful.

Many people are criticising legal tax avoidance methods as morally questionable. Methods and strategies for tax avoidance aim to circumvent the tax-establishing facts. The goal is to pay attention to not create the tax-triggering facts. The legal tax avoidance methods are frequently attacked to be morally reprehensible because they are circumventing the scope of the tax law. It should be pointed out that in many cases the legislator deliberately wanted to leave a gap in the law open.

“If you do not take advantage of such gaps, you make a mistake. Lawyers are here to apply the law. We are not moral apostles or politicians judging on the fairness of the law. We apply the law, and that’s it.”

5. President Trump supports the Offshore Industry

When Hillary Clinton attacked Donald Trump to be a constant tax offender and a tax fraudster, Trump replied casually: “That makes me smart.”

“Donald Trump is known for using aggressive methods and strategies to save the last penny in taxes.”

https://www.independent.co.uk/voices/donald-trump-tax-dodging-offshore-havens-bermuda-bahamas-cayman-islands-paradise-papers-a8157386.html

Based on information in the Paradise Papers, Donald Trump founded the offshore company “DJ Aerospace Ltd.” in 1994 in Bermuda. He also had a holding company in Delaware. He transferred 110 registered trademarks to offshore companies and saved millions of taxes. In the Bahamas, Trump made a USD 68 million profit by buying and selling a casino hotel.

He is not the only US President who used offshore structures to optimize his taxes. Bill Clinton spent 5 years as an Advisor to the “Yucaipa Global Investment Fund”, with account relationships in the Cayman Islands and Dubai. Billionaire Ron Burkle was the owner of the mutual fund and appointed Bill Clinton as a consultant. Bill Clinton earned at least USD 15 million from this offshore advisory mandate. The Clinton Family had some benefits from Bill Clinton’s business connections with the offshore industry. There is no doubt. Hillary Clinton should consider her own involvement before making allegations against the offshore industry.

The big companies in the US have bunkered Billions with offshore companies. General Electric has USD 119 billion in Bermuda, Bahamas and Singapore. Pfizer has invested USD 74 billion offshore. Merck has USD 60 billion offshore and 10 subsidiaries in Bermuda alone.

President Trump’s secret Agenda:

“Trump’s comments on the offshore industry reveal his agenda: he wants to create the largest tax haven in the world in the US. Delaware, Nevada and Wyoming are promoting anonymity, secrecy and very low taxes around the world.”

Trump’s message is unequivocal:

“Bring all the world’s offshore money to America. We offer the best asset protection with the highest level of discretion that no longer exists in other offshore locations.”

Trump attracts US companies repatriating their money to the United States. US companies will be rewarded with massive tax reductions. At the same time, the US is putting pressure on all the world’s financial centres imposing the severe FATCA laws. FATCA demands all confidential account information from all countries. In return, the US provides no data.

“The USA is preaching water and drinking wine.”

6. Tax Avoidance Measures, Models & Strategies for Private Individuals

6.1. Citizenship by Investment & Second Passport

Why do you need second citizenship if you are an international businessman?

Businessmen who are not living in the “right” country often face visa restrictions. Let’s assume that an important business meeting is coming closer. You notice that you need a visa. The formalities are laborious and tricky. You must list all the countries you have travelled in the last 5 years.

Maybe you need to go to the embassy and get through an interview. You have to deposit your passport at a local embassy for a period of 3 or 4 weeks. You are 3 or 4 weeks without a passport. You are blocked. The visa costs you as much as a plane ticket. You are considering if you should cancel the appointment.

Businesspeople in politically unstable countries suffer from substantial visa restrictions. Each departure becomes a torture. Geopolitical crises, sanctions and embargoes limit the freedom of travel. Because of your nationality, you may are associated with terrorists. On the passport are stamps of countries, which are not desired by the country of destination.

A new nationality offers many business people security from political, religious and ethnic persecution. In politically unstable countries, a passport can be withdrawn overnight. Without a second passport you are under the risk to become stateless (ex. Prime Minister Taksim in Thailand).

