Offshore Banking: How to open an Offshore Bank Account legally (Guide 2019)

There are multiple reasons for an Offshore Bank Account. Lower Taxes, Strict Privacy Rules, Asset Protection, Safest Offshore Banks and Low Corruption are just a few benefits for entrepreneurs going offshore. Switzerland, for example, offers the lowest VAT (7,7%) in Europe. Disclosing client information would result in criminal charges against the employees of the bank. Therefore, more than 30% of all offshore banking assets are managed by Swiss banks. Together, we will discover why Swiss banks are so special.

Offshore banking in a carefully selected jurisdiction can offer little-known advantages for the long-term if you follow the laws and accomplish the reporting requirements. Offshore banking isn’t illegal but hiding is. We reject illegal tax evasion schemes (Panama Papers).

We will guide you through the most important Financial Centres in the world disclosing the recipes of successful investors, for example, how to find out if a bank is safe. 14 Help-Videos will disclose the secrets of offshore banking in simple words.

We will help you on how to open an offshore bank account legally outside of your home country. We show you how to find the best offshore banks in the world. What we recommend is fully compliant with the laws in your home jurisdiction and the laws in the chosen offshore jurisdiction.

Autor: Enzo Caputo

Banking Lawyer since: 1986

Position: Founder & CEO of the

Boutique Law Firm Caputo & Partners

Last Update: 30.07.2019

- What is an Offshore Bank Account?

- What is an Offshore Bank?

- Do Numbered Bank Accounts still exist?

- What are the benefits of an offshore bank account and the advantages of offshore banking?

- Offshore Banking Country List

- How do I know if my bank is safe? Which is the safest bank?

- Offshore Banking List 2019

- 9 Questions: How to find the safest offshore bank among the best offshore banks 2019

- Offshore Banking Countries

- Best Offshore Bank Account 2019

- What happens to my money if my bank goes bust?

- How to open an Offshore Bank Account legally?

- The following offshore banking countries should be better avoided

- The 5 most common mistakes people with an offshore bank account make

- It is illegal to have an Offshore Bank Account?

- The 8 Best Reasons to open an Offshore Bank Account

1. What is an Offshore Bank Account?

An Offshore Bank Account is a normal bank account located in a foreign country with a foreign jurisdiction. As the investor has no residence in the offshore jurisdiction, the authorities in the home country have no influence over his overseas bank account. Offshore Banking means banking activities with a foreign bank account located in a tax haven.

Offshore Bank Account Definition:

“An offshore bank account is a foreign bank account located in a country known as a tax haven.”

2. What is an Offshore Bank?

Offshore banks were once associated with shadow economy, organized crime, money laundering, corruption and tax evasion. They were weakly regulated. The absolute banking secrecy made the anonymous bank account extremely attractive. Opening an offshore account anonymously using a password or number was widespread back then. There were even offshore banks (shell banks) with no physical presence until the Bush Administration passed the USA Patriot Act in October 2001 and declared shell banks with offshore accounts illegal.

Anyone wishing to open an offshore bank account today is aware that offshore banks no longer offer absolute banking secrecy. Automatic Exchange of Information (AEOI) and Common Reporting Standards (CRS) have eliminated banking secrecy in tax matters almost everywhere. Today, good offshore banks are heavily regulated. They want to know who they do business with. The KYC Rules (Know Your Customer Rules) are strictly applied. Not only does the client have to explain the origin of funds, but he has to provide documentary evidence where his money comes from and what kind of business he does.

Attention, it means this bank is not regulated. No supervision means zero protection.

You run the risk of losing all your money.

You should run away from this institution and open your instant offshore bank account somewhere else.

3. Do numbered bank accounts still exist?

The days of an anonymous secret bank account are over. However, you can open a secret safe deposit box for tangible assets if you do it outside of the banking system. Numbered bank accounts still exist in Switzerland for more privacy. Today, they are not anonymous. The numbered account has a number or code and your identity is exclusively known to your private banker. Other employees of the bank will not see your name. However, secret numbered bank accounts are subject to the AEOI & CRS.

The most common bank accounts are Private Accounts and Corporate Accounts.

The Private Account is opened in the name of a private individual. A private account can also be set up as a joint account (joint account). Couples love joint accounts. A private account can be set up as a savings account for resident clients or an account for investments for non-resident private banking clients.

Why is a Swiss bank account so special?

Swiss private banks mainly offer investment accounts for private banking and asset management to wealthy non-resident clients, so-called High Net-Worth Individuals (HNWI). A private banking client has a dedicated private banker responsible for his investment accounts.

