REYL & Cie. SA | REYL Bank

Origin of REYL & Cie. SA | REYL Bank

REYL received the banking license in 2010. In 2017 REYL took a minority interest in Aspiration, an online banking platform in Los Angeles. In 2018 REYL entered into a partnership with Hermance Capital Partners, an investment fund platform which is concentrated on non-listed assets. Besides the family founding managers, three partners are responsible for the different business lines.

Do you have a bank account with this Bank? Do you wanna open a Bank Account with this Bank?

🎞️ Then you must watch the following Video first:

Philosophy and Strategy

The core principles of REYL are team spirit, philanthropy, innovation, responsibility, and integrity. The diversification of its business lines and the international expansion was contributing to the steady growth of REYL Group. Initially, REYL was only concentrated on wealth management but as the needs of the institutional and private clients increased the group expanded its services.

The group is continuing to follow an innovative strategy with the focus on providing support to a dynamic and promising clientele. The clients are mainly institutional investors and international entrepreneurs. The five business lines and different entities allow the group to offer its full range expertise to customers looking for multi-dimensional services. The aim of the group in 2018 is to optimize its process and internal control system further.

Do you know that we are the only one worldwide that Analyse all Swiss Private Banks annually?

► Here you can find all Swiss Private Banks

We even created a Study about Swiss Wealth Management Firms and why you not should trust blindly Top Rankings in Financial Magazines.

Services and Solutions

The approach is highly personalized, and there is a full range of services and products. The customer can choose between execution-only or advisory services and discretionary mandates. Through REYL Overseas Ltd., they offer investment services for US persons. REYL & Cie. Is assisting large corporations and family holdings in optimizing their administration and optimize their structure.

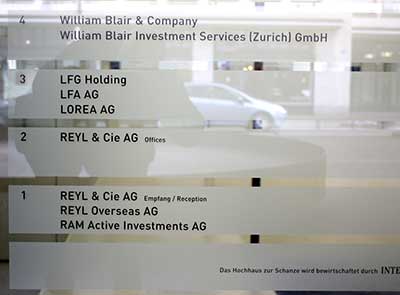

Since 2012 REYL & Cie. has developed a full range of investment banking services, like inventing innovative solutions for businesses, mergers & acquisitions, restructuring, private debt, structured finance and private equity. The Asset Service line handles financial and administrative services for institutional clients. RAM Active Investments is a fund manager who won several awards since its inception in 2007. It offers actively managed equity and fixed income products, UCIT funds and Alternative Funds. Since March 2018 the principal shareholder is Mediobanca S.p.A., but the REYL Group has still a meaningful equity stake.

Risk Management

REYL Group is exposed to several risks. The priority of the group is to identify, monitor, manage and measure these risks. The bank wants to hold its high credit rating and its excellent reputation. The critical elements of risk management are the definition of various limits and indicators to be reported and monitored. Ensure a timely reporting of the risks and have a comprehensive risk policy. The Board of Directors defines the risk policy and approves the risk limits.

The only entity in the group that grants loans to the clients is REYL & Cie. SA. The mortgages or loans are only given if a pledged real estate secures them. Credit limits set the credit exposure to counterparties. A multi-level system is used to manage the default and counterparty risk. To reduce the currency risk, the Group tries to balance the assets in foreign currencies with the liabilities in foreign currencies.

The Board of Directors approves the trading book limits. The clients mainly do trades in derivatives. REYL might use derivatives for hedging purposes but on a shallow level. The Treasury Department manages the liquidity. The operational risk handles the risk of losses due to the failure of internal policies or errors by humans and systems.

“How can you be sure to have chosen the Best Swiss Private Bank among over 200 private banks?”

We find the best private bank for you.

Call us now +41 43 508 24 59

Are you interested in First-Class Information about Private Banking?

Do you want an inside look behind the Secrets of Private Banks?

Then you should sign up in our Private Banking Letter

Mr. Caputo send you personally only from time to time the useful Information that can you save Millions.

Added-Value Services

In 2016 REYL was awarded “Most innovative business model” and in 2017 “Outstanding Boutique Private Bank” in 2017. The REYL Group wants to invest the proceeds from its partial exit of RAM Active Investments SA to develop its illiquid asset management and corporate finance team and to further develop its digital platform. The REYL Group is a responsible partner of the society. They are committed to giving back to the community in meaningful ways. The Group supports the Research for Life Foundation, the RAM Active Philanthropic Foundation, Intermezzo and the Grand Theatre of Geneva.

REYL & Cie. SA | REYL Bank – Facts & Figures

(Rotate your Mobile Phone for optimal Table-View)

| Address | Rue du Rhône 62, 1204 Geneva |

|---|---|

| Phone | +41 22 816 80 00 |

| Website | www.reyl.com |

| Year of foundation | 1973 |

| Subsidiaries | 5 |

| No. of employees | 419 |

| Rating | – |

| Chairman | Christian Merle |

| CEO | François Reyl |

| Eligible Regulatory Capital | 125.390 m CHF |

| Tier 1 Ratio | 13.78 % |

| Leverage Exposure | 2.317 bn CHF |

| Leverage Ratio | 5.41 % |

| Liquidity Coverage Ratio | 230 % |

| Risk Weighted Assets | 856.536 m CHF |

| Loans outstanding | 1.499 bn CHF |

| Assets under Management | 13.381 bn CHF |

| Assets under Management / Employees | 31.935 m CHF |

| Net profit | 5.011 m CHF |

| Net Profit / Employees | 11’959 CHF |

| Cost / Income Cost Ratio (CIR) | 89.67 % |

| Return on Equity | 4.78 % |

| Own structured products | No |

| Foreigners accepted | Yes |

| Presence abroad | Group: London, Luxembourg, Malta, Singapore, Dubai, United States |

Source: Annual Report 2021

We are a fully independent boutique law firm. That’s why we don’t have any cooperation agreements with the banks.

Few banks do not disclose their Annual Reports to the public. Therefore, we collected reliable information on a best-efforts basis. We renounced to collecting information from unreliable sources. Until today, Swiss law does not impose the duty of publication to the banks as it is the case in the EU. Therefore, for a few banks, the information from the annual reports was not summarized and published.

There are some smaller banks without a rating. It makes no sense for them to apply for a rating because they are not involved in the lending business. If the bank has no rating, it’s not automatically a negative point. There are excellent private banks without a rating.

One hour after your first call we accompany you in the bank solving your issue.

We act faster than any other big law firm in Zurich.

Get answers now +41 43 508 24 59 or write us an E-Mail.

Who is Enzo Caputo?

► ► ► Click here and learn more about

the Tax Attorney & Financial Lawyer No.1