We also have high net-worth individuals (HNWI) from countries such as the USA, Germany, Italy, Norway and France, who need a second passport for tax optimization and legal tax avoidance. Many countries have introduced the Exit Tax (Exit Tax, Emigration Tax, Expatriation Tax). Anyone who leaves his country of residence remains taxable for a long duration. In most countries, the Exit Tax is scheduled for a period of 5 years.

If you have a second passport, you can renounce to the first passport forever – without being stateless. The relinquishment of the citizenship will eliminate the tax liability if the tax obligations are connected to the passport as it is the case for the USA. As the laws are changing rapidly, each case must be analysed individually before spending money on passports. All consequences of such an important step must be adequately considered on a case-by-case basis.

More and more countries are introducing the Exit Tax. If Germany follows the example of the USA making the taxation liabilities dependent on nationality and not on the effective residence only, other EU countries will follow. Since the HNWI want to give back the old passports, they need new passports to avoid statelessness.

The “Citizenship by Investment” industry is booming. Never before have so many passports been sold with the various Citizenship by Investment programs as the last year. More and more wealthy citizens will buy a new passport and give the old passport away with the adverse tax consequences of the Exit Tax.

6.1.1. US Tax Refugee „Tina Turner“ is teaching us how to avoid Taxation

Read here how Tina Turner realized substantial amounts of instant tax savings

Tina Turner lives in Switzerland and has become a Swiss national. She relinquished the US passport immediately after getting the Swiss passport. This ends their tax liability to the IRS.

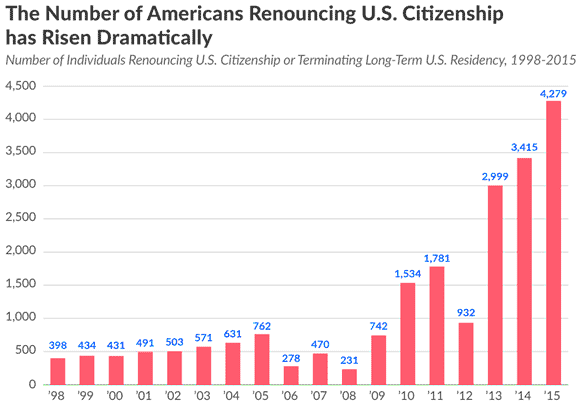

“In 2016, 5411 US citizens renounced to their passports for tax reasons. Before they could give back their US passport, they had to buy a new passport.”

Various high-tax countries – above all Germany – have announced that they want to tie tax liability to nationality (as in the USA). More wealthy businessmen and women are now ready to establish a new residence for tax reasons. This tendency has not escaped the tax authorities.

The Exit Tax is not the only reason. Instead, a second nationality can also be interesting to avoid the income tax, the gift and inheritance tax. Depending on the country and situation, various tax avoidance methods can legally save millions of taxes.

6.1.2. Banking Passport

Successful businesspeople are using the second passport as a so-called “Banking Passport”. Assets can be diversified more discreetly with account opening procedures based on the Banking Passport. Individual countries in the Caribbean are offering a package of Banking Passport combined with a legal procedure to change the name. Who opens a bank account with a new passport and a new name wants to maximize the asset protection effects. Such asset protection strategies are very popular among Russian businessmen.

6.2. Flat Tax Program in Italy & Golden Visa

6.2.1. Non-Dom Status

Italy is offering the Non-Domiciled Tax Status to wealthy immigrants, since 2017. Due to the new residence with the attractive Non-Dom Status in Italy, all income from abroad is tax-free, as long as the incomes are not imported into the country.

The Italians have copied the Non-Dom Status of the British. Italy wants to stimulate the economy attracting new wealthy immigrants. Unlike other countries with Non-Dom Status, Italy offers a unique advantage allowing an extended family reunion, not limited to the closest family members.

6.2.2. Flat Tax of EUR 100‘000

With the payment of a lump-sum tax of EUR 100’000 per year, the tax for all income generated abroad is paid. While a taxpayer without a Non-Dom Status in Italy has to declare each bank account abroad using a special tax form, this obligation does not apply to Non-Domes. The Italian tax authority has expressly exempted foreign accounts of Non-Doms from the obligation to be disclosed.