What is the minimum balance to open an account in a Swiss bank?

Swiss banks accept investment accounts only. For successful investments with sufficient risk diversification, your investment product must be well-diversified. To achieve a sufficient diversification grade you need a substantial amount of minimum ca. 500’000 USD. Therefore, Swiss offshore bank account with no minimum deposit does not exist. The minimum deposit requirements are different from bank to bank.

The Corporate Account is a company account that is in the name of an offshore company. It is typically used as a transaction account. Corporate Accounts opened in the name of a classic offshore company (IBC) are very widespread in offshore banking (offshore business bank account). To mask the identity of the beneficial owner of the account, tax evaders misused corporate accounts of IBCs. In the past, they had an anonymous account, which was opened on behalf of an offshore company and protected by strong banking secrecy with offshore banking jurisdictions.

Non-tax-compliant assets, also known as tax neutral assets (in fact it’s black money), were maintained via Corporate Accounts in the name of offshore companies.

Let me give you an offshore banking example:

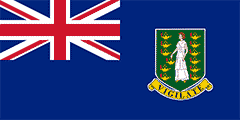

Companies being domiciled in the British Virgin Island Company (BVI) were the most used offshore companies globally to hide untaxed assets (no accounting obligation, bearer shares, secret owner) with offshore banking. When the bearer shares of BVI were abolished as a result of international pressure, so-called nominee shareholders acted as shareholders, to hide the identity of the effective shareholder or beneficial owner. If you want to found such a letterbox company today, you can still set up the offshore company quickly, but no good bank will approve the subsequent account opening.

Upon specific request, we are in a position to open Commercial Bank Accounts with Swiss banks. Swiss banks are opening Commercial Accounts if the owner of the company maintains a private banking account for his private wealth. They ask for a substantial turnover for account opening.

4. What are the benefits of an offshore bank account and the advantages of offshore banking?

International offshore banking with the scope of asset protection has become more important than ever. It’s imperative placing your assets beyond the control of the rapacious authorities at your place of residence. The authorities at home should not have easy access to your offshore bank account. A bank account in a tax haven offers an account in multiple currencies, including online access via the Internet. How to transfer money from offshore account? No problem. You can make the payments online and enjoy the usual credit card service.

3 Questions you should answer before starting your battle-proven asset protection strategy!

5. Offshore Banking Country List

In which countries do I find the best offshore bank accounts 2019?

For sure not at your house bank around the corner in your own country.

Banks in the European Union (EU) or in the USA are massively undercapitalized and therefore dangerous. As a result of existing Bail-in legislation since 2017, every State in the EU is already authorized to legally confiscate your assets.

Bail-in means that the state can take away your fortune legally. The state will transform you from a creditor into a shareholder of your bank. Your supposedly safe savings capital is converted into risk capital overnight. Your hard-earned savings will become the share capital of the bankrupt bank.

Imagine your bank at home is giving you the shares of the bank instead of your money back, and the stocks are falling. From 2008 to 2012, 465 US banks went bankrupt. The Federal Deposit Insurance Corporation (FDIC) has exchanged 465 different bank shares for client assets. Bail-in is a bad deal.

“Save and protect your wealth – not your bank.“

Switzerland is the only country in Europe that has no bail-in legislation besides Liechtenstein.

Open an offshore bank account outside the country of residence. You need an offshore bank account where the authorities at your place of residence have nothing to say.

Do not hesitate to open your offshore bank account. Transfer part of your assets abroad as long as it is still permitted. History has proven that capital export restrictions are introduced overnight. Payments abroad will be declared illegal. Moving money out will become illegal. You need to anticipate events.

Remember: It is never too early, but often too late – especially in case of emergency.

Then, everything happens very fast. Experience shows that emergency laws are coming overnight. One morning, when you look at the newspaper at breakfast, you will discover accomplished facts. You will read that your government will help the banks with your hard-earned assets. If you remain passive and do not decide on your assets, others will decide on it, but not in your favour.

Banks in the EU and in the US are responsible for the over-indebtedness.

According to one of the many studies conducted by the Global Finance Magazine on the safety of banks and best offshore banks 2019, the USA occupies the position number 40. Many banks in Europe are even worse off.

Here is the Offshore Banking Country List 2019

6. How do I know if my bank is safe? Which is the safest bank?

To evaluate a bank, you need to take a closer look at factors such as the safety, reliability and financial stability of the bank, and especially the country where the bank is located. Not the service quality alone is important for the right choice of a bank.

A bank’s Rating and the Tier One Capital Ratio are more important than ever. Banks taking risks with the trading of derivatives, investment banking and lending activities should not be considered as a future business partner.

Warren Buffet said, “Derivatives are poison to the financial world.”

He’s right. On the other hand, you should have a closer look to private banks specializing in traditional private banking. Private banking is considered a low-risk business.

Many foreign private clients of Swiss banks have the widespread misconception that their assets are much safer with a global player such as UBS, Credit Suisse, BNP Paribas, HSBC, etc. The size of a bank is no guarantee of security.

The opposite is the case. International big banks that are present all over the world can easily be victims of extortion. The US Department of Justice has blackmailed the big Swiss banks with their presence in the United States in the billions. The extortion has meant that UBS even had to disclose the names of approximately 4500 customers to the Americans. The Swiss Federal Court in Lausanne has subsequently determined that this disclosure violated banking secrecy. That was a small consolation for those affected.

Better work with a smaller private bank. Better choose a small but well-capitalized private bank specializing in private banking, located in a safe country like Switzerland for an international bank account. Please make sure that the private bank of your choice is not represented abroad. The international big players are internationally exposed. They will not defend you. They will defend their own interests abroad.

Banks in Europe should achieve a Tier One Capital Ratio of at least 9%. In the Swiss Private Bank Directory (Swiss offshore banks list) there is an exact definition on the Tier One Capital Ratio. This is the most important Ratio to determine the financial stability of a bank.

Only a few banks in the European Union and in the USA can reach 9%. All Swiss partner banks we recommend to our clients consistently have a Tier One Capital Ration of over 20%. This makes our partner banks in Switzerland the most secure banks in the world.

Every day, the media discover new insolvent banks that fail the stress test and risk the assets of their customers.

7. Offshore Banking List 2019

Can I open an anonymous bank account?

Today, in offshore banking countries with proper regulation, offshore accounts can no longer be opened to mask black money. It is not worth to evade taxes with an anonymous bank account. Providers on the Internet offer an anonymous bank account in Serbia, Montenegro, Taiwan, Puerto Rico, Georgia, Ukraine, Armenia and Mongolia to evade taxes. They state that the country in question does not participate in the Automatic Exchange of Information (AEOI) & Common Reporting Standard (CRS). They offer simple and fast account opening in 10 minutes only. The banks of their choice will not ask questions.

Honestly, I would not trust a bank that asks no questions and just wants to collect my money. A bank that does not want to know its business partners will sooner or later have problems with contaminated funds (criminal money) and end up in the headlines. Such a bank can’t be good. I would immediately get up and leave the bank in no time. Such a bank is not regulated. How can my money be safe there when nobody oversees the bank and investor protection is not an issue?

Swiss banks are sometimes portrayed on the internet as arrogant and sophisticated. Swiss banks will ask many questions to future clients. Swiss banks want to make sure that they do not do any business with criminals. Word has got around that opening an account in Switzerland is time-consuming. Account opening forms of 150 pages are not uncommon. Opening an account is time-consuming but it’s convenient to invest the time in serious due diligence on the economic background. The bank carefully selects future business partners. A good bank wants to know who she’s dealing with.

“Today, Bank Account Opening Forms of 150 pages are not uncommon.”

My customers are taking the time-consuming account opening process because they love a bank that screens out their future business partners. Once the account is opened, you will have an entrance ticket to the international business community. Every businessman in the world has the certainty that you have been successfully screened by a Swiss bank and successfully passed the Due Diligence and KYC process (Know Your Customer). A new Swiss bank account is like becoming a passport for access to the international business community.

Opening an account in 10 minutes only in a country without adequate regulation has no value. In 2 or 3 years, Georgia, Montenegro and other countries will join the AEOI & CRS. It is not worth to evade taxes. Sooner or later the instant offshore bank account will be discovered by the tax authorities. It’s a question of time. There are legal tax-saving models. Offshore accounts are used for asset protection and legal tax optimization, not for tax evasion.

8. 9 Questions: How to find the safest offshore bank among the best offshore banks 2019

Question 1. How strong is the economic environment and political stability in the country where the bank is located?

Question 2. Does the country have adequate regulation of the banks? Is the Financial Watch-Dog strong enough to ensure the supervision of banks?

Question 3. Are the Rights of Investors adequately protected without investors being patronized when investing (such as in Italy)? What obligations does the bank have to inform the client on risks of investments?

Question 4. What happens to my money if my bank goes bust? Do customers’ assets fall into the bankrupt estate or is there a client protection privilege allowing to take out clients’ assets from the bank? The investments of clients with Swiss banks are fully protected in case of bankruptcy of a Swiss bank.