Whether or not a Non-Dom, which has recently moved to Italy, has an account in Switzerland, is not of interest to the Italian tax authority. The tax of the income with this account in Switzerland is absorbed with the lump-sum tax.

If, as a result of the automatic exchange of information, Switzerland informs the new state of residence, Italy, about the existence of the account, this has no consequences for the Non-Dom taxpayer. Based on the new Non-Dom Status in Italy offered with the new Golden Visa Program, the new resident can simultaneously legalize his black money in Switzerland.

Italy’s tax is limited to the lump sum of EUR 100,000. That’s it. Italy has no interest to be informed if the taxpayer generates additional revenue from the Swiss bank account. Italy will not charge more than EUR 100’000 tax per year.

Cristiano Ronaldo moved to Italy with the new Flat Tax Benefits. He will pay EUR 100’000 per year only instead to be taxed for 54 Million EUR. That’s a super deal for him. Having good tax advisers mean saving millions.

7. The Legalisation of Black Money with International Tax Number

The Golden Visa Program will legalize a Swiss bank account with undeclared money. Income is automatically taxed by the flat tax. The Italian authority immediately will issue an international tax number for the new Italian resident. Once the Swiss bank has the customer’s international tax number, the account is considered legalized and tax-compliant.

8. Lump-sum Taxation in Switzerland

There are many strategies to protect assets and avoid taxes. You can contribute your assets to an insurance policy. You can structure your assets in many ways with companies and trusts optimizing liability risks. You can diversify your assets in different banks in different jurisdictions. One of the most efficient tax avoidance strategies is the relocation of your residence.

You can avoid taxes and protect your assets at the same time. The best tax avoidance strategy is a combination of an asset protection strategy. You can achieve both by transferring your residence to a secure and stable legal system having a functioning jurisdiction and fair taxation. You can find it all in Switzerland.

As a successful businessman, you have a large selection of places to live such as Malta, Monaco, Cyprus, Canada, Singapore, etc. If you move to Switzerland, you have tremendous tax advantages combined with the highest quality of life in the world. International relocation and tax experts are considering the lump-sum taxation in Switzerland as the ultimate Rolls Royce solution.

8.1. Exclusive Lifestyle in Switzerland

Every place has its charm. Switzerland offers attractive tax laws and a high quality of life with best living standards. It offers exactly what wealthy people from all over the world are dreaming.

Switzerland offers unique advantages no other country can offer:

- Best security standards and very low crime rate

- Reserved and multilingual population

- High standards of living with political and economic stability

- Social peace

- Personal safety is guaranteed day and night

- Bodyguards and high security measures for exceptional events only

- Multicultural cities with international population

- Excellent health infrastructure

- Efficient public services

- Best private schools in the world

- First-class infrastructure like Singapore and Finland

- Effective law enforcement

- Efficient protection of intellectual property rights

- Moderate taxation

- No capital gain tax for private persons

- High productivity, high quality products and services

- Best ski resorts in the world

- Mild climate

“The international lifestyle in Switzerland attracts celebrities from all over the world.“

8.2. Celebrities List with the Rich & Famous living in Switzerland

- Frida Lyngstad (ABBA Pop Group)

- Roger Moore alias James Bond 007

- Tina Turner

- Alain Delon

- Phil Collins

- Victor Vekselberg, Russian Investor

- Latsis Familie, Greek Ship-Owner

- Bernie Ecclestone, Formula One

- Michael Schuhmacher, Formula One Pilot

- Jacques Villeneuve, Formula One Pilot

- Kimi Räikkönen, Formula One Pilot

- Jean Alesi, Formula One Pilot

- Sebastian Vettel and other Formula One Pilots

- Athina Onassis

- Boris Becker

- Ana Ivanovic

- Yannick Noah

- David Bowie

- Yoko Ono

- Laura Pausini

- Celine Dion

- Daniel Hechter

- Dimitry Ryboloviev

- Ermenegildo Zegna

9. How much Money do you need to qualify for the Lump-sum Taxation

There are three levels of taxation in Switzerland:

- the Federal Government

- the Canton

- the Municipality

The applicant should not pursue any professional activity in Switzerland. At present, the Canton of Zug requires a minimum taxable income of CHF 400,000 per year and minimum net-assets of CHF 6 million. For the Canton of Schwyz, at least CHF 500,000 per year is required as income with the corresponding net assets of at least CHF 10 million.