Question 5. How many outstanding loans are granted and where does the bank invest the funds of the clients? In the bank’s Annual Report you check the Balance Sheet and Profit and Losses. You will see what the bank does with the money of its customers. Is the money of the clients invested prudently and conservatively way? Are there investment banking activities with high leverage? Is the bank involved in derivatives trading? Has the bank a risky loan portfolio with distressed debtors?

Question 6. Is there enough liquidity to meet unexpected liabilities?

Question 7. What is Tier One Capital Ratio? Here is the answer: Here you can read more about the Tier One Capital Ratio

Question 8. Does Tier One Capital Ratio reach at least 10%? The higher the Tier One Capital Ratio the better the bank is capitalized. Our partner banks, which we recommend, have a Tier One Capital Ratio exceeding 20%.

Question 9. Does the bank have a physical presence, for example, a branch in your country of residence? Better not. Otherwise, it is easier to blackmail. A wide-spread physical presence around the globe (Credit Suisse, UBS) will expose the global players. They are at risk of being blackmailed. UBS is involved with the tax evasion case in France. The authorities in France are asking a compensation of 4.5 billion EUR. Such compensation is beyond any reasonable amount of money. Swiss banks with an international presence are visible on the silver plate. They are the ideal victims as a source of funding for distressed governments.

Let me give you an offshore banking example:

Suppose you live in the USA as an American citizen and want to get the hard-won assets to safety. You want to open your offshore bank account at Citi Bank in Zurich. It is much smarter if you, as an American, choose a Swiss private bank that is not represented in the USA and does not do business with the USA. The government in Washington will find it extremely difficult to assert its influence over a private bank in Switzerland. On the other hand, the US government has a simple game influencing his power on Citi Bank in Zurich.

9. Offshore Banking Countries

Switzerland – Swiss Bank Account

In Switzerland, we are currently working with 9 banks. All are well-capitalized. Every day, we are asked to make recommendations about the best banks and the best international bank account. Banks are sensitive when they are mentioned by name on the internet. Unfortunately, we received unpleasant letters from lawyers of banks due to some videos on YouTube. We were almost ready to publish the names of our partner banks but decided differently at the last moment. Therefore, we refer to our best Swiss private bank list (Swiss private bank directory). 115 banks in Switzerland offering private banking services are listed with the most important key figures. We are happy to disclose the banks upon specific request on a case-by-case basis.

Such a list can never replace a private consultation. We are always looking for the best bank according to your needs and expectations.

Principality of Liechtenstein

In Liechtenstein, we work together with 2 banks. We maintain excellent relationships with trust companies in Liechtenstein managing sophisticated structures.

Principality of Monaco, Monte Carlo

We have relationships with two banks in Monte Carlo managing the assets of our Russian and Italian clients.

Singapore

We cooperate with 3 banks in Singapore. Customers from Asia are happy with Singapore banks. Due to tightened regulation in Hong Kong, we have rebooked our customers from Hong Kong to Singapore.

Luxemburg

We have clients with corporate structures in Luxemburg. Our customers are served by 4 banks in Luxembourg.

United Arab Emirates (UAE), Dubai

Our clients from North Africa, India and the Middle East conduct business in Dubai. We introduced our clients to Noor Bank and Mashreq Bank in Dubai.

USA

Many visitors to our website come from Brazil. We work in the USA with 5 banks in Miami and New York. Miami has become the Mecca of South American investors.

We are happy to help you find the best bank for you. The factors that influence the decision on the best bank are manifold. There is no patent remedy.

We only work with professionals. We introduce you directly to a Senior Banker whom we know and trust. Our Senior Banker has something to say in his bank. His opinion counts. This means that he will be in a position to defend your interests inside the bank. We like to sit with you at the table. Together, we will find out which bank suits you and your business.

🖱️Move your mouse over the bars to find out more.

The most important offshore financial centres

AuM = Assets under Management in bn USD

10. Best Offshore Bank Account 2019

There is no overall answer to the question of the Best Offshore Banking & Offshore Bank Account 2019. Depending on the client’s situation, domicile and business, the choice of the best bank may be different.

Gambling, casino and other gaming activities are suitable for banks in Gibraltar. They have gained a lot of experience in these business areas. They are knowledgeable. They can judge these risks much better than other banks can. Opening an offshore bank account in Switzerland is virtually impossible for a professional poker player. This is where our partner banks from Gibraltar come into play. We always find a solution, even in seemingly hopeless cases.

Are Offshore Bank Accounts legal for US Clients?

We can open an Offshore Bank Account for US citizens. Let’s say you live and work in New York. You have a USA Passport or just a Green Card. As a USA Passport Holder or Green-Card holder, you are a US Person under FATCA (Foreign Account Tax Compliance Act). As a US person, you may only open an offshore bank account with Swiss banks that have an SEC license in the United States. Also, you may only work with an external asset manager who must also have an SEC license. He will enter into a discretionary asset management agreement with you. We are specialized in the on-boarding of US Clients.

Since President Trump, US citizens are flocking to Swiss banks. Swiss banks have rebuilt their US desk again. We serve many customers from the USA because they are interested in the exclusive Centurion Amex Black Card issued in Europe. However, we do not refer our US clients to Credit Suisse or UBS because both universal banks are represented in the United States. We recommend US clients to Swiss banks that have no physical presence in the US but also have the SEC license. All our US clients sign the IRS Tax Form W-9 (IRS Form, Internal Revenue Service). The foreign bank accounts for US Citizens are tax-compliant with the IRS.

11. What happens to my money if my bank goes bust?

Who protects my money? The deposit insurance? The government?

Guess.

Here is the truth.

The truth is that many banks have very little liquidity. They only have a small change to pay off the customers. The deposit insurance cannot even satisfy 1% of all claims. If you can recover the first 100’000 EUR (statutory deposit insurance) you must already call yourself lucky. With the amount exceeding 100’000 EUR, you get shares of the ailing bank by Bail-in legislation.

This means that your money is used to save your bank from the disaster. If your bank declares bankruptcy it will be difficult to recover your money.

How and where can you diversify your wealth and be certain that it is safe?

The solution is to open an Offshore Bank Account.

Having some of the assets abroad, far from the influence of the local authorities, is imperative.

That’s the main objective of every successful asset protection strategy.

If a bank goes bust in Switzerland the investments of the client will not fall into the bankruptcy estate. In Switzerland, the investment portfolio of the bank’s customers will be segregated from the bankruptcy estate. The clients are privileged under the laws applicable in Switzerland. If a Swiss bank is under financial pressure, it will be absorbed by another bank.

12. How to open an Offshore Bank Account legally?

Unfortunately, the procedure for opening an offshore bank account is not as easy as it used to be. The days when you were able to deposit a suitcase full of cash anonymously at a Swiss bank in Zurich at Paradeplatz, count it by machine and immediately open a bank account, are long gone.

The “Know Your Customer Rules” have tightened. The more appropriate term would be “Know Your Customer’s Customer Rules”. The standards for combating money laundering and terrorist financing have become more complex than ever. The banks want to know exactly who they are doing business with. Therefore, the bank will collect the Identity of the Beneficial Owner (BO). Swiss banks have a Form A for establishing the BO’s Identity.

Nevertheless, it is definitely worth the inconvenience of opening an account abroad.

There are 2 procedures for opening an offshore bank account:

- 1. In-person

- 2. By correspondence/video

How to open an offshore bank account online?

At present, it is possible to open a Swiss bank account online. FINMA (Swiss Financial Market Supervisory Authority), the financial Watch Dog introduced new regulations for online account opening with the identification by webcam. Even though the Online account opening by a webcam is possible today, we do not recommend online account opening without physical presence. You have to know the bank. We prefer introducing the client into the bank. The client should know the bank engaged in protecting his wealth. The average duration of a Swiss bank account is 17 years. Swiss banking is a long-term project.

What documents I need to open a bank account?

The passport is crucial for identification. A certified copy of the passport is required for opening the account online. Documents that have expired are not accepted.

You need a recent utility bill in original (water, gas, electricity, but not the telephone bill) to prove the residential address.

You need documents evidencing the economic background and the origin of funds.

These are generally documents relating to income-producing activities such as:

Selling of real estate, inheritance, investment, divorce, IPO, royalties, donation, trust distribution, copy of the service contract, diploma, last will, bill of a sale, bank statements, licenses, legalized agreements etc.. If the documents were created in a country with high corruption you should legalize and super-legalize the most important documents with Apostille.

If the economic background is connected to sensitive activities (physical gold trading, adult entertainment, real estate etc.) the due diligence procedure is much more intensive. You should investigate specialized banks being familiar with such sensitive activities.

Here I help a Client with a small Gold Transaction

If you have income from countries with high corruption you should prepare your set of documents very carefully. Not telling the truth can trigger a report for suspicious activities. If substantial amounts are involved we strongly advise engaging a professional intermediary familiar with compliance issues. There are always specialized banks on the market for sensitive industries.