The Canton of Zurich recently abolished lump-sum taxation. The political climate for Lump-sum taxation is not friendly. The requirements for the applications are becoming stricter due to high demand from around the world. The financial crisis in 2008 and the Arab Spring have increased the number of applications.

“Check your options and the possibilities of moving to Switzerland as soon as possible. Verify your family situation before it will be too late.”

10. Taxation is calculated on the Cost of Living

For the lump-sum taxation, the taxable income is calculated on the basis of the annual cost of living inside and outside Switzerland of the applicant and his family living in the same household. The yearly cost of living will be multiplied by factor seven. This leverage factor has recently been increased from factor 5 up to factor 7 due to high demand and the politically opposite situation.

The cost of living per year multiplied by factor seven corresponds to the taxable income.

The taxable income defines the amount of tax payable. The amount of the tax can even be calculated on the internet. It depends on the place of residence. Depending on the municipality and Canton, the amount of taxation may vary.

Müller Milch saves Millions with Donation Tax

Mr Theo Müller, the founder of Müller-Milch, moved away from Germany and moved to Erlenbach on Lake Zurich. He avoided the astronomical gift and inheritance taxation in Germany. At the federal level, there is no inheritance and no donation tax. An applicant benefits from very low gift and inheritance taxes. Some Cantons have no inheritance and gift taxes at all.

That means that the benefits of inheritance planning can be calculated for each applicant. Mr Theo Müller hired first-class tax advisors. He is a master of tax avoidance. Nobody has saved so much money with tax avoidance in Germany as the founder of Müller-Milch. He kept and protected a fortune from the access of the German tax office. The following generations will be grateful for his smart tax planning.

11. Taxation in Switzerland

Switzerland has a sophisticated taxation system. Unlike in most other countries in the world, the federal, cantonal and communal authorities exercise tax jurisdiction together. The choice of a tax-friendly place as the new domicile must be well considered. It has a direct impact on taxation. Due to the federal state structure, Switzerland knows various types of taxation. There are the direct taxes that the taxpayer pays directly to the federal government, to the Canton and the Municipality. There are also indirect taxes levied on the consumption and use of goods or services. Due to cantonal differences, the tax impact in Switzerland has to be calculated on a case by case basis. Depending on the Canton and Municipality, the difference can be substantial.

12. Special Purpose Vehicle – The Instrument for Confidential Business

A “Special Purpose Vehicle” (SPV) is a company formed for a specific purpose. The scopes of an SPV are manifold. It is the preferred instrument of Billionaires when it comes to the segregation of assets and limitation of liabilities. They are suitable for holding yachts, private jets, intellectual property rights (intellectual property such as copyrights) and real estate. The creation of an SPV elegantly outsources and controls liability risks in connection with a specific project. In addition, assets can be anonymized.

In many countries, financial kidnapping, blackmail and the exercise of political pressure are widespread. Due to the Automatic Exchange of Information (AEOI) confidential information in connection with bank accounts will be distributed across borders.

My Clients of South America are very concerned about financial kidnapping. Corrupt tax officers will receive confidential bank account information due to the AEOI. Some of them will sell this information to criminals. The protection of privacy is vital in these countries. Adapting low-profile lifestyle measures have become part of a survival strategy. Wealth needs protection. Many HNWIs have deliberately adopted a low-profile lifestyle and increased security measures. Many of them will change their residence in more protected residence areas as a consequence of the AEI. An SPV is an ideal tool to separate, anonymize and protect assets.

The AEOI will limit the confidentiality offered by an SPV. Due to the AEOI new unknown financial centres located in countries who have not signed the agreements for the AEOI are overgrowing rapidly. The city of Tiflis in Georgia is one of such new financial centres.