13. The following offshore banking countries should be better avoided

There are many good offshore jurisdictions. Offshore banking is changing. Depending on the residence, situation, the origin of funds, the selection of the best bank in the best jurisdiction may vary on a case-by-case basis.

Attention with Offshore Banking in corrupt countries.

Professional advice can save you substantial amounts of money. Errors can cost you a fortune.

The wrong choice of Offshore Company has caused 80 million USD in damage.

How can this happen?

This video shows a real story. How a client lost a super-market by choosing the wrong offshore company in a country with corruption? Check the video and you will see it.

The best article on the internet can never substitute for customized advice.

Avoid Wild-West Offshore Banking!

25-year-old internet marketing professionals are suddenly selling themselves on the Internet as experienced international tax and private banking experts. These people, without hesitation and using all the psychological marketing tricks, in all seriousness recommend generally unknown banks in corruption-prone countries such as Nevis, St. Vincent, Belize, Montenegro, Mongolia, Armenia, Turks & Caicos Islands, Vanuatu and others for account opening.

I wonder how many investors have already lost all their fortune with these “Wild-West Offshore Banks” just because they followed the instructions of the smart internet marketing experts.

We recommend such jurisdictions only for specific situations, with limited sums and only about a specific project or particular transaction. Without local back-up with the help of a trusted person in such a country, the venture quickly becomes an expensive wild-west adventure.

Again and again, I have inquiries from people seeking advice on repatriating assets from exotic jurisdictions such as Belize, Vanuatu, Armenia, Dubai etc. The problems only arise when the investor demands his money back. The banks stubbornly refuse to return the money with flimsy justifications.

Investors are out of the blue when the supposedly safe bank owned by the sheikh offers an alternative solution for investing in dubious real estate projects. In many cases, where the regulation of banks exists only on paper, it is the owner of the bank, who exercises his power without restriction. Challenging negotiations are announced. The negotiations take years. Arab intermediaries demand huge sums for a successful mediation.

“Transferring money to offshore account is a simple matter. The way back is much more complicated or even impossible.”

Don’t blindly follow the advice of the big bank’s advisors.

I have seen significant losses in the millions of dollars and hidden fees that have destroyed many assets of wealthy entrepreneurs.

Be smart and learn from other millionaires’ mistakes.

Speak to Mr. Enzo Caputo today and let us analyze your situation.

14. The 5 most common mistakes people with an offshore bank account make

⚠️ 1. Hiding assets with Offshore Banking

The offshore account in Montenegro is offered on the Internet with the mischievous hint that the Automatic Exchange of Information (AEOI) & Common Reporting Standard (CRS) in Montenegro does not apply. That’s right, but not for long. Montenegro is expected to be admitted to the EU in 2025 according to the “Guardian” 6 February 2018.

The days without AEOI & CRS are numbered. Step back from tax evasion. Criminal proceedings are not worthwhile. There are enough legal tax-saving models.

It is not worth saving taxes with an offshore bank account in Georgia, Puerto Rico, Armenia or Montenegro. Sooner or later, all who violate the reporting obligations will fly up. Then, it gets really expensive.

Offshore Banking isn’t illegal but hiding it is.

⚠️ 2. Reporting Obligations

The OECD Countries and the USA have strict reporting obligations for offshore bank accounts. Failing to file an FBAR (Foreign Bank Account Report) or reporting obligations according to the AEOI & CRS will be sanctioned with heavy penalties. Good banks have bank statements issued according to the reporting requirements of the specific country.

⚠️ 3. Being unaware of the laws in the offshore jurisdiction

Before you start going offshore with your assets, you have to do your due diligence on the laws and on the economy of the country. How to transfer money from offshore account back to Europe or the USA can be a problem in some countries. Banks are no regulated. It can be difficult to send money back. Your money can disappear. Is there enough protection for investors? What happens if a bank goes bust?

⚠️ 4. Not telling the truth to the bank

For making the account opening more simple many investors are not telling the truth on their economic background to the bank. The bank will check you on google. If the bank will find contradictory information you can be blacklisted. The amount of information on google is huge. This can backfire. Make your own due diligence on yourself on google before meeting the bank. If there is negative information on you we can help with special companies canceling negative content.

⚠️ 5. Try to manage violations alone

If you are informed that you are out of compliance you may consider fixing the problem alone. Negotiating a quick and easy solution alone can be dangerous. There are governments (USA, France, Germany, Denmark etc.) imposing heavy penalties on those involved with criminal tax evasion. Check out the IRS website naming and shaming individuals charged with illegal offshore tax avoidance.

Only an experienced attorney can minimize the financial consequences and criminal charges in case of non-compliance and tax evasion. There is no easy and quick self-made solution. We will help you finding a specific attorney to efficiently represent you.

15. It is illegal to have an Offshore Bank Account?

Before you open an offshore account, you must follow different rules and regulations depending on your residence. However, as long as you comply with the laws of your home country and the laws of the country of the foreign bank, your offshore account is 100% legal.

Each OECD country has introduced reporting obligations for an offshore bank account of non-residents. When choosing the best bank for you, you should ask the offshore bank before opening the account whether the bank statements of the selected bank meet the tax reporting requirements of your home country.

Offshore Banking Example: Reporting requirements for foreign accounts of Italians

We often recommend Bank Vontobel to our Italian clients. The IT department of Bank Vontobel provides ready-made bank statements so that Italian customers can easily meet their tax reporting obligations without any further ado. Bank Vontobel presents the capital gains that can be taxed in Italy according to the criteria of Italian tax law. Effortlessly and without additional costs, the customer can use the statements to fulfill his reporting obligations. For banks that are not specialized in clients from Italy, you have to commission complicated calculations in order to meet your reporting obligations.

If you comply with the reporting obligations a foreign account is 100% legal. Choosing a bank to help you meet the reporting obligations since the beginning will save you time, money and nerves.

As the Swiss banks are known to have the best IT systems in the world, we also find the right bank who can offer exactly the statements of your country of residence.

16. The 8 Best Reasons to open an Offshore Bank Account

Many little-known advantages speak for an overseas account for investments.

Deferred benefits that the person concerned does not know are only properly recognized and appreciated when he discovers them.

You should not leave all of your assets on the control of a single government at your place of residence.

1. Geographical Diversification of Political Risks

As you invest your assets in various asset classes (bonds, stocks, real estate, precious metals, commodities, art, car collection, gold coins, etc.) to diversify the risks of the investment, assets placed outside of the influence of your government will diversify the political risks.

Diversification with asset classes is well known to many investors. On the other hand, few investors know that you can diversify the political risks with offshore investment accounts. Avoid that a single state controls your entire fortune! Disconnect your assets from the influence of your government and courtrooms.

Opening an offshore savings account with an overseas bank is the first step to protect your assets. This is best done in a country and with a bank, where you can be certain that your fortune can not be pulverized overnight with Bail-in laws.

“Today, you do not have to ask whether your fortune abroad is sufficiently secure, but rather whether your wealth is still safe enough at home.”

2. Reduction of Legal Risks

Authorities shoot first from the hip and ask questions later.

I advised several German business people whose accounts were blocked in a tax audit. These were happy that they could handle their most urgent payments through their Swiss account. If they had not had an account in Switzerland, they would have long gone bust.

The competition is merciless today. Every businessman has to expect that he is wrongly accused by a competitor. It does not take much to get you involved as an innocent person in a criminal procedure.

Experience shows that the first step of a prosecutor is always to freeze the bank accounts. Every successful businessman is used for planning. That’s why every businessman has to expect frozen bank accounts as part of his business life. Who does not do it, is a fatalist. Having or not having an account abroad, where the authorities in the home country have nothing to say, can decide on life and death in business, regardless of whether you are guilty or not guilty.

A few years ago, the German Intelligence Service bribed a banker with LGT Bank in Liechtenstein and bought stolen account information (Known as the LGT Bank Tax Compact Disc Case). The former employee with LGT Bank received compensation of 4’600’000 EUR. What they did was illegal. Subsequently, the German government acted as a fence (stolen bank information passed on) and forwarded the illegally obtained account data to other states, such as France, UK, USA, Italy. This incident proves that no one has questioned the ethically questionable behavior of the state. When the State is involved in illegal activities, everyone just looks away.

3. Asset Protection

As mentioned earlier, Bail-in legislation in the EU has been converted into domestic law since 2017. The next financial crisis will come for sure. What happened in Cyprus in 2013 will be repeated, because the framework conditions have not changed significantly since the 2008 financial crisis.

Invest part of your assets via an Offshore Bank Account in Switzerland.

“Take a part of your assets out of your country of residence before your country takes it out from you (and saves your house bank).”

Switzerland is one of the few countries (besides Liechtenstein, Luxembourg, Norway) that has a Credit Rating of AAA (Standard & Poor). Also, Switzerland has signed the Hague Convention on the recognition of trusts. Trust structures are needed for international asset protection strategies.

Switzerland has become particularly attractive in recent years. That’s why many Family Offices have moved their headquarters from London to Zurich. Since the Brexit, the Swiss financial centre is in high demand.