Some Swiss asset managers have transferred part of their business in Tiflis. The banks in Tiflis invited Swiss bankers to educate the local staff. An SPV with bank accounts in Tiflis, Georgia, can be an interesting option to segregate, anonymize and protect the assets of clients living in areas in which financial kidnapping is frequent.

12.1. The SPV guarantees Confidentiality for the Project

Investors invest as shareholders in project companies. An SPV is an ideal vehicle for a project. Shareholders are also board members in the SPV. As board members, you can easily control the activities of the project manager. Investors benefit from the valuable professional experience of the project manager. The project manager is often an investor. He is Chairman of the Board of the SPV.

SPVs are often used for construction projects. The land is bought with the SPV. The project takes its course. The SPV creates a win-win situation for investors and project managers. Thanks to the SPV, the project manager comes to investors. Investors are securing an attractive investment opportunity by benefiting from the professional experience and network of the project manager. After completion of the project, the properties are sold individually. The SPV has accomplished its mission. It is therefore dissolved.

13. Club Deals – The secret Transactions of Key-clients of Swiss Private Banks

So-called “Club Deals” are often offered to key-clients of Swiss private banking. Club Deals are confidential business opportunities for outperforming investments in specific projects. A top banker with good connections to project managers offers a club deal to his prime clients. This happens discretely. Club Deals are Off-Market Deals. The public is excluded. Private banking clients can invest in an SPV managed by an experienced project manager.

The Top Banker trusts the project manager. It’s a business based on trust. The project manager has proven many times that he has been successful in tackling and completing projects. The investors will realize above average returns. As an investor, you benefit from the professional experience, the special skills and the network of relationships of the project manager. The project manager comes quickly and discreetly to solvent investors. He can implement his project quickly and easily thanks to the establishment of an SPV.

The role of the private banker is crucial. He is the link between project leaders and investors. Club Deals are very attractive. The private banker will carefully select the project manager before introducing him to his best clients. He has no interest to put at risk the relationship to his key-clients. If all participants have known each other and the team has already proven itself in the past, the risks of failure are very limited.

Top bankers enjoy working with trustworthy lawyers. We know some top private bankers with an excellent network. We always have access to international private investors offering exclusive off-market Club Deals.

If you have an exclusive investment idea, a trophy asset, an off-market deal or merely a commercial off-market property call us and let us explore the options. The volume of the transaction should exceed CHF 10 Million.

“We have access to solvent buyers who are interested in off-market transactions and Club Deals only. Explore your options. Please be informed that we accept off-market deals only. If the deal is already distributed on the internet we have no interest. The last 30 years we have built up a powerful network of relationships with top bankers that we can count on. We have excellent connections to close your off-market transaction fast and successful.”

14. Tax Avoidance based on Loopholes

Our clients own operating companies in many countries. International business must be tax-compliant and tax-efficient at the same time. Tax avoidance solutions must be developed for companies that are recognized as tax compliant in the countries concerned.

Ideally, the tax consequences should be approved in writing by the tax agencies. Tax rulings are tax avoidance methods based on written contracts with the tax authorities. Before an investor invests in Switzerland, he can arrange a tax ruling for future tax treatment in writing. Sometimes, the tax law is not explicit. You have to be certain before you invest. With a tax ruling in your pockets, you can avoid costly disputes on the correct interpretation of tax law and loopholes.

A businessperson will know exactly the tax consequences of the project. Exploring the options for an attractive tax ruling is one of the best tax avoidance methods. Uncertainties of unexpected taxation can be eliminated. Expensive disputes with the tax authority regarding the tax treatment of a transaction, a project or a construct can be circumvented. A tax ruling can be the trigger for doing business in Switzerland. Investors will know precisely how much the tax bill will be.

International tax law is becoming more complex from year to year. Tax loopholes that were still in use until recently are being closed due to new anti-abuse provisions. Cross-border tax optimization and tax avoidance are becoming more sophisticated. The European Union has sharply attacked the tax rulings common in Switzerland as tax avoidance models. The European Union will bite on granite. The tax rulings are being vigorously defended in the Swiss parliament. I hope that Switzerland will not make concessions.