Once the crisis is there, it is already too late. Capital export restrictions are the result. Capital exports abroad become illegal overnight. Then it’s definitely too late to implement your asset protection strategy.

“That EU States will expropriate wealthy investors with more than EUR 100,000 on the account is as clear as the Amen in the church.”

Experience has shown that tax revenues for some countries are not even enough to offset national commitments. Unconstitutional emergency law becomes the norm. Bank accounts of wealthy clients have already been used in Poland, Hungary, Cyprus, Argentina and other countries to top up the treasuries. In 2013, Poland forced the owners of private retirement funds to invest in government-controlled investment vehicles.

Spain has taxed savings accounts. Hungary and Portugal have nationalized pension assets. If your account is located overseas, the authorities’ access to your account is much more difficult. I guarantee that you will have a reassuring effect on knowing your fortune abroad.

Aggressive lawyers, supposed creditors and frustrated partners will bite their teeth.

You protect your assets by effectively outsourcing business activities in tax-efficient countries and legally reducing the tax burden. You must do this by following the law, because draconian punishments are intended for those who make mistakes here.

Avoid banks having a physical presence in your country of residence. Credit Suisse and UBS are not ideal because they have a strong presence overseas. As a result, they can easily by a victim of extortion as the high penalties from the USA have proven. If you select a bank in Hong Kong for diversification, forget HSBC. If you already open an offshore account in China, then you should choose a real Chinese bank. If a state official of your country of residence calls, then a reply will come in Chinese. No one speaks English.

4. Diversification of Currency Risks with Multi-Currency Accounts

Offshore banking offers multicurrency accounts, allowing you to diversify currency risks. The strong Swiss franc is popular as an escape currency. When the EUR was introduced, 1 EUR cost 1.72 CHF. Today, 1 EUR costs only 1.10 CHF. To protect the Swiss export industry, the Swiss franc is purposefully devalued by the Swiss National Bank through interventions. The true value of the Swiss franc would be much higher in reality. Our private banks offer offshore accounts in up to 15 foreign currencies (multi-currency account).

5. Better Interest Rates

The European Central Bank and the Federal Reserve have manipulated interest rates down to near historic lows. These artificially low-interest rates destroy the return on wealth, so even real inflation can’t be cushioned. Abroad, you will find banks that offer significantly higher interest rates. But you have to accept currency risks, which you can hedge through currency options. Multi-currency accounts give you access to investments with higher interest income. Swiss banks offer Lombard loans at 1% interest rate in CHF. You can pledge your portfolio to the bank as collateral and receive a loan (Lombard loan) at an interest rate of around 1% in CHF. The interest rate is very attractive because the bank has your assets as collateral.

Foreigners are allowed to purchase commercial properties in Switzerland that generate a return of between 4% and 7% in CHF. Banks grant mortgages up to 70% (LTV) of the value of the commercial property (LTV, Lending –to-Value). For this mortgage, you pay about 1% interest in CHF. This allows attractive returns with controlled risk. Consequently, real estate is ideal for the diversification of your assets.

6. International access to medical care (medical emergency kit)

Access to an offshore account gives more flexibility and quick action.

When it comes to life and death, the best surgeon maybe abroad.

If urgent payments are needed to pay for expensive operations in the hospital,

you’ll be glad to have access to foreign accounts.

Capital export restrictions may prevent or delay payments.

7. More Privacy

In the EU and in the US, payments exceeding 100’000 EUR are reportable. An Offshore Bank Account offers more privacy. It does not suit anyone for what you spend your money on. Everybody knows that SWIFT payments in USD are monitored by the US intelligence. Multi-currency accounts give you the flexibility to make confidential payments avoiding payments in USD.

Many international business people work with Swiss banks. Most probably, your contracting party also has an offshore bank account in Switzerland. This allows your transaction in CHF to be handled very confidentially as you transfer CHF from your account in Switzerland to another account in Switzerland in CHF.

8. Your Offshore Bank Account is an Insurance Policy

Offshore Banking offers the ideal protection against ailing banks, the arbitrariness of authorities and hasty actions of indebted governments. You have several options. A foreign investment account abroad works like an insurance policy. It increases peace of mind.

It’s never too early, but often too late!

You must act now rather than wait like a fatalist. Capital Export Restrictions can torpedo your plan overnight.

“Jump in the Driver’s Seat and you decide on the best bank in the best jurisdiction for protecting your assets, or, you do nothing and remain passive, but then – and I guarantee you – the day will come that someone else will decide about your hard-earned money.”

It’s always better to sit in the driver’s seat when it comes to your money.