15. Tax Avoidance Examples

The Double Taxation Treaties (DTT) are important bilateral tax agreements between countries. Two states enter into agreement deciding which state should exercise the right to tax.

Examples

The dividends paid out to a holding company coming from another country are taxed in one country only, thanks to the double taxation agreement. The same concept of avoiding double taxation with a bilateral treaty also works for cross-border payments of interest, royalties, loans and capital gains.

Favorite countries for a tax-efficient application of double taxation agreements are:

- Cyprus

- Austria

- Hong Kong

- Hungary

- Luxembourg

- Malta

- Holland

- Singapore

- Sweden

- Great Britain

- Switzerland

Holding structures in the above countries are mainly used by families as family holdings.

“The holding privileges offered in Switzerland are very attractive. Switzerland is famous for their holding privileges. A third of all Fortune 500 companies have holding companies in Switzerland.“

16. Canton Zug – The Paradise for Holding Companies

Thanks to the Tax Agreement in Interest Rates with the European Union (EU) in force since 1 July 2005, Switzerland has become even more attractive. Interest, dividend and royalty payments between affiliated companies are virtually no longer taxed provided that at least 25% of the shares be held for at least 2 years. Thanks to such Tax Agreement, Switzerland achieves the benefits of the EU Parent-Subsidiary Directive and the EU Interest Rates and Royalties Directive. Holding companies do not pay any profit tax in the Canton of Zug. The capital tax is reduced. At the federal level, the participation deduction can be asserted. 25% of all newly founded holding companies in Switzerland are founded in the Canton of Zug.

17. Tax Avoidance Methods of Lewis Hamilton

The Formula 1 Pilot Lewis Hamilton avoided the payment of a VAT of GBP 3.3 Million for importing a GBP 16.5 Million Bombardier Private Jet from Canada to England. Ernest & Young and Appleby advised him. He formed an offshore structure with British Virgin Islands (BVI), Guernsey and Isle of Man (IOM) offshore companies.

The BVI Offshore Company owns the jet. The BVI-company made a leasing agreement with the IOM-company for a leasing rate of GBP 140’000. The IOM-company leased the jet to a UK company. The leasing contracts and the payments of leasing rates should demonstrate the existence of a genuine business to the tax agency to avoid VAT payments. According to the tax law, there are no VAT payment obligations if the business is genuine. The agreements were made to create documentary evidence for a business and persuade the tax agency. If Lewis Hamilton needs the jet for private purposes, VAT is due.

17.1. What was Lewis Hamilton’s mistake?

According to the reports in the media, Hamilton needed his jet only for private purposes, which speaks in favour of a VAT obligation. Unfortunately, Hamilton used his private bank accounts to pay the lease instalments, rather than the bank accounts of the offshore companies that signed the leasing agreements.

The offshore companies controlled by Lewis Hamilton were only letterbox companies without substance. He should not have made the payments from his private account, but only from the company accounts that entered into the leases. If he pays privately, the tax authority argues that he also used the jet privately.

I would also have recommended him to provide his companies more substance. He should have set up a small but real leasing business. Nobody would have come up with the idea to attack his constructs. Mixing private payments with business payments is a frequent mistake of owners of offshore companies.

“Lewis Hamilton’s advisors Ernest & Young and Appleby made a tremendous mistake. Among professionals, it’s a well-known mistake that clients are often mixing private payments with business payments. They should know that clients need practical advice. If you play your game with offshore structures, you have to play it correctly.”

17.2. How to avoid tax legally?

If offshore companies sign contracts, then you should make sure that the payments are made in accordance with the contracts. Payments made with private accounts are not connected to the business. Lewis Hamilton controlled all involved offshore companies. Lewis Hamilton was the sole beneficial owner. He should have used the accounts of his offshore companies. If you want to save taxes with offshore companies, then you have to do it right and follow all the rules.

Despite the expensive advice from Ernest & Young and Appleby, elementary mistakes were made here. That’s why Lewis Hamilton was easily attacked in the press after the Panama Papers. Although he uses legal structures to avoid taxes, he has not complied with the rules of the game. The structure is legal, but a structure must also be appropriately substantiated and lived.

Respecting the rules of the game means that if an offshore company buys something, the same offshore company should pay for it. He should not have used the jet for private purposes only. Rather, he could have rented the jet also to a company owned by a friend, for example. You have to respect the “Spirit of the Law”. Under “Spirit of the Law”, the lawyers from the Anglo-Saxon area (USA, UK, Canada, Australia) understand the deeper meaning and purpose of the law.

The technical term for “the spirit or purpose of the law” is “Ratio Legis”. The legislator does not want to charge VAT on imports since the taxes are later collected from the real business activities. If business is only fabricated with the use of offshore companies to persuade the tax agency, but in fact, only private use is planned, in my view VAT should be paid.

When designing models for tax avoidance, it is important to create the conditions for not having the taxable situation. That’s not enough. Rather, one must also ask questions about the meaning and purpose of the law (“Ratio Legis” or “Spirit of the Law”) in the legal model for legal tax avoidance. A structure of offshore companies with professionally designed leasing contracts is not enough if the owner cannot prove a minimal business with his jet and makes payments with his private account.

From an economic point of view, Lewis Hamilton rents his jet to himself.

The tax avoidance model must be watertight, both from a legal and economic perspective. Swiss banks are now denying account openings by offshore companies if aggressive tax avoidance methods are implemented.

“What used to be tolerated as a cavalier offence by the tax authorities is sanctioned today in the age of transparency.”

18. How Giants like Google, Amazon, Apple & Starbucks avoid Income Tax!

How to avoid income tax? Giants like Google, Amazon, Apple and Starbucks are shifting their profits to low-tax jurisdictions such as Ireland, Luxembourg, Switzerland, Bermuda and the Netherlands. In Luxembourg, profits from intellectual property are taxed at only 5.7%. Ireland, in conjunction with Holland, offers the famous tax avoidance model “Double Irish with a Dutch Sandwich”. That’s not a cocktail, as one might think, but a cleverly orchestrated corporate structure.

Two Irish companies and one holding company in Holland are being used to shirk profits from advertising revenue and royalties until the profits are bunkered tax-free at the end in the Caribbean.

18.1. Double Irish with a Dutch-Sandwich

Shifting of Profits

- First Irish Group of Companies collects profits from Germany and pays Licencing Fees to a Holding in the Netherlands. Income and Expenses are compensated

- The Holding in the Netherlands transfers the Licensing Fees to a Second Group of Companies in Ireland

- The Second Group of Companies in Ireland is owned by a company in Bermuda

- The Company in Bermuda collects the profits, tax-free

The investigative commissions of governments interrogated the big shots of Google, Apple, Amazon, Starbucks to justify themselves. Nevertheless, such Google tax avoidance structures are legal, despite moral concerns. Only a new law can define abuse regulations and change existing laws. Once new laws come into force, years go by when legal taxes can be avoided. These are the rules of the game of capitalism.

For such Apple tax avoidance models to pay off, several companies are needed. The substance requirements for the offshore companies are increasing. If there is no substance in the company, the tax agencies are piercing the veil of the legal entity. The company is not considered to exist.

The substance is created by renting office space and hiring people. The maintenance of such structures becomes more expensive. Before you decide on an Amazon tax avoidance scheme with several companies, it is worthwhile to calculate the effort accurately.

In the last few years, the business of relocation and citizenship by investment has grown to gigantic proportions. The world has not become safer but more dangerous. Rapacious tax authorities are eliminating financial privacy. Business people from all over the world are looking for more protection and instant tax savings.

When you come to us, we not only discuss Starbucks tax avoidance models. We will holistically analyze your actual family situation. Where can you find the best protection and a high quality of life for your family? We will make a health check on your current corporate structures. We are already improving your structures today so that you are prepared to face the future. Today, we make sure that you will be tax-compliant in the future.

What used to work yesterday is dangerous today. There are so many legal ways to avoid overwhelming taxation. After searching the internet, you should call us. We will check with you the solutions you have found. Get a second opinion. Successful people get advice.

Take the first step for a tax adjustment before the tax agency comes with an audit. We are happy to discuss battle-proven solutions with you. You will be surprised what solutions are